Two years ago, President Donald Trump and Republicans in Congress cut the corporate tax rate from 35 percent to 21 percent via the Tax Cuts and Jobs Act of 2017 (TCJA). At the time, the Trump administration claimed that its corporate tax cuts would increase the average household income in the United States by $4,000. But two years later, there is little indication that the tax cut is even beginning to trickle down in the ways its proponents claimed.

The Trump administration claimed its corporate tax cuts would translate into a $4,000 raise for the average household

In selling the large corporate tax cut to Congress and a skeptical American public, the Trump administration claimed that corporate tax cuts would ultimately translate into higher wages for workers. The tax cuts would trickle down to workers through a multistep process. First, slashing the corporate tax rate would increase corporations’ after-tax returns on investment, inducing them to massively boost spending on investments such as factories, equipment, and research and development. This investment boom would give the average worker more and better capital to work with, substantially increasing the overall productivity of U.S. workers. In other words, they would be able to produce more goods and services with every hour worked. And finally, U.S. workers would capture the benefits of their increased productivity by successfully bargaining for higher wages.

According to President Trump’s Council of Economic Advisers (CEA), this process would “in the medium term boost the average U.S. household income annually in current dollars by at least $4,000, conservatively.” CEA’s “optimistic” estimate of the average household’s raise was $9,000. Then-CEA Chairman Kevin Hassett claimed that it would take “three to five years” for these massive trickle-down effects to materialize. A number of critics noted that the Trump administration’s claims were unlikely to pan out, in part because they hinged on the same supply-side economics that decades of tax cuts for the wealthy have consistently discredited.

These critics emphasized a number of flaws with the CEA’s theory of the case. First, corporations were holding large amounts of cash. Second, they were able to access capital very cheaply with interest rates at historic lows for almost a decade. Third, the effective tax rates on U.S. corporate investment, especially debt-financed investment, were already quite low, indicating that the cost of capital—let alone the portion attributable to taxes—was hardly holding back corporate investment. The critics noted that greater corporate market power meant that corporate profits consisted largely of economic rents, not marginal returns on investment. Therefore, a new corporate tax cut would, even if effective, likely be passed onto shareholders rather than being reinvested by the firms receiving the tax cut. Critics emphasized further that even if the tax cuts sparked an investment boom that increased productivity, it would be far from clear whether workers would be able to capture the gains, given the power imbalances between U.S. workers and employers.

The promised boom in business investment never happened

In the year following the tax cut, business investment increased—but not by nearly as much as the tax cut proponents’ predictions would have implied. Furthermore, a study by the International Monetary Fund (IMF) concluded that the relatively healthy business investment in 2018 was driven by strong aggregate demand in the economy—not the supply-side factors that tax cut proponents used to justify the tax cut. In other words, the increase in business investment from the relatively weak 2015-2016 period seems like another example of an economic indicator returning to more-normal levels.

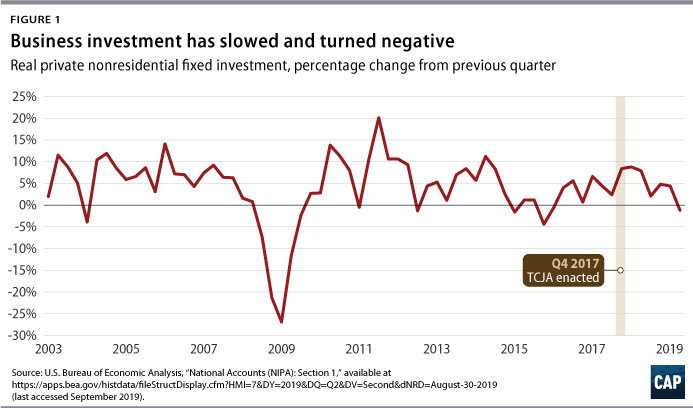

Worse, business investment has slowed more recently. The most recent data show that private nonresidential investment actually declined in the second quarter of 2019, contributing to an overall slowdown in growth. Federal Reserve Chairman Jay Powell pointed to the “continued softness” expected in business investment and declining output in manufacturing sector as reasons for the Fed’s recent rate cut. Measures of the investments that companies are planning have also declined. As analysts at the nonpartisan Tax Policy Center wrote recently, “This slowdown in business purchases of plant and equipment contrasts sharply with President Trump’s rosy forecast of a long-term investment boom that would lead to annual wage increases of $4,000 or more.” Moreover, investment in housing has declined every quarter since the passage of the tax legislation.

Instead of substantially increasing investment, the windfall businesses received largely went to paying off wealthy investors. One analysis of Fortune 500 companies found that just 20 percent of increased cashflow in 2018 was spent on increasing capital expenditures or research and development. The remaining 80 percent of cashflow went to investors through buybacks, dividends, or other asset planning adjustments. The vast majority of corporate stocks are held by the wealthy, including foreign investors, and thus they are the ultimate beneficiaries of the windfall corporate tax cuts.

To be sure, President Trump’s erratic pronouncements on tariffs have clearly created considerable uncertainty for businesses, leading many to hold back on investments. At this point, it is not possible to disentangle the negative effects of Trump’s misbegotten trade war from his tax policies. What we do know, however, is that nearly two years after the tax bill passed, the investment boom that was supposed to justify the corporate tax cuts—and even pay for those tax cuts over the long run—simply has not happened.

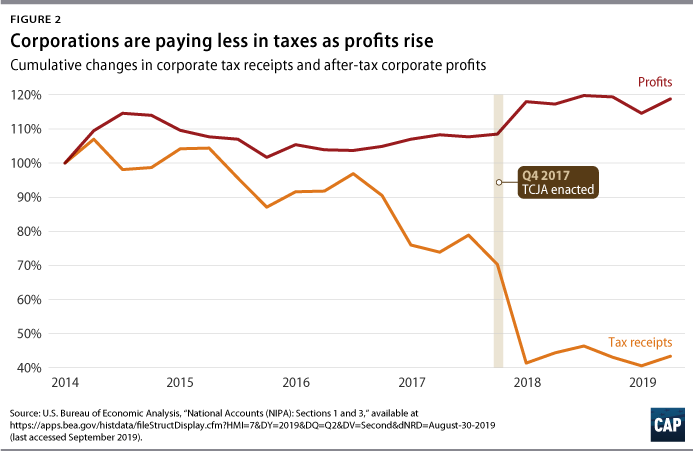

Corporate revenue has dropped precipitously since Trump’s tax cut

While the promised benefits of Trump’s corporate tax cuts have yet to materialize, the costs can be seen dramatically in the data on corporate tax revenue. As a result, since the law passed in December 2017, revenues from corporate taxes have fallen by more than 40 percent, contributing to the largest year-over-year drop in corporate tax revenue that we have seen outside of a recession. This has added even more to deficits than experts had previously predicted. The U.S. Treasury reported that from fiscal year 2017 to FY 2018, the federal budget deficit increased by $113 billion while corporate tax receipts fell by about $90 billion, which would account for nearly 80 percent of the deficit increase. Though the Trump administration and the Congressional Budget Office (CBO) projected corporate revenues to bounce back somewhat in FY 2019, there is no sign yet that that is happening, with 11 of 12 months having already been reported for FY 2019.

Perverse incentives in the TCJA may be encouraging investment overseas rather than in the United States

While cutting corporate tax rates, the 2017 tax law also overhauled the tax rules for U.S. companies’ overseas profits. In fact, one of the claimed selling points of the TCJA was that the legislation would allow U.S. firms to access profits that had been “trapped” overseas by the old international tax system, enabling them to invest more in the United States. In reality, these profits were never really trapped overseas, and past experience had demonstrated that extending special low tax rates to past overseas profits would not boost jobs or investment in the United States.

Worse, as the TCJA was being rushed through Congress, critics warned that some of the key international tax provisions would actually create new incentives for U.S. companies to invest overseas instead of in the United States. The law replaced the old international tax system (which was undoubtedly highly flawed) with a new regime that generally exempts the overseas profits of American firms from U.S. tax, thereby favoring them relative to domestic profits. The law also includes two provisions that are intended to prevent U.S. companies from artificially reporting their profits overseas to avoid U.S. tax and encourage them to locate intangible assets (such as patents or copyrights) in the United States. But under these two provisions—known as GILTI and FDII, respectively—firms can reduce their tax liability by locating more tangible assets (factories, equipment) overseas relative to the United States. For this reason, a group of leading tax scholars warned that the design of the GILTI regime “pushes U.S. firms in the direction of locating real assets (and accompanying jobs) overseas rather than domestically.” The CBO echoed this concern, noting that the two key international tax provisions of the TCJA “may increase corporations’ incentive to locate tangible assets abroad.”

It is still early, but a new study finds evidence that the TCJA is producing more investment overseas than in the United States. The study found that since the passage of the TCJA, the multinational firms that had been subject to high “repatriation costs”—in other words, the very firms that proponents claimed would be able to tap their “trapped cash” to invest in the United States—have increased their investment overseas rather than in the United States. Pointing to the incentives created by the GILTI and FDII provisions, the authors conclude that these early results “[conflict] with a stated goal of the TCJA to spur domestic economic growth.” If the tax law is incenting U.S. firms to locate more tangible assets overseas instead of in the United States, it would put U.S. workers at a further disadvantage.

The ballyhooed tax cut bonuses were a mirage

Finally, recent data show that the tax bill did not lead to a meaningful increase in worker bonuses, debunking the forceful public relations campaign waged by the proponents of the tax cuts and the corporations receiving them.

Immediately following Trump’s tax cut, corporations began announcing bonuses attributed to the TCJA. But new data show that this may have been nothing more than tax-motivated timing shifts. This is because corporations were able to take deductions on bonuses that they gave out in 2017 and early 2018 against the higher tax rate, making them more valuable than if they had handed the bonuses out later in the year. This created an incentive for corporations to shift up any bonuses that they planned to give out later. Now that this method of tax planning is no longer available, employers have reduced the value of bonuses, which have now fallen lower than their pre-TCJA levels—showing that the much-hyped benefit for workers was illusory.

Conclusion

While the effects of a very large tax overhaul will take years to fully develop and analyze, the evidence from the first two years suggests that corporate tax cuts are draining revenue from the U.S. Treasury while doing little that would ultimately benefit U.S. workers. Instead of trickling down to workers, the 2017 tax cuts have largely served to line the pockets of already wealthy investors—further increasing inequality—with little to show for it.

Galen Hendricks is a research assistant, Seth Hanlon is a senior fellow, and Michael Madowitz is an economist at the Center for American Progress.