See also: “Fact Sheet: Improving the Formula for Federal Higher Education Coronavirus Funding” by Viviann Anguiano

Click here to download a spreadsheet of estimated allocation results by institutional, state, sector, and minority-serving institution type. Users can also create their own estimated results.

At $14 billion, the investment in operating support for higher education institutions from the coronavirus relief bill, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, is the largest one-year federal infusion of funds going straight to colleges since the Great Recession.1 That includes $6.2 billion each for institutional support and emergency financial aid for college students; $1 billion for minority-serving institutions; and about $350 million for colleges most affected by the pandemic.2

Yet it’s nowhere close to enough.

Many states have already announced higher education funding cuts for this fiscal year that exceed what their public colleges and universities will receive through the CARES Act, to say nothing of the costs colleges have incurred refunding student room and board and shifting programs online because of the novel coronavirus pandemic. And the state budget crisis next fiscal year will undoubtedly be even bigger.

To make clear how far short the CARES Act falls in the face of a historic economic shock, consider that the University of Arizona reports it has already lost $66 million but will get only $16.7 million in federal money that doesn’t go to students.3 Meanwhile, the University of Oregon estimates a $25 million loss from the spring semester; it will get less than one-third of that in CARES Act funding.4 That does not even reflect any budget cuts that may happen in the future.

With further cuts sure to come, Congress will have to allocate additional funding for higher education if it wants to stave off a devastating crisis across America’s postsecondary education system. These funds need to increase by tens of billions of dollars; the Center for American Progress and many other partner organizations have called for at least $46 billion in additional spending for public colleges based on state cuts during the Great Recession and how much worse this situation appears to be.5

Yet making future stimulus as effective as possible is about more than just the dollar amount provided. Congress must also address restrictions on who can receive the funds as well as the funds’ allowable purposes. On the former, additional funds must not carry the complex restrictions—such as the exclusion of undocumented students and the need to demonstrate a student’s eligibility to receive federal financial aid—that the Trump administration created around the CARES Act money.6 Any new legislation also needs to allow a broader use of funds than the CARES Act does in order to acknowledge that colleges need the funds not just to respond to the unique effects of this crisis, such as closing dorms or going online, but also to replace almost certain massive cuts in state operating support as well as address lost revenue from tuition and other enterprises.

While fund uses and restrictions matter, the most complex issue Congress will need to address is what formula it uses to allocate dollars to colleges. Choices made here can raise or lower the amount a given institution receives by millions of dollars and affect funding for a given sector or type of college by hundreds of millions of dollars.

When Congress chooses a formula, it must recognize that the single most important policy goal is saving public higher education. Public institutions of higher education are highly reliant on state funding to keep prices lower and quality high for the nearly three-quarter of students in higher education who attend them.7 Public colleges serve a large share of historically marginalized students and are more dependent on the states to operate. Yet with each recession, states enact larger cuts to public postsecondary education, which get passed along to students in the form of increased tuition as well as cost-cutting measures that can weaken the quality of education.8 Insufficient investment in public higher education during the coronavirus crisis risks exacerbating racial and economic inequities among students who already struggle to access, afford, and graduate from college.

The best way to head off state funding cuts is to provide a separate pot of dollars directed exclusively to public institutions of higher education—instead of the CARES Act’s one program for all institutions. These funds must flow through the states, giving governors some discretion for how to allocate them. However, governors must be required to focus funding toward institutions that serve larger numbers of low-income students and that are more reliant on state funding. Congress could achieve this by tweaking the Governor’s Emergency Education Relief Fund created by the CARES Act so a set share of it must be used for institutions of higher education. This approach would guarantee that public institutions get a defined amount of resources that recognizes they serve a more important role than private institutions in America’s postsecondary education system, and it wouldn’t allow private colleges to siphon off resources. Routing dollars through states would also give Congress more leverage to limit states’ ability to defund higher education through requirements such as a maintenance-of-effort provision that puts a floor on how much funding a state can cut. Private colleges, meanwhile, would receive access to a separate, smaller pot of funds, while minority-serving institutions should continue to receive an exclusive set-aside.

Despite being the clearly superior option, a direct pot of funding for public higher education will be a tough sell. The higher education lobby, including many organizations that represent public colleges, has already endorsed the use of the CARES Act formula in future funding bills.9 The U.S. Senate, meanwhile, used the single program approach in the first draft of the CARES Act. For its part, the U.S. House of Representatives proposed separate funds for public colleges and private institutions.10

If Congress does not create a specific pot of money for public colleges, it will have to reckon with the distortions it created through the CARES Act funding formula. The formula favors institutions with many full-time students or with large graduate student populations and underestimates need at already low-resourced community colleges that serve far more low-income students. Unfortunately, addressing these quirks would add complexity, but that is the price of sticking with the conceptually flawed single pot of funds.

CAP is adamant that it is best to allocate future stimulus dollars through separate funding streams for public and private college colleges. However, this brief also lays out a set of options for making a single program approach more effective and targeted than the CARES Act. It employs the allocations and methodology used by the U.S. Department of Education to model the effects of these proposed changes if they had been included in the CARES Act. The author has provided a downloadable spreadsheet at the end of this brief that readers can use to see the effects of these changes across individual institutions.

Options for improving upon the CARES Act formula include:

- Prohibiting private for-profit schools from receiving any funds or limiting the amount of funds they can receive to only aid for students

- Giving greater weight to community colleges by running allocation formulas based on total student head count instead of full-time equivalent (FTE) enrollment

- Reducing the allocations for wealthy, private four-year universities by excluding graduate students from the formula

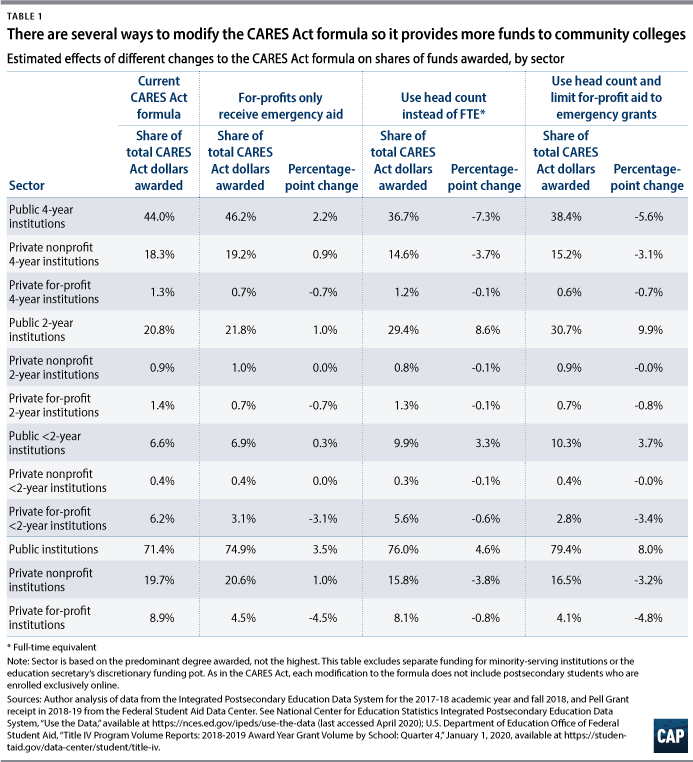

Limiting for-profit colleges to only emergency aid for students and measuring colleges’ enrollment based on head count, not FTE, is the best combined option. It would have directed $1.7 billion more to public colleges of two years or less. (see Table 1)

Congress cannot wait. Every week, states announce massive cuts to public higher education, and institutions report significant losses. And it will only get worse. Absent sufficient emergency spending in the right places, public higher education in its current form may not survive.

The CARES Act formula and its distribution of funds

Apart from set-asides for minority-serving institutions and a smaller pot for institutions most affected by the pandemic, 90 percent of the CARES Act money for higher education flows through a newly created formula. The formula allocates 75 percent of the funds based upon an institution’s share of all Pell Grant students nationally. It allocates the other 25 percent based upon an institution’s share of all non-Pell Grant recipients nationally. Both populations are based on what is known as full-time equivalent enrollment, which, for example, treats two half-time students as akin to one full-time student. The effect is that a college gets much less credit for someone who takes only a course or two in a term than a student who takes a full load. These figures also exclude students who were enrolled exclusively online prior to the start of the coronavirus crisis. This reflects the fact that colleges with many fully online students did not face the same emergency costs—such as moving classes online and closing dorms—as did colleges that were teaching more of their students in person. See Appendix A for a detailed look at how the Education Department modeled this formula.

Because the Education Department only released allocation amounts and not the underlying data used to generate these awards, CAP built a model that attempts to replicate the federal government’s approach. Doing so makes it possible to both understand how much of colleges’ allocations come from Pell or non-Pell funds and identify flaws in the formula. See Appendix B for a description of how CAP recreated the Education Department methodology. All tables in this brief show the distribution of the full $12.5 billion allocated through the CARES Act, which was divided equally between emergency grant aid and institutional support. They do not include the funding for minority-serving institutions or the discretionary pot for colleges most affected by the pandemic.

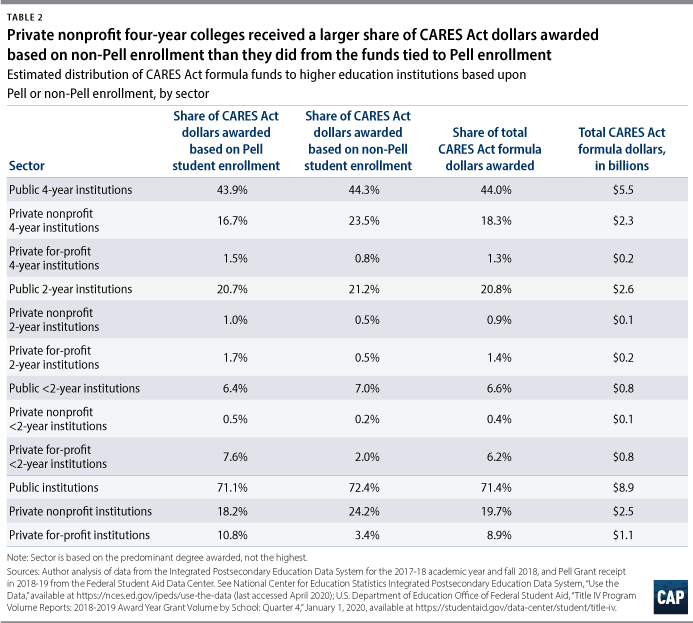

Slightly more than 70 percent of the formula dollars went to public institutions, while 20 percent went to private nonprofits and 9 percent went to private for-profits. But a few trends are worth noting. First, community colleges received a lower share of funds than one might expect. Public colleges of two years or less educate almost 40 percent of students, yet these institutions only received about 27 percent of the funds.11 This appears to be the result of basing the formula on FTE, not total head count, which gives less credit for part-time students.

The second thing that stands out is how much four-year private nonprofit colleges benefit from the non-Pell allocation—driven by graduate school enrollment and higher shares of students who attend full time. These institutions received only 17 percent of the dollars allocated for Pell enrollment, but they received 23 percent of funds awarded for non-Pell enrollment. This is because these universities enroll about 46 percent of FTE graduate students who do not attend exclusively online. That’s more than 830,000 students added to the allocation formula for non-Pell money. Compare this with the about 1,300 FTE graduate students not attending online who were enrolled at less-than-four-year public colleges—defined mostly as public colleges that grant associate degrees, as well as some vocational institutions that award certificates.12

The importance of the online-only student exclusion

The exclusion of students studying entirely online prior to the beginning of the pandemic was the biggest policy change in the CARES Act formula from the original Senate proposal. It made sense; colleges with large shares of students already studying online did not face the same transition costs to remote learning that others did. Although many fully online students did experience emergency costs, they generally did not face as many expenses related to how their education had to change due to the coronavirus, such as buying computers or internet service to start studying online and leaving on-campus environments.

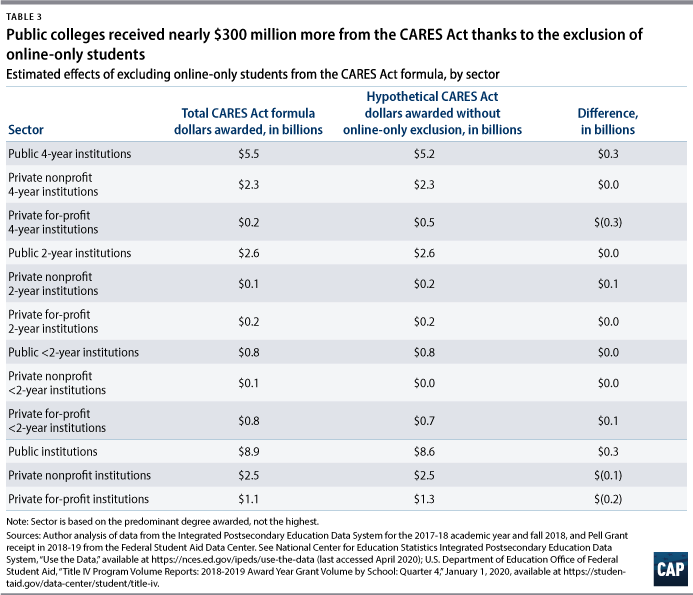

The CAP model of the CARES Act formula estimates that the exclusion of online students affected the flow of more than $902 million. On net, it resulted in more than $290 million more funding for public colleges and reductions of $221.7 million for the for-profit sector and $70.2 million for private nonprofit colleges. (The total and net figures are different because the exclusion also moved money within sectors.) For example, Purdue University Global—the online-only component of Kaplan University, purchased by Purdue—saw its estimated allocation decline by $43.8 million by excluding online-only students, while Rutgers, several California State University campuses, and Texas A&M University each saw their allocations increase by $5 million each. (see Table 3)

Fixing the CARES Act formula must start with routing funding for public colleges through states

The first step in making sure that the next stimulus is better targeted than the CARES Act is fixing that bill’s foundational error: including all colleges in a single pot of formula funds instead of creating a specific program for public institutions. The latter funding stream does not have to cut private colleges out entirely, but they would be relegated to a second, smaller pot of funds. Minority-serving institutions, meanwhile, should continue receiving a separate set-aside. Congress could enact this approach by making some tweaks to the existing governor’s fund established in the CARES Act. Separately, it should also fix the structure of the education secretary’s discretionary fund for helping colleges most affected by the crisis to ensure the relief aid doesn’t continue to be a windfall for small colleges. (see text box)

A separate pot for public colleges has many benefits. First, it acknowledges that public colleges need special treatment over private ones. Public colleges enroll nearly three-quarters of students. They are designed to be more affordable options, and most have an open access mission to serve anyone who is interested. In many parts of the country, public colleges are the only meaningful education option available to students. Private colleges should not be considered equal in terms of necessary federal investment.

Second, a state-based approach for public colleges makes it possible for Congress to ensure that these institutions get adequate funding, because Congress can specify the dollar amount. For example, Congress could have written in the last coronavirus relief package that public colleges would receive $10 billion of the formula funds. This would have resulted in $1 billion more than the public sector ultimately received.

Third, a state approach could have employed a formula that doesn’t rely on the limitations of the Pell Grant as a proxy for low-income students. Allocating dollars based upon Pell receipt means that only individuals who applied for and received these funds get treated as low income. That’s a major limitation for community colleges, especially those in California. For example, a 2018 research brief found that nearly 20 percent of the state’s students in two-year public colleges—nearly 71,000 students—applied for federal aid in 2014 and should have received a Pell Grant yet did not.13 The exact reasons why these students did not receive Pell Grants are not clear, but it could be because they received what is now called the California College Promise Grant fee waiver, a state award that covers tuition, referred to as a per-unit enrollment fee.14

Fourth, the formula for state funding could focus on overall population demographics, such as the number of individuals between ages 18 and 34—prime college-going years—and how many of them are low income, instead of only looking at who is in college. Each state could then devise its own formula to distribute the money as long as there are clear requirements in place to address resource equity, such as directing more funds to institutions that enroll low-income students, using more robust measures of income than federal data allow, and prioritizing institutions that receive a larger share of their operating budget for educational expenses from the state.

Finally, routing dollars through states would strengthen Congress’ ability to create much-needed higher education policy connections between the federal government and states. This is the concept behind federal-state partnerships—the key policy solution advocated by organizations such as CAP for fixing higher education affordability over the long run.15 A partnership involves the federal government giving states greater support for higher education, and in exchange, the state must increase its funding or in the case of a recession, maintain it. States receiving additional funding would also have to address policy issues, such as improving access or completion for traditionally underserved populations.

A state-based allocation in the next stimulus would test out the federal-state partnership, albeit with no upfront policy strings, given the need to get dollars out the door quickly. Governors would gain a significant pot of funds with some control over awarding dollars where funds are most needed. This could mean overinvesting in community colleges and regional four-year institutions that are most underfunded currently. In exchange, states would face requirements that limit how much funding they can cut from higher education and would be required to produce statewide plans for ensuring sufficient support for students who are forced to study remotely and for addressing equity.

This state-based approach is the best thing that Congress can do to protect public higher education from a funding crisis that is only in its earliest stage—and will almost certainly worsen if state revenues fall off a cliff.

Fixing the education secretary’s fund for the most affected colleges

In addition to the formula money and set aside for minority-serving institutions, the CARES Act set aside 2.5 percent of the money for higher education into a fund for colleges most affected by the pandemic. Congress placed few rules on this account but did note that the Education Department should prioritize the needs of institutions that received less than $500,000 from other funding streams when making awards.

Instead of asking institutions to apply for the funds and demonstrate need, the Education Department awarded more than 90 percent of the funds by issuing additional awards to 981 colleges that received less than $500,000 from the CARES Act formula or money for minority-serving institutions.16 This had the effect of disproportionately rewarding colleges with very small enrollments. The small size of these institutions also means that some of them may be receiving awards that are larger than the total revenue they take in during a normal year.17

The Education Department has shown that it cannot be trusted to operate this discretionary program without clearer rules from Congress. Any future fund of this sort must eliminate any preference for colleges that received lower amounts of money. It should also include clearer criteria about what evidence of disproportionate coronavirus effects the Education Department should consider when assessing need. This could include things such as higher rates of positive cases in the area around the institution, large numbers of students who have tested positive, low rates of home internet access among students, or something that relates more directly to the virus or the difficulty of responding to it due to having a lower-income student body.

Fixes if funds are not routed through states

If Congress does not create a state-based fund for public colleges, it will need to improve upon the CARES Act formula. While this is not the preferable approach, there are steps that can be taken to make the formula more effective. Congress should ensure that dollars flow more equitably, favoring institutions that serve larger numbers of low-income students and cutting off additional operating funds for private for-profit colleges. Below are some options for addressing these challenges.

Limit or exclude for-profit colleges from some or all support

The CARES Act set a new, distressing precedent: direct operating support to private for-profit colleges. These schools received $1.1 billion in total support from the CARES Act, including more than half a billion dollars for operating help. This is a new step in the relationship between the federal government and these institutions. While past stimulus bills included funds that helped the proprietary sector, they always came in the form of increased benefits to students, which then flowed as financial aid dollars to whatever colleges students chose, regardless of sector.

Congress should not continue the precedent set in the CARES Act. The premise of private for-profit colleges is that they can rely on the market to determine if they are viable. And unlike private businesses in other industries, they can already receive up to 90 percent of their revenue from the Education Department’s federal financial aid programs.18 Most for-profit colleges can also rely on other company-related provisions contained in the stimulus legislation.

Here are three ways to address the issue of private for-profit colleges in future bills.

Limit for-profit colleges to emergency aid

There is some rationale for continuing emergency financial aid for students attending private for-profit institutions, since their personal needs have nothing to do with their college’s sector. Keeping for-profits eligible for emergency aid while stopping subsidies for operating ensures that students are held harmless. Some large private for-profit colleges have already announced that they will use the CARES Act funds exclusively for this purpose.19

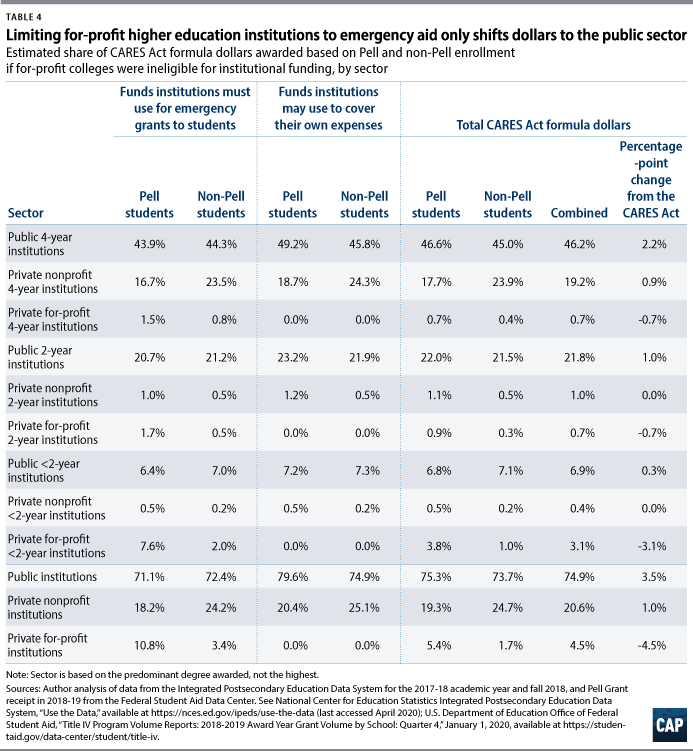

Funding emergency grant aid but not institutional operating support at for-profit colleges would result in a nearly direct transfer of that money to public colleges. Public four-year institutions would get about 2 percentage points more of the funds, while another 1.33 percentage points would go to other public institutions. (see Table 4)

Cap for-profit allocations at their CARES Act amounts

Another way to deal with private for-profit institutions would be to cap their future money at the level they received from the CARES Act. In other words, the University of Phoenix would be ineligible for any amount in the formula above the $6.6 million it received from the relief bill. This approach works best if Congress appropriates substantially more funds than it did in the last round. For example, a $46 billion program would give for-profits slightly less than 2.5 percent of the funding. Funding levels equivalent to or less than those of the CARES Act would make this provision pointless. This approach could also be combined with the one above to cap future for-profit allocations just at the amount of emergency grant aid received in the CARES Act.

Exclude for-profit colleges entirely

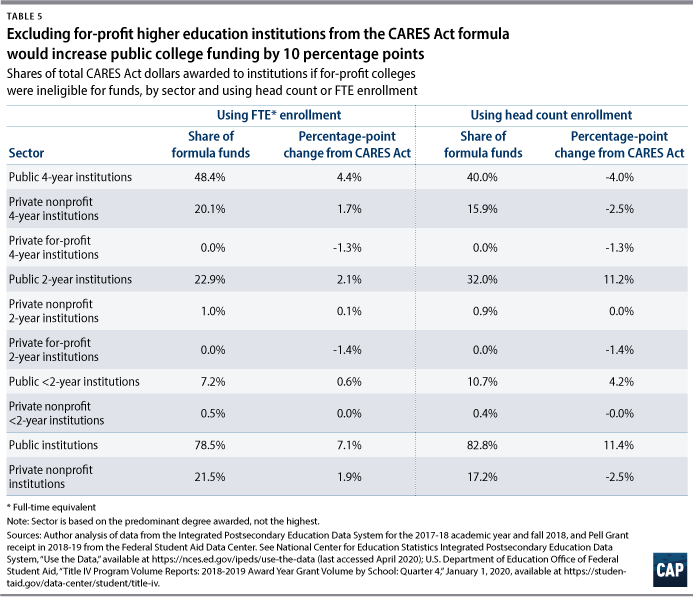

Some lawmakers have called for a more aggressive stance toward for-profits that would have excluded them entirely from the CARES Act. Taking for-profits out of the formula would free up more money for community colleges without the enaction of other options—described later in this brief—that result in trade-offs between these institutions and public four-year institutions.

As Table 5 shows, a complete exclusion of for-profits would most help public four-year colleges, but it would also add 2.7 percentage points of funding to public two- and less-than-two-year institutions. That may seem small, but in a $46 billion program—CAP’s recommended amount for future stimulus rounds—that translates into another $1 billion in funding.

Excluding for-profits entirely would limit the effects on public four-year institutions of shifting to a head count approach, while still helping community colleges.

Use head count instead of FTE enrollment

The CARES Act formula allocates funds using a college’s FTE enrollment. This approach treats each part-time student as equal in value to a portion of one full-time student, depending on their enrollment intensity. FTE enrollment is a commonly used measure; for example, funding levels are often expressed as an amount for each FTE student.

But the consequence of using FTE instead of head count is that it shrinks the enrollment at community colleges—a sector where part-time students are predominate—compared with four-year institutions. For example, the FTE enrollment of public and private nonprofit four-year institutions is equal to about 75 percent of their unduplicated head count.20 This means that an FTE adjustment reduces the total enrollment of these institutions by about one-quarter. By contrast, the ratio is 45 percent at public two-year colleges.21 This means that the 7.6 million students enrolled at community colleges are measured as 3.4 million students when adjusted to FTE.

Given the purpose and timing of CARES Act funds, it is not entirely unreasonable that Congress chose to use FTE, at least for operating support. Four-year institutions with dormitories bore the brunt of the initial crisis because they had to move students off campus and close dining halls. That said, other expenses, such as moving in-person teaching online, were widely felt by any college that did not already have a significant distance education presence.

Yet the type of economic harm from the coronavirus will change as the crisis goes on, altering how much of the effects are borne disproportionately by four-year institutions. Even now, the crisis has expanded beyond the immediate costs of closing dorms and dining halls to funding cuts from states; the potential for declines in enrollment; and the erosion of family finances, which will limit what students can pay for some time to come. Some of these elements will continue to have effects more heavily felt among four-year colleges—they will still face expenses if dorms are empty in the fall—but less selective colleges are more reliant on state funding for their budgets and could very well end up seeing disproportionately large cuts.

The arguments for using FTE for emergency grant aid, at any point, are not as strong. A part-time student doesn’t need to eat any less than a full-time one. If a part-time student’s car breaks down on the way to college, they don’t only have to fix half of it. It is also likely that as the crisis goes on, the broader effects of the economic disasters caused by the coronavirus will be felt even more deeply by community college students, who are generally lower-income than the typical four-year student.22

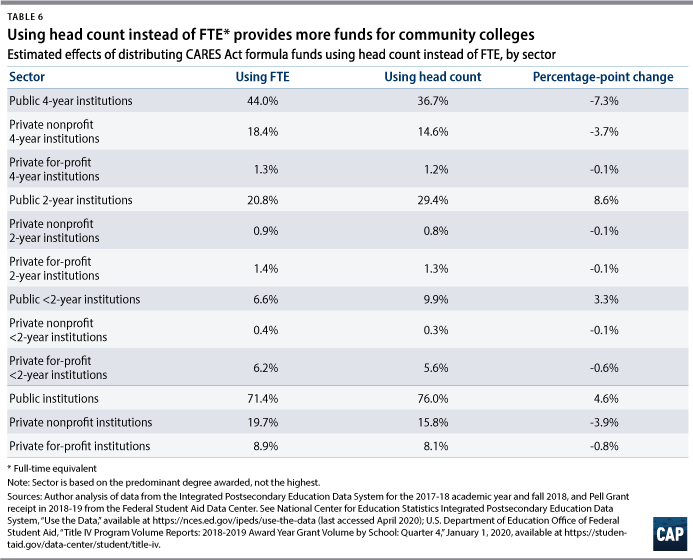

Table 6 shows what would happen if the CARES Act had awarded dollars based upon student head count, not FTE. This scenario continues to exclude students attending exclusively online.

A head count approach would have directed substantially more funds to community colleges. Less-than-four-year public colleges would have received 39 percent of funds, up from the 27 percent they got under the CARES Act. This increase would be driven by declines for public and private nonprofit four-year colleges. The former would see funds decline by 7 percentage points, while the latter would see funds fall by 4 percentage points. If the CARES Act had used head count instead of FTE, associate and certificate-granting public colleges would have received nearly $1.5 billion more.

Exclude graduate students from the formula

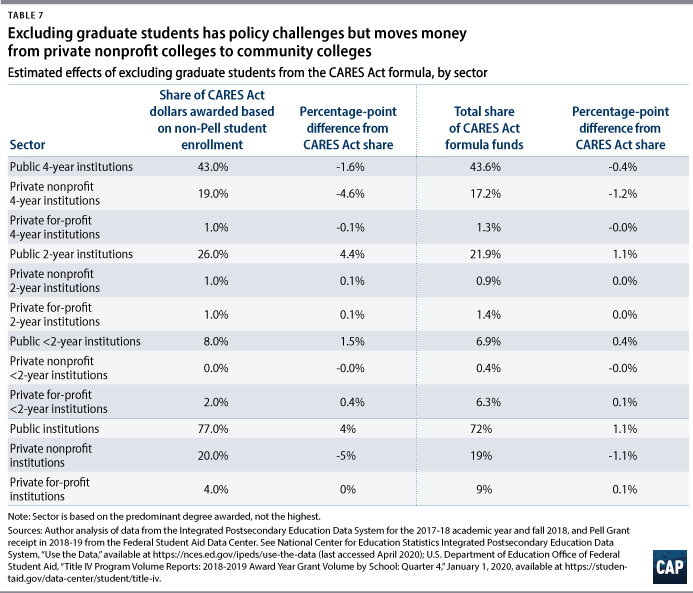

Several private nonprofit colleges drew significant media attention after the CARES Act allocations came out because they received awards that were larger than those awarded to community colleges that served far more low-income students.23 Some of these critiques noted that the community college allocations were lower due to the adjustment to FTE, but they missed the other factor: large graduate student enrollment at private nonprofits.

Take Columbia University, which received $12.8 million through the formula. It has about 2,000 Pell Grant students but 10 times as many graduate students, and 97 percent of its graduate students are not exclusively online. The result is that nearly two-thirds of its allocation comes from non-Pell enrollment, a striking result given that 75 percent of overall funds are based on Pell enrollment. Taking graduate students out would reduce Columbia’s allocation by an estimated $5.8 million.

Table 7 shows the effects of excluding graduate students from the allocation formula. It doesn’t affect the flow of Pell dollars, since only undergraduates can receive those funds. The overall effect, however, is a transfer of about 1.5 percent of the funding from four-year colleges to public colleges that are two-year institutions or less. Private nonprofit four-year institutions lose about 1.2 percentage points of funding, and public two-year colleges gain almost the same amount. Private for-profit colleges are largely unaffected, because so many of their graduate students are online and thus already excluded from the formula.

While excluding graduate students from the formula would better target funds to public institutions that serve far more low-income students, such a choice would be complicated from a policy standpoint. There are plenty of graduate students who were low-income undergraduate students and are not in programs tied to remunerative professions. Graduate students still need to eat, have families to take care of, and can face emergency expenses. At the same time, the idea of helping low-income graduate students before reaching all low-income undergraduates is concerning. These trade-offs illustrate how insufficient funding creates harmful rationing that will inevitably hurt some students.

Conclusion

The upcoming weeks and months will be a pivotal time for higher education. Swift action can prevent or ameliorate calamities that are, in the absence of Congress’ intervention, inevitable. But the support must come soon and be sufficiently big. While all types of higher education institutions will face struggles, no sector is going to face greater threats than public colleges. In 2018, states were spending $7 billion less in real terms on public higher education than they did in 2008.24 Painful state budget cuts will make that even worse.

As Congress works to secure more money for colleges, it must provide public colleges with their own dedicated fund that can run through states. In the absence of that, it must make the current formula more effective. Otherwise, precious dollars will not get to those who need them most.

Ben Miller is the vice president for Postsecondary Education at the Center for American Progress.

Appendix A: The CARES Act formula in depth

Because of data limitations, the Education Department had to combine multiple data sources and make some assumptions to implement the CARES Act formula.25 For starters, it calculated each institution’s share of Pell Grant recipients in the 2018-19 academic year using data from the Office of Federal Student Aid’s data center.26 It then applied that share to the total number of Pell Grant recipients reported for the 2017-18 academic year in the Integrated Postsecondary Education Data System (IPEDS).27 It did this because the most recent data for all the other enrollment variables used in the formula were for the 2017-18 year, and making such an adjustment increased the allocation for institutions with significant growth in Pell recipients over the last year.

An example highlights this adjustment in practice. All the numbers that follow here are based on CAP’s attempts to recreate the Education Department formula but are not completely exact due to factors discussed in Appendix B. Bishop State Community College in Alabama had 2,139 Pell Grant recipients in the 2018-19 academic year but 1,757 reported in IPEDS for 2017-18. Its 2018-19 Pell recipients represented 0.031 percent of the national total, so it was given an equivalent share of the more than 6.1 million Pell students reported in IPEDS. That adjusted its 2017-18 total upward to 1,903 recipients. This adjustment also explains why some colleges had awards per student that seemed way too high looking only at 2017-18 data. For example, the Interactive College of Technology in Texas had 46 Pell students in 2017-18 but 1,034 in 2018-19.

The next set of assumptions related to estimating the number of FTE Pell students. Because the Education Department did not have this data point, it calculated the ratio of the number of undergraduate FTE students to the total unduplicated head count over 12 months, capping the ratio at 1-to-1. The Education Department then multiplied the adjusted number of Pell recipients by that number. For example, Bishop State reported undergraduate FTE enrollment of 2,310 and unduplicated undergraduate enrollment of 4,748—a ratio of about 49 percent. Multiplying its adjusted Pell total by that ratio yielded an estimated 926 FTE students who received Pell Grants.

Next, the Education Department had to remove students who were attending entirely online. To do this, it assumed that Pell students attended online at the same rate as all other undergraduate students as reported to IPEDS in the fall of 2018. In the case of Bishop State, only 51 of its 2,860 undergraduate students were exclusively online that fall, meaning that 98 percent were either somewhat or not online at all. Multiplying the estimated Pell FTE figure by the estimated share of students not fully online yielded a projected 909 FTE Pell students who were not online.

This final count of Pell students drives 75 percent of the dollars awarded—about $9.4 billion overall. Bishop State would receive an amount equal to its share of the estimated 3.5 million FTE Pell students who are not entirely online, multiplied by the amount of funding allocated based on Pell. This works out to about $2.47 million.

The dollars allocated based upon students who did not receive Pell Grants used a similar approach. However, the Education Department started by subtracting the estimated number of FTE Pell recipients from the total FTE count and setting it to zero if this yielded a negative number—a possibility due to the Pell student adjustment. The Education Department then multiplied the non-Pell FTE count by the share of all students not attending college exclusively online. Bishop State reported a total FTE of 2,310; after subtracting the estimated 926 Pell FTE, the college had an estimated 1,384 non-Pell FTE students. With 98 percent of its students not entirely online, the college had an estimated 1,359 non-Pell FTE students who were not studying exclusively online.

The remaining 25 percent of dollars—about $3.1 billion—was then awarded based upon each institution’s relative share of the non-Pell students not studying exclusively online. For Bishop State, its 1,359 students represented 0.013 percent of the 10.7 million students estimated to be in this category. That works out to about $396,000.

Adding together the funds awarded based upon Pell and non-Pell students yielded an award of about $2.87 million for the Alabama institution. This does not include additional money the college received from the pot reserved for minority-serving institutions.

Appendix B: Modeling the CARES Act formula

CAP attempted to recreate the Education Department formula using the same data sources described in Appendix A. The data analysis had to account for differences in campus-level reporting across the two data systems. In many cases, data from the Office of Federal Student Aid combine multiple campuses under one identifier, known as the six-digit Office of Postsecondary Education identification (OPEID) number. Data from IPEDS report campuses at the eight-digit OPEID, meaning that those branch campuses are reported separately. To get a mergeable dataset, the author collapsed data to the six-digit OPEID level for the 2017-18 number of Pell recipients; for the unduplicated head count overall and for undergraduates and graduates; for FTE enrollment for the same student groups; and for fall 2018 data on the share of students attending exclusively online for the whole campus population, undergraduates, and graduates.

Merging the IPEDS and Office of Federal Student Aid data with the Education Department’s list of CARES Act allocations resulted in a few cases where institutions needed individual adjustments. This included New England College, which had a different OPEID between the datasets due to a partnership with a Texas-based community college. The author also identified at least one case where National University College in Puerto Rico had merged with a few other institutions, but its OPEIDs did not yet reflect this change. The author adjusted its identifiers to make this match work.

The author compared the estimated results of this model with the Education Department’s listed allocations. In many cases, the results are different by relatively small dollar amounts. Of the 5,135 institutions with data, 98.3 percent had a difference of 1 percent or less. These differences largely disappear when rounding figures. Only 24 institutions had a difference of 10 percent or more. Princeton University had the largest gap between estimated and actual funds, at more than $2 million. The author is convinced that this was due to a data error by the Education Department.

The way the formula works, estimates that vary for institutions of any size could cause small inaccuracies elsewhere. The estimated allocations are all based on the relative share of the national total, so an institution with an estimate that does not match the actual figure either has a different student count than expected or the overall student total is wrong. It is likely that fixing the estimates for the 23 institutions that are off by more than 10 percent would result in more exact figures for all institutions.

The author used this model to estimate how this brief’s proposed changes to the CARES Act would affect funding levels. Readers can recreate all the work in this brief using the downloadable replication package.28

To find the latest CAP resources on the coronavirus, visit our coronavirus resource page.