President Donald Trump is preparing to unilaterally and fundamentally change the U.S. system for legal immigration in ways that would restrict immigration to the wealthiest and most privileged applicants. Under a new policy being drafted by the Department of Homeland Security (DHS), an archaic federal immigration provision known as the “public charge” test would be reinterpreted to limit both family-unity and diversity-based immigration in ways that are a radical departure from current immigration law.1 Under the rewritten test, people would generally fail if they had income and resources of less than 250 percent of the federal poverty guidelines or had a medical condition and no unsubsidized source of health insurance.2

In this brief, the Center for American Progress aims to give the public a sense of the radical nature of the unilateral action the Trump administration is planning. To do so, the authors estimate what would happen if all people in the United States—U.S.-born citizens and immigrants alike—had to take this “Trump test,” based on the most recently leaked draft of the rule.3 According to CAP’s estimates, the proposed Trump test is so restrictive that more than 100 million people—about one-third of the U.S. population—would fail if they were required to take it today.

This estimate is a conservative one that is based on a snapshot of people’s current circumstances. Yet the Trump test is ongoing, so people who pass the test today could very well fail it in the near future due to economic downturns, mass layoffs, job insecurity, health problems, disability, or other factors. While, in this brief, the authors do not estimate an upper bound for Trump test failures, it is reasonable to assume that at least half of all people in the United States could fail this test over a period of several years.4

In short, the Trump test is not just a radical attempt to unilaterally and fundamentally rewrite federal law, it is also the latest iteration of discredited conservative attempts to label working-class Americans as “takers” rather than “makers.” The GOP-controlled House recently voted to reject legislation that would have imposed harsh restrictions on family- and diversity-based legal immigration.5 The administration should follow suit and discontinue its plan to impose similarly harsh restrictions unilaterally.

The “public charge” test: History and current policy

In 1882, the same year that Congress adopted the notorious Chinese Exclusion Act, it also adopted a law that prohibited entry to the United States of “any convict, lunatic, idiot, or any person unable to take care of himself or herself without becoming a public charge.”6 Since its establishment, federal immigration officials have often abused the public charge test in order to keep out people considered “undesirable” or deviant, according to prevailing norms.7 The test was initially aimed at Irish Catholic immigrants and, later, used to keep out Jewish refugees fleeing Nazi Germany.8 Immigration officials have also used the test to exclude people with disabilities, LGBTQ immigrants, unmarried women, and other categories of people considered deviant.9 The term “public charge” is so archaic that it far predates the existence of federal immigration law. For example, when the Alabama state Legislature authorized grants of emancipation to individual slaves in the 1800s, they were only granted on the condition that emancipated slaves “never become a public charge.”10

Over roughly the past half-century, both the courts and the executive branch have interpreted the test in a way that limits, but does not completely eliminate, its abuse by front-line immigration and consular officials.11 According to long-standing interpretation, an immigrant applying for a family-based or diversity visa is considered “likely to become a public charge” if they are likely to become “primarily dependent” on means-tested public cash assistance—Temporary Assistance for Needy Families (TANF), General Assistance (GA), or Supplemental Security Income (SSI)—or are likely to be institutionalized for long-term care at the government’s expense, excluding imprisonment for conviction of a crime.12

Immigration and consular officials determine an applicant’s likelihood of falling into either of these categories based on the “totality of the circumstances,” including age; health; family status; assets; resources and financial status; and education and skills.13

This long-standing interpretation is consistent with the core historical understanding of a public charge as someone who is a “charge”—effectively, a ward of the state. In other words, this definition of a public charge refers to someone who is incapable of work, lacks family support, and is likely to become completely dependent on government or charity for shelter and subsistence. For example, in 1930, former President Herbert Hoover explained the test by noting, “[i]n normal times an applicant for admission [an immigrant] to the country … if he appears to be an able-bodied person who means to work and has sufficient funds to support himself and those dependent on him until he gets to his destination” would not be excluded on public charge grounds.14

How the Trump administration plans to radically rewrite the test

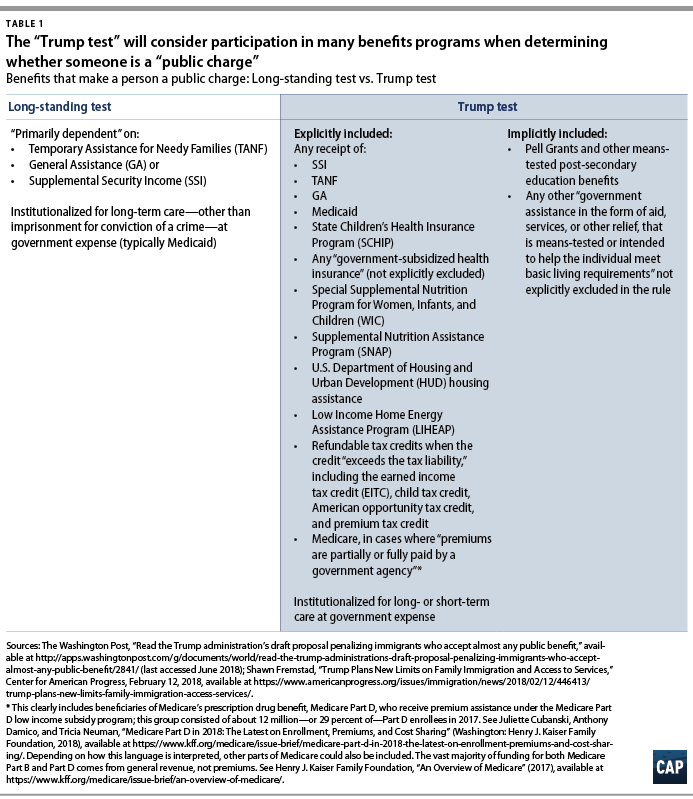

Under the most recently leaked version of the draft regulation, the current definition of public charge would expand to include anyone who receives or is considered likely to receive “any government assistance in the form of cash, checks or other forms of money transfers, or instruments and non-cash government assistance in the form of aid, services, or other relief, that is means-tested or intended to help the individual meet basic living requirements.”15 As the table below shows, this includes both a long list of benefits and services that are explicitly named in the draft regulation as making someone a public charge as well as additional benefits that seem to be implicitly included.

Nearly all of the additional benefits that are considered by the Trump test are ones that employed people with no health conditions are eligible to receive as long as they meet any income, asset, and categorical requirements. As a result, one of the most radical aspects of the Trump test is that it would treat employed people as public charges.

Instead of depending largely on current employment and future employability, Trump’s test for determining whether someone is likely to become a public charge at any time in the future would largely hinge on the presence of specified “heavily weighed” positive and negative factors.16

There is essentially only one heavily weighted positive factor: whether someone has annual earnings; income, not including means-tested income; financial assets; resources; and support of at least 250 percent of the federal poverty guidelines. In 2018, this is equal to $30,350 for a one-person household and $62,750 for a four-person household.17 By comparison, median earnings for a full-time, year-round worker in 2016 were $51,640 for men and $41,554 for women.18

There are essentially four heavily weighted negative factors:

- Having a medical condition and being unable to show evidence of unsubsidized health insurance, the prospect of obtaining unsubsidized health insurance, or other nongovernmental means of paying for treatment

- Currently receiving “any government assistance” (see table above)19

- Having received any government assistance for more than six months at a time within the last 36 months

- Not currently working or being enrolled in school full time and having no employment history or reasonable prospect of future employment

In addition to these explicit factors, the rule also gives DHS the authority to heavily weigh—both positively and negatively—any other “factors, as warranted, in the discretion of DHS, in individual circumstances.”20 As a practical matter, this means that DHS has nearly unbounded discretion to decide whether to pass or fail someone taking the Trump test.

Finally, if someone fails the Trump test, the administration’s plan would allow immigration officials to admit them on a discretionary basis as long as that person submits a “public charge bond.” Immigration officials would have case-by-case discretion to set the amount of the required bond, but it would have to be at least $10,000. Any immigrants admitted after providing a required bond would forfeit the entire bond amount to the federal government if they or their family members were to receive “any government assistance,” as defined above, after entry and before becoming a naturalized citizen.21

More than 100 million people in the United States would fail the Trump test

To produce a lower-bound estimate of the number and share of people in the United States who would be considered a public charge under the draft regulation, the authors estimate how many people would currently fail the test based on household income, financial assets, and resources—not having the heavily weighted positive factor—or because they are living in a household in which someone has a medical condition and no one has unsubsidized health care, one of the heavily weighted negative factors. (See appendix for details of authors’ methodology)

By CAP’s estimates, more than 100 million people—about one-third of the U.S. population—would fail the Trump test if they had to take it today. This figure includes:

- People who live in households with combined income and assets of less than 250 percent of the federal poverty guidelines and thus would be considered public charges based on income and assets alone. The authors estimate that this demographic accounts for a little more than 25 percent of the U.S. population.

- People not included above—individuals who live in households with combined income and assets of 250 percent or more of federal poverty guidelines—who live in households in which someone has a medical condition and no one has unsubsidized health care.22 The authors estimate that an additional 6 percent of the U.S. population falls into this category.

This is a snapshot, or point-in-time estimate, based on a single year of data. A growing body of research documents that income, asset, and job instability mean that most people in the United States experience periods of low income and economic insecurity during their working years. Contributing factors include economic downturns, mass layoffs, decline in the value of assets, job insecurity, health problems, and disability. For example, based on income volatility alone, a family’s odds of failing the test could vary dramatically from year to year. Between 2014 and 2015, one-third of households experienced a 25-percent change in annual income.23 Similarly, using longitudinal data, sociologist Mark R. Rank and his colleagues have estimated that nearly half of the U.S. population will have annual household income of less than 150 percent of federal poverty line at some point between the ages of 25 and 60.24 They also estimate that about 4 out of every 5 Americans in that same age range will experience at least one year of “economic insecurity” in their household—which is defined as low income, unemployment, or receipt of certain means-tested benefits to help meet basic living standards.25

As a result, the number of people who pass the Trump test today but fail it tomorrow would increase over time. While, in this brief, the authors do not estimate an upper bound for Trump test failures, it is reasonable to assume that half or more of all people in the United States could fail it over a longer-term period.

Finally, while the focus of this brief is on the income, financial asset, resources, and health factors that are heavily weighted in the Trump test, analyses of current receipt of means-tested social assistance by DHS and the Migration Policy Institute provide further perspective on the radical scope of this test.

In the draft rule, DHS estimates that 69 million people—about 22 percent of the U.S. population—received one or more of the following six benefits: Medicaid; Supplemental Nutrition Assistance (SNAP); Special Supplemental Nutrition for Women, Infants, and Children (WIC); public housing; rental assistance; or Low Income Home Energy Assistance (LIHEAP). Notably, DHS also finds that a substantial number of people with incomes of more than 250 percent of the federal poverty line receive these benefits. For example, it estimates that nearly 10 million people in families with incomes of more than 250 percent of the federal poverty line receive at least one of these mean-tested, in-kind benefits.26 The overwhelming majority of these 10 million are native-born U.S. citizens.

This DHS estimate does not include several other benefits that would make someone a public charge under the Trump test, including refundable tax credits and parts of Medicare. Previous research has found that about half of all taxpayers with children receive the earned income tax credit (EITC) at some point.27

The Migration Policy Institute recently estimated that about 3 percent of the U.S.-born population receives benefits that could be considered in a public charge test under the current long-standing policy.28 It then estimated how much this would increase based on just adding SNAP, Medicaid, and the State Children’s Health Insurance Program (SCHIP) to the test—simply adding these three programs would increase this percentage from 3 percent to 32 percent, a more than tenfold increase.

Conclusion

Trump’s public charge test would make it impossible for most working-class immigrants seeking green cards through the family- and diversity-based immigration processes to legally come to the United States. Requiring immigrants to have the inherited wealth of President Trump’s son-in-law, Jared Kushner, for example, or the education necessary to work a high-tech job in Silicon Valley means that they will need to have already achieved the American dream before even stepping foot on U.S. shores. Moreover, by narrowing the legal channels to family reunification, the Trump test could increase undocumented immigration.

President Trump may claim to be for working-class people, but his policies reveal a disdain for them and a complete dismissal of the contributions that generations of immigrants who arrived in this country with few or no resources have brought to America.

Melissa Boteach is the senior vice president for the Poverty to Prosperity Program at the Center for American Progress. Shawn Fremstad is a senior fellow at the Center. Katherine Gallagher Robbins is the director of policy for the Poverty to Prosperity Program at the Center. Heidi Schultheis is a policy analyst for the Poverty to Prosperity Program at the Center. Rachel West is the director of research for the Poverty to Prosperity Program at the Center.

The authors are deeply grateful to Christian E. Weller for his expert advice and analysis; Eliza I. Schultz for her research assistance; and Emily Gee and Philip E. Wolgin for their review.

Methodological appendix

The draft rule treats having “financial assets, resources, and support of at least 250 percent of the Federal Poverty Guidelines” as a factor that will “generally weigh heavily in favor” of a finding that someone is not likely to become a public charge.29 The authors of this brief assume that people in households with incomes and assets of more than 250 percent of the federal poverty guideline (FPG) will generally pass the Trump test and that people in households with incomes and assets equal to or less than 250 percent of the FPG will generally fail the test.30 most recent tax return; any other person whom the [individual] is legally required to support; or any other person who lives with the [individual], and who is being cared for or provided for by the [individual], and benefits from but does not contribute to the [individual’s] income or financial resources, to the extent such person is not claimed on the [individual’s] tax return.” See The Washington Post, “Read the Trump administration’s draft proposal penalizing immigrants who accept almost any public benefit,” p. 204. While there are certainly many cases in which there are dependents outside of the household, the household is the best available unit of analysis.] Using the 2016 Survey of Consumer Finances (SCF), the authors compare the countable income and assets of the unit that approximates the family—what the SCF refers to as a “primary economic unit” (PEU)—to 250 percent of the FPG for 2016.31

The draft rule does not define “financial assets, resources, and support.”32 The authors assume it will include all forms of income from sources, other than “government assistance,” that make someone a public charge under the rule. The authors further assume that it will include the value of nonliquid assets such as homes and automobiles, net of mortgages and automobile loans. To determine whether households have insufficient resources, a household’s net assets are counted in a manner consistent with the public charge test as including their home and car, retirement savings, nonretirement financial assets, other real estate, and business ownership net of debt—including mortgages; installment credit, such as student and car loans; outstanding credit card debt; and other debt, such as loans from a 401(k) plan. The authors also count the following types of income: wage and salary income; Social Security Disability Insurance and retirement income; realized capital gains; interest and dividend income; business and farm income; rental income; other annuity income; alimony and child support payments; retirement account withdrawals; and unemployment insurance and workers compensation. Excluded are means-tested social assistance such as TANF, SNAP, and what the SCF categorizes as “other forms of welfare or assistance such as SSI.”33

The authors use this information to estimate how many households fall below this threshold and then multiply this number by the average household size for households that fail the income and assets test in order to estimate how many people in the United States fail the Trump test based on this factor alone.

By the authors’ estimates, about one-quarter of people in the United States live in households with combined income and assets of less than 250 percent of the FPG and thus would be considered a public charge based on income and assets alone.

To determine what share of the remaining people in the United States would be considered a public charge based on having a medical condition and receiving subsidized health care, the authors first use the 2016 SCF to exclude from the final figure all of the nonelderly households that include someone who has health insurance coverage through an employer or union—which the authors use as a proxy for unsubsidized care.34 The authors then estimate the prevalence of someone in the household having a medical condition, relying on estimates from the Department of Health and Human Services (HHS) that determine the likelihood, by age group, of someone having a narrowly defined pre-existing condition.35 Specifically, based on the age of the householder, the authors calculate how many of the remaining nonelderly households—that is to say, the nonelderly households in which no one has unsubsidized health care—in each age group include a householder with a pre-existing condition.36 They then estimate the likelihood that nonhouseholders in these households have a pre-existing condition by conservatively assuming all nonhouseholders, regardless of their age, have a likelihood of pre-existing condition equal to that of the youngest age group—under age 18—since this age group has the lowest probability of a pre-existing condition. Based on this estimate, the authors again multiply the number of these households by the average number of people in each household depending on the householder’s age group. It is assumed that all low-income seniors who have subsidized health insurance are already included in the group of households that failed the income and assets test, and thus, the authors assume that no additional households with householders over the age of 65 will be included as a public charge.37

Based on this analysis, the authors estimate that an additional 6 percent of people live in households in which someone has a medical condition and no one has unsubsidized health care.

In total, the results suggest that about 32 percent of all people in the United States live in households that are below the income and assets threshold or include someone with a medical condition and lack unsubsidized health coverage.

This figure is a conservative estimate in a number of ways. First, as noted in the text, because this estimate represents a single point in time, it does not account for fluctuations in income, assets, or health conditions over time. Both the current public charge test and the Trump version of the test assess whether individuals are likely to become a public charge at any time in the future based on their current demographics and circumstances.

The second way in which the authors are conservative is how they estimate the likelihood of someone in a household having a medical condition. Due to data limitations, the authors first look at the likelihood, based on the age of the head of the household, that the household includes someone with a pre-existing condition; they then conservatively assume that any other individuals in the household have a very low probability of having a pre-existing condition—specifically 6 percent, which is the likelihood that someone under age 18 has a pre-existing condition. Assuming the other people in the household have an average chance for a nonelderly person of having a pre-existing condition, the overall figure would rise from 32 percent to 35 percent. Additionally, while, in many instances, the householder will be the oldest person in the household and thus the most likely to have a pre-existing condition, in the instances in which there is another older person in the home, this method of estimation does not account for the person in the home who is most likely to have a pre-existing condition.

Third, the question regarding health insurance in the SCF asks whether any person in the household is covered by a public or private health plan, not whether each person is covered or not, so the authors’ approach assigns employer- or union-provided coverage—used here as a proxy for unsubsidized care—to the whole household, even if some members are not covered. It also means that some members of the household may be covered by a subsidized plan, which is not captured here. This likely overestimates the extent of unsubsidized health insurance coverage in the household, which will produce a conservative estimate of those likely to become a public charge.