This issue brief contains an update.

In 2014, 46.7 million Americans—more than one in seven—lived in poverty, and nearly half of Americans will experience at least a year of poverty or near-poverty during their working years. Along with causing tremendous human hardship and suffering, poverty is enormously costly to the United States. It hampers educational attainment, reduces health, decreases workforce productivity, and damages the social cohesion of communities. Child poverty alone costs the United States an estimated $672 billion every year—nearly 4 percent of U.S. gross domestic product.

Poverty is not inevitable, particularly not in the richest nation on earth. Rather, its persistence is in large part a result of misplaced priorities and deliberate policy choices. Indeed, it has already been shown—in both past experience and extensive research—that policy choices can make a difference in the lives of low-income families, helping them reach and remain in the middle class. Recently, however, politicians and policymakers have lacked the political will to make many of these policies a priority.

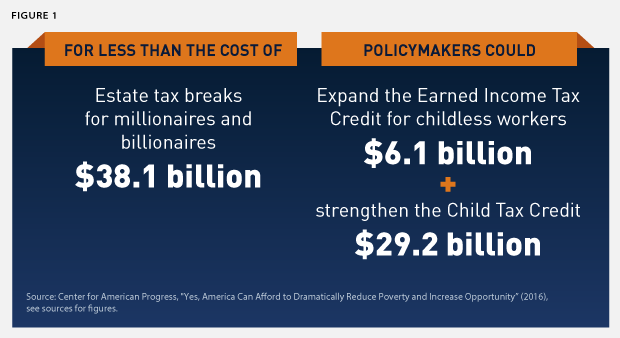

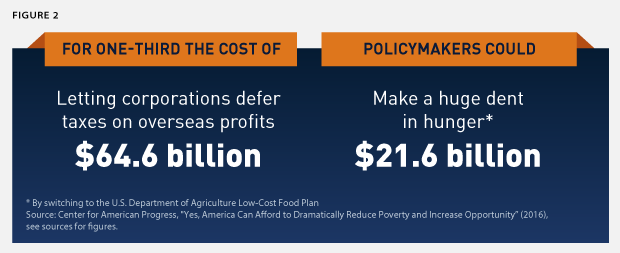

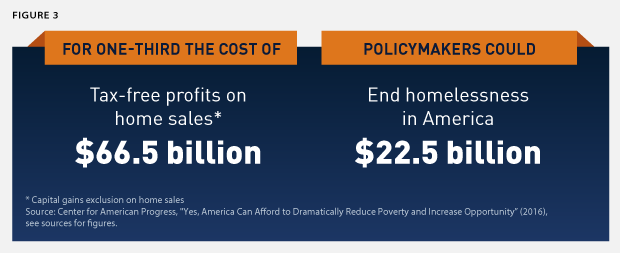

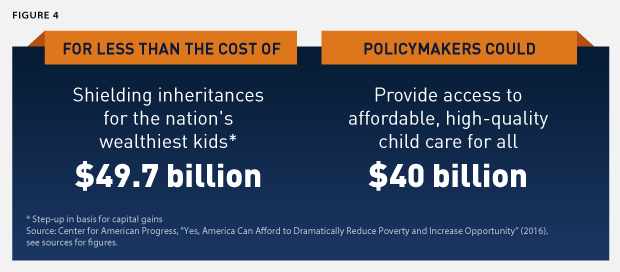

Most good policies are not costless. But the price tags for many poverty-reducing programs pale in comparison with the billions of dollars the United States already spends on tax breaks that primarily benefit wealthy individuals and corporations—funds that could be used to provide adequate nutrition or access to high-quality child care, reduce homelessness, or invest in low-income children and workers. What’s more, the price tags of smart policies do not reflect the substantial public savings the nation experiences from investments that improve health, increase educational attainment, enhance workforce productivity, and boost the economy. To take just one example, every dollar spent on benefits in the Supplemental Nutrition Assistance Program, or SNAP, generates an estimated $1.70 in additional economic activity.

The United States can afford to dramatically reduce poverty and increase economic opportunity. Here are four ways in which the U.S. Congress could make an enormous dent in poverty and the opportunity gap—each costing significantly less than the tax breaks Congress currently gives to the wealthy.

Boost effective tax credits for low-income workers and families

The Earned Income Tax Credit, or EITC, is one of the nation’s most effective anti-poverty tools, encouraging work and boosting family income. In 2014, it helped more than 6.2 million Americans—including 3.2 million children—avoid poverty. However, low-income workers without qualifying children receive very little help from the EITC; indeed, these so-called childless workers are the only group whom the tax code taxes further into poverty. Lawmakers across the political spectrum—including Speaker of the U.S. House of Representatives Paul Ryan (R-WI)—have long called for improving the EITC for childless workers. President Barack Obama’s and Speaker Ryan’s similar proposals, which would double the maximum credit to more than $1,000 and lower the minimum age of eligibility from 25 to 21, would help nearly 13 million workers, lifting more than half a million people out of poverty.*

The Child Tax Credit, or CTC, delivers a credit of up to $1,000 per child to families with children. The credit protected about 3 million people from poverty in 2015, including 1.6 million children. Because it is not fully refundable, however, the CTC misses the poorest children entirely, and only about 20 percent of the CTC’s benefits go to families who earn less than $30,000, compared with 60 percent of the EITC.

Expanding the CTC—as proposed by the Center for American Progress in a recent report—would ensure that the credit does not skip the families who need it most. The proposal would also create a supplemental credit—delivered monthly—for families with children younger than age 3. This would nearly double the number of children younger than age 17 who are lifted out of poverty by the CTC and would protect more than two-and-a-half times as many children younger than age 3 from poverty than does the current law.

Reduce hunger and food insecurity

Each year, SNAP benefits, formerly known as food stamps, protect millions of struggling Americans from poverty, including children, individuals with disabilities, seniors, and low-wage working families. SNAP’s nutrition assistance also boosts health outcomes, educational attainment, and earnings over the long term. Currently, the value of SNAP benefits is based on the Thrifty Food Plan, the lowest-cost of the four food plans developed by the U.S. Department of Agriculture, or USDA. At an average of just $1.41 per person for each meal, SNAP benefits—while critical—provide only the “bare bones” of nutritional adequacy. Many families are unable or barely able to stretch these modest benefits until the end of the month: Recipients use nearly 80 percent of SNAP benefits within the first half of each month. Switching to the Low-Cost Food Plan, the second lowest-cost of the USDA’s four plans—would increase SNAP benefits 30 percent. This would dramatically reduce hunger, food insecurity, and poverty, as well as boost long-run economic mobility for struggling families.

End homelessness

Homelessness and housing instability are leading causes—and consequences—of poverty. On any given night in 2015, more than 560,000 Americans faced homelessness, a problem primarily caused by a lack of affordable housing. The housing voucher program plays a crucial role in keeping at-risk households stably housed, yet 3 in 4 eligible families receive no housing assistance due to scant funding.

The Bipartisan Policy Center’s Housing Commission calls for reforming and expanding the Housing Choice Voucher program in order to end homelessness in the United States. Their proposal would provide rental assistance to all 3 million currently unassisted renting households that are extremely low income and cost burdened, meaning that they spend more than 30 percent of their income on housing and utilities.

Allow all families to access high-quality child care for their children

Child care is an economic necessity for most families with children: 65 percent of children younger than age 6 have all of their available parents in the workforce. But its cost is prohibitive for many families and especially for low-income families. In 37 states and the District of Columbia, the annual cost of child care for an infant is more than half of what a full-time, minimum-wage worker in that state earns. Existing child care assistance reaches only a small portion of eligible families and is much lower than actual child care costs.

Unable to forego critical income from work, many parents have little choice but to seek out low-quality care, potentially putting their children’s health, safety, and development at risk. The Center for American Progress recently proposed a tax credit that would expand access to affordable high-quality child care, allowing more low-income parents to participate in the work force while promoting their children’s healthy development. High-quality child care is an investment in the nation’s human capital: It increases children’s school readiness and reduces the educational disparities—based on socioeconomic status—that can be predicted long before a child even starts kindergarten.

Conclusion

Radically reducing poverty in America may sound like a costly proposition. But compared with the billions of dollars that lawmakers give away to the wealthy each year, Congress could make a huge dent in poverty at a bargain price. What’s more, investments that reduce poverty today will provide enormous economic opportunity for generations to come. Prioritizing the nation’s struggling families is an investment Americans cannot afford not to make.

Rachel West is an Associate Director for the Poverty to Prosperity Program at the Center for American Progress.

* Update, April 15, 2016: This sentence has been updated with new data on the number of workers who would be helped by President Obama’s and Speaker Ryan’s proposals, as well as the number of people who would be lifted out of poverty.