Last year, the Senate passed the historic and bipartisan Border Security, Economic Opportunity, and Immigration Modernization Act, or S. 744. Since then, the House of Representatives has talked a lot about immigration reform but has failed to move the legislative process forward. That inaction carries a hefty cost by delaying the significant economic and social benefits of enacting immigration reform. The nonpartisan Congressional Budget Office, or CBO, and many other independent economic researchers have found that comprehensive immigration reform would significantly reduce our nation’s deficit, create thousands of jobs each year, and spur economic growth. In addition to broad economic benefits, immigration reform would also improve the financial stability of the Medicare Hospital Insurance, or HI, Trust Fund, which pays for many of the critical health care services used by the millions of Americans enrolled in Medicare.

The HI—also called Part A—Trust Fund is one of four distinct components of Medicare, our nation’s largest publicly funded health insurance program. Today, the trust fund finances health care for more than 50 million Americans enrolled in Medicare Part A, which covers inpatient hospital services, skilled nursing facility services, and home health care. Over the coming decades, the number of beneficiaries is only expected to increase as Baby Boomers reach age 65. As a result of these demographic changes and other factors, such as rising health care costs, the trust fund is projected to be depleted by 2026.

While the trust fund has previously been projected to reach depletion numerous times, legislative adjustments such as changes in payroll tax rates have ensured that the trust fund never reached insolvency. Thus, there is little doubt that the HI Trust Fund could remain solvent well past 2026.

Immigration reform, though, would provide immediate financial relief to the trust fund without changing any of the current parameters of the program. Undocumented immigrants would pay taxes into the HI Trust Fund now before ever drawing a dollar in benefits. The net-positive contributions of undocumented immigrants would extend the solvency of the program.

In this brief, we estimate the net fiscal impact—taxes paid into the program minus benefits received—of undocumented immigrants on the HI Trust Fund. We limit our analysis to only the HI Trust Fund, which funds about 50 percent of total Medicare expenses, because this is the only portion of Medicare that is financed almost exclusively through payroll taxes. Thus, similar to Social Security contributions, individual contributions to the HI Trust Fund are easily identifiable over their lifetime, which enables us to estimate undocumented immigrants’ net fiscal impact on the fund.

In the analysis below, we assess how immigration reform would change the projected depletion date of the trust fund. That is, if immigration reform were to cause expenses under the trust fund to rise faster than additional tax contributions made by undocumented immigrants, then the trust fund would be depleted much sooner than 2026. Conversely, if immigration reform leads to higher payroll tax contributions than additional expenses, then the depletion date, or solvency of the trust fund, will be extended. Our analysis demonstrates that undocumented immigrants will pay more in payroll taxes than they will receive in benefits under the trust fund and would extend the solvency of the HI Trust Fund by four years.

But the net impact of immigration reform goes well beyond simply extending the solvency of the trust fund. Assuming changes are made to the trust fund so that it is viable beyond the current estimate of insolvency in 2026, undocumented immigrants would continue to provide a net fiscal contribution. We estimate the size of this contribution under two immigration reform scenarios.

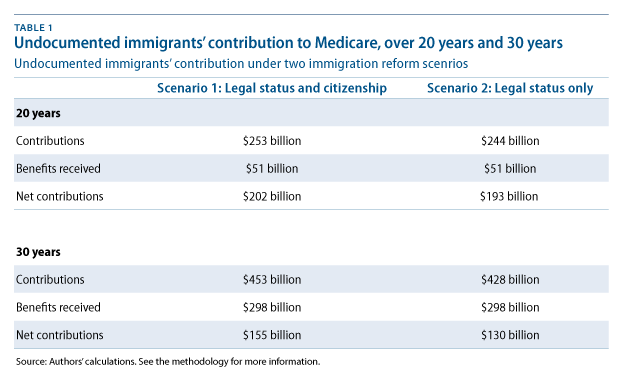

Under the first scenario, we estimate both the payroll contributions made and the Medicare expenses generated by undocumented immigrants under S. 744 over the next 20 and 30 years. Under the second scenario, we estimate what the net contribution would be over the same time period if immigrants were granted legal status but denied a pathway to citizenship.

Undocumented immigrants who receive legal status under immigration reform may become eligible to receive premium-free Part A benefits after 10 years. So the 20-year analysis under both reform scenarios captures undocumented immigrants’ net contribution a decade after the first members of the undocumented population become eligible to receive Medicare Part A benefits. In order to more fully evaluate the impact of reform on the finances of the trust fund, however, we expand the analysis to 30 years, recognizing that the undocumented population is on average relatively young and will not enroll in Medicare for decades to come.

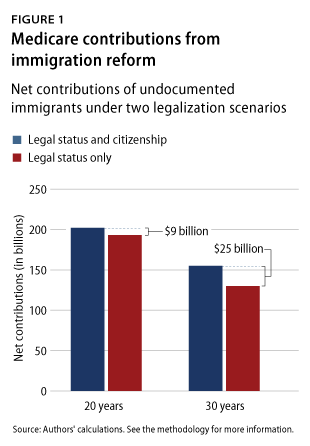

In the first scenario—enactment of the Senate bill—we found that undocumented immigrants who become citizens would pay $202 billion more into the system than they will receive in benefits over the next 20 years. Even over 30 years, undocumented immigrants would contribute a net $155 billion to the HI Trust Fund. Thus, despite undocumented immigrants receiving an increasing amount of Part A benefits in the third decade, they will still contribute more than they take out.

Our results under the second scenario—permanent legal status only—show that citizenship creates additional positive impacts for our country’s fiscal health. Over the next 20 years, if immigrants were provided legal status but denied citizenship, the net contribution to the trust fund would be $9 billion less than it would be with citizenship. Over the next 30 years, undocumented immigrants’ net contribution to Medicare would be $25 billion less.

Contrary to reform opponents’ claims, providing legal status and citizenship to undocumented immigrants will not further strain the trust fund over the next three decades. Instead, it will sustain the trust fund’s solvency for another four years. In fact, the net contribution of undocumented immigrants will come at the very time that Medicare spending increases due to Baby Boomer retirements. Thus, if immigration reform is enacted, the Medicare HI Trust Fund will have more money than it otherwise would to fund Part A benefits of enrollees over the next three decades.

Significantly, this analysis also demonstrates that providing undocumented immigrants legal status but denying them citizenship will not reduce net expenses under Medicare Part A. Instead, the increased incomes associated with earned citizenship would be lost thereby diminishing the net benefits our country stands to gain.

The current state of the Medicare Part A Trust Fund

Our country’s Medicare system is complex and made up of four parts—the largest being Medicare Part A. This part is funded through the HI Trust Fund and covers inpatient hospital services, hospice care, home health services, and stays in skilled nursing home facilities. The HI Trust Fund receives most of its income through payroll taxes; employers and employees combined pay 2.9 percent of an employee’s wages in taxes. Similar to Social Security, today’s workers are funding the benefits of individuals currently enrolled in Medicare Part A. Upon turning 65, a person is eligible to enroll in Medicare Part A without having to pay any premiums, as long as they have paid payroll taxes for at least 10 years and have been lawfully present in the United States during those years.

Medicare currently covers more than 50 million people, and the trustees of the Medicare trust fund estimate that more than 88 million people will be enrolled in Medicare Plan A by 2040—a rise largely due to aging Baby Boomers.

Throughout its history, the HI Trust Fund has at times paid out more in benefits than it received in income. When this occurred, the assets in the trust fund paid for the remaining expenditures. In 2013, the trust fund began the year with $220.4 billion. This money will be used in part to cover the projected $22.2 billion shortfall—the difference between total income and total expenses. The trustees of the Medicare trust fund project that by 2026, the trust fund will be depleted; in other words, the trust fund will no longer be able to cover the difference between total income and total expenses.

It is important to note that other parts of the Medicare system—such as the Supplementary Medical Insurance, or SMI, Trust Fund that finances Part B—do not face the same threat of insolvency as the HI Trust Fund. The board of trustees of the Medicare trust funds notes that the SMI Trust Fund is not at risk of being depleted, because each year its general revenue is adjusted to meet expected expenses.

Immigrants’ current contribution to the Medicare trust fund

A recent study by researchers at Harvard University looked at both the expenses generated by all immigrants under the Part A Trust Fund and the amount of money they contributed to it between 2002 and 2009. The study found that immigrants made a net contribution of $13.8 billion in 2009, whereas the native-born population had a net drain of $30.9 billion. And from 2002 to 2009, immigrants paid $115.2 billion more in Medicare taxes than they received in Medicare Part A benefits. Immigrants made a net contribution to the system, because they generally tend to be younger and healthier than the native-born population. Thus, the expenditures that immigrants generate under Medicare Part A are nearly 30 percent less than the expenditures created by the native-born population.

But it is not just the legal immigrant population that is already making significant contributions to the HI Trust Fund; undocumented immigrants also provide important financial support. Under our current immigration system, it is unlawful for employers to knowingly hire undocumented immigrants. Despite this prohibition, more than 8 million undocumented immigrants are working across our economy, making up 5 percent of our labor force. While many undocumented immigrants work in the informal or “underground” economy, the Social Security Administration estimates that 37 percent of undocumented workers are on the books and pay payroll taxes.

Undocumented immigrants collectively paid $13 billion in payroll taxes to the Social Security system in 2010. This suggests that undocumented immigrants’ payroll contributions to Medicare total more than $3 billion each year. But while undocumented immigrants already make important contributions to the trust fund, the contributions are far smaller than they would be if these immigrants were given legal status and citizenship.

Immigrants’ eligibility for Medicare under immigration reform

As discussed above, most prospective premium-free Medicare Part A enrollees—or their spouses—must meet a 10-year work and legal immigration eligibility requirement. Under S. 744, undocumented immigrants will be able to begin working legally and start the 10-year clock toward Medicare eligibility. Given the bill’s implementation timeline, the earliest that undocumented immigrants could start accruing credit for Medicare via payroll taxes would be 2015. This means that the first year undocumented immigrants could conceivably enroll in Medicare is in 2025—10 years after they have been legally working and once they reach age 65.

It is important to note, however, that some undocumented immigrants have already been working and paying payroll taxes despite being undocumented. These previous years of work will not be counted toward the needed 10 years of contributions under S. 744. The consequence of denying credit for previous years of tax contributions has serious implications for immigrants who are over age 55. Under comprehensive immigration reform, for example, a 60-year-old immigrant who has been in the United States working and paying taxes for five or more years will not be eligible for Medicare Part A when they turn 65, because they will not have been credited the 10 years of Medicare payroll tax payments. Instead, they would have to work and pay payroll taxes until they are 70 if they want to receive Part A premium-free benefits. Thus, while immigrants who receive legal status under the bill will be able to play by the same rules as other Americans, some will be disadvantaged and only receive Medicare after age 65 or not at all if they fail to acquire enough years of credit.

Immigration reform’s impact on the Medicare Part A Trust Fund

Opponents of immigration reform often claim that providing legal status and citizenship to undocumented immigrants would create a fiscal burden on Medicare as immigrants become eligible to draw benefits. There is no disputing the fact that if more people enroll in Medicare, program expenses will increase decades later as these people become eligible for the program. But this should not be a reason to deny undocumented immigrants benefits or delay the passage of immigration reform, because the amount they will pay into the trust fund will more than offset the benefits they will receive for at least the next three decades.

Immigration reform would strengthen the Medicare Part A Trust Fund for two primary reasons. First, immigration reform would increase the number of people working legally and paying payroll taxes. As discussed above, only 3 million undocumented immigrants are currently paying payroll taxes, meaning more than 5 million undocumented immigrants—nearly 65 percent of the undocumented workforce—are working off the books and not contributing to the Medicare trust fund. Immigration reform such as S. 744 would provide the means for employees and employers to follow the rules and pay taxes. In short, immigration reform would bring millions of undocumented immigrants onto the books and ensure that all employers and workers are paying into Medicare.

Second, immigration reform would increase contributions to the trust fund, as undocumented immigrants’ wages will increase after legalization. Research has found that undocumented immigrants currently face substantial wage disparities as a result of their legal status and precarious situation. In a study following the 1986 legalization program under the Immigration Reform and Control Act, the U.S. Department of Labor concluded that undocumented immigrants who gained legal status observed a 15 percent increase in their earnings. But it is not just legal status that improves economic outcomes for undocumented immigrants; independent researchers have found that the acquisition of citizenship is associated with an additional 10 percent increase in wages. These wage gains occur because, with the acquisition of legal status and citizenship, immigrants are able to work legally, find jobs that best match their skill set, and invest in their education—all of which enhance their earnings. The combined 25 percent increase in earnings would in turn significantly boost undocumented immigrants’ contributions to the Part A Trust Fund.

Short-term benefits of immigration reform: Extending the solvency of the trust fund

Recognizing the potential impact immigration reform could have on Medicare, we estimated what impact undocumented immigrants would have on the solvency of the Part A Trust Fund.

As noted above, the trust fund is currently projected to be depleted by 2026. Undocumented immigrants would extend the solvency by four years, because their contributions would significantly reduce the annual difference between total income and total expenditures. The shortfall, for example, is projected to be $10.2 billion in 2014, meaning that the total income will be $10 billion shy of covering all of the year’s expenses. But under immigration reform, undocumented immigrants’ net contribution would reduce the shortfall to just $2 billion, meaning that the trust fund’s assets would only need to cover $2 billion worth of expenses in 2014, and $8 billion would be saved.

Using estimates on annual income, expenses, and current asset levels of the trust fund, we project that undocumented immigrants would extend the solvency of the HI Trust Fund by four years, demonstrating the financial potential of undocumented immigrants. Immigration reform would provide Congress with four more years to identify and implement other measures to address Medicare’s rising costs.

Long-term benefits of immigration reform: Three decades of net contributions

Extending the solvency of the Part A Trust Fund is just the tip of the iceberg; immigration reform would provide significant financial support to the trust fund long past 2026. To quantify the long-term impact of immigration reform on the trust fund, we estimated the net contributions of undocumented immigrants under two immigration reform scenarios.

The first scenario assumes a pathway to citizenship as laid out in S. 744: The majority of undocumented immigrants would be given registered provisional status with the ability to adjust to legal permanent residency after 10 years and become a naturalized citizen after 13 years. Under this scenario, we found that undocumented immigrants would contribute $253 billion in Medicare taxes over the next 20 years, while Medicare is estimated to provide only $51 billion in Medicare Part A services. Thus, undocumented immigrants’ net contribution to the trust fund over the next 20 years would be $202 billion.

The large net contributions over the next 20 years are not surprising given the age profile of undocumented immigrants. The average adult undocumented immigrant is 36 years old and therefore will work and pay taxes for many more years. Accounting for the fact that only 18 percent of undocumented immigrants would be over age 65 during the 20-year analysis—and to more fully capture the years when Medicare costs will rise due to the retirement of the Baby Boomers—we extended our timeframe another 10 years. Even after 30 years, when 43 percent of currently undocumented immigrants will be over age 65, the positive impact on the trust fund holds. Over 30 years, if provided legal status and citizenship, undocumented immigrants would contribute a net $155 billion to Medicare: $453 billion in Medicare taxes versus $298 billion in Medicare Part A benefits.

Denying citizenship forgoes benefits to the trust fund

In recent months, some members of Congress have floated the idea of passing immigration reform that includes legalization but withholds a pathway to citizenship for the nation’s undocumented immigrants. In the second scenario, we estimate the impact that this type of approach would have on the Medicare trust fund.

We found that over the next 20 years, immigrants would pay $9 billion less into the Part A Trust Fund if citizenship were denied—a net $193 billion versus the potential net $202 billion. Similarly, over the next 30 years as more immigrants turn 65 and can enroll in Medicare Part A, contributions would be $25 billion less if they were not able to naturalize: undocumented immigrants would pay a net $130 billion in contributions versus the potential net $155 billion.

The significant drop in net contributions can be explained by the fact that withholding citizenship would stifle undocumented immigrants’ economic mobility. As discussed above, the acquisition of citizenship is associated with a 10 percent increase in wages. This means immigrants’ contributions to the Medicare trust fund through payroll taxes after the acquisition of citizenship would also increase. Thus, denying citizenship would result in immigrants paying less into the fund while the expenses that immigrants generate would remain the same, since eligibility for premium-free Medicare Part A services is not contingent upon citizenship.

Conclusion

Immigration reform that provides legal status and a pathway to citizenship would do more than just fix our broken immigration system. It would also strengthen social programs such as Medicare. The analysis in this brief demonstrates that bringing undocumented immigrants out of the shadows and allowing them to participate fully in our society and social programs as other Americans do will lead to a net contribution to the Medicare Part A Trust Fund over the next three decades.

If immigrants are provided legal status and citizenship, they will contribute a net $202 billion over 20 years, or a net $155 billion to the trust fund over the next 30 years. More importantly, this analysis proves that withholding citizenship would significantly decrease immigrants’ contributions; over the next 30 years, net contribution to the Medicare Part A Trust Fund would be $25 billion less if immigrants are denied citizenship.

As the House continues to consider immigration reform, policymakers and Americans need to recognize the economic boost and fiscal support that undocumented immigrants could give the country if they were provided legal status and citizenship. The positive impact that undocumented immigrants can make on Medicare’s Part A Trust Fund is significant, but it requires Congress to act now.

Undocumented immigrants are younger, and they have great potential to work for many years and contribute to the Medicare Part A Trust Fund. Congress cannot afford to let this opportunity pass by.

Patrick Oakford is a Research Associate on the Economic and Immigration Policy Teams at the Center for American Progress. Robert Lynch is a Senior Fellow at the Center and the Everett E. Nuttle professor of economics at Washington College.

This study was made possible by the generous support of the JBP Foundation. The views expressed are those of the authors and not necessarily of the JBP Foundation.

Appendix

Methodology

The calculations in this report utilize the following data sets: the March 2012 Current Population Survey, or CPS; Pew Research Center’s estimates on the age profile of the undocumented population; the Migration Policy Institute’s estimates on the age profile of undocumented immigrants who came to the United States before age 16; and estimates of annual Medicare expenditures by immigrants as calculated by researchers at Harvard University.

Medicare contributions

Medicare contributions are estimated by summing the Medicare payroll tax contributions that each age cohort will make over their lifetime. We assume that individuals enter the workforce and begin paying payroll taxes at age 18. For age cohorts older than 67, we applied current and projected labor-force participation rates as estimated by Dowell Myers, Steven Levy, and John Pitkin. We applied the standard 2.9 percent Medicare tax rate to the estimated earnings for each cohort, which were calculated using the March 2012 CPS. Based on previous studies, we assumed that legalization would increase the earnings of undocumented immigrants by 15 percent, and the acquisition of citizenship would result in an additional 10 percent increase. We increased the average earnings each year by 3.8 percent as estimated by CBO.

Under S. 744, undocumented immigrants who entered the country before age 16 and have met a series of requirements, such as graduating from high school or having a GED, are put on a faster pathway to citizenship. This means they would experience the 10 percent increase in their earnings sooner than those on the 13-year pathway to citizenship and subsequently contribute more to Medicare sooner. Thus, in our estimates, we calculated this cohort’s—known as the DREAMers’—future contributions separately from the larger undocumented immigrant population. After calculating each age cohort and the DREAMers’ contribution to Medicare over the next 30 years, we summed each age group to come to a total contribution for the population.

Medicare benefits

To estimate undocumented immigrants’ future benefits, we used estimates of individual Medicare Part A expenditures of legal immigrants under Medicare in 2009. We assumed that immigrants receive $3,923 in Part A benefits on average each year. We increased the amount of annual benefits received by annual growth rates in Part A spending per beneficiary as estimated by CBO through 2023. We then used CBO’s projected 4.3 percent increase for each subsequent year.

We estimated future benefits not only by age cohort but also by gender to account for varying life expectancies. The model assumes that everyone starts enrolling in Medicare Part A at the age of 65. Medicare allows eligible individuals to enroll in Medicare at age 65, even if an enrollee is still working and covered by employer-provided health insurance. When an enrollee—or their spouse—is still working for an employer with 20 or more employees and covered by private health insurance, Medicare becomes the secondary insurance, and costs covered by Medicare will decline. Our model does not account for savings in expenses due to enrollees having employer-based health insurance. Thus, our model overestimates the benefits received by immigrants who are still working beyond age 65.

Based off of Social Security life-expectancy projections, we assumed that men will receive benefits for 21 years and women will receive benefits for 23 years.