The G-20—a forum of 20 of the world’s largest economies—has a record of ambivalence on the topic of climate change. One case in point is the disconnect between the group’s efforts to address climate risks and its efforts to reduce the shortfall in global infrastructure investment. On one hand, the G-20 is aware that investing in projects that are high-carbon or vulnerable to the physical effects of rising temperatures carries risks that could have a destabilizing influence on the global economy. On the other hand, the G-20 is seeking to narrow the infrastructure gap in the absence of a guiding principle that infrastructure investments must be climate-compatible.

Members of the G-20

- Argentina

- Australia

- Brazil

- Canada

- China

- European Union

- France

- Germany

- India

- Indonesia

- Italy

- Japan

- Korea

- Mexico

- Russia

- Saudi Arabia

- South Africa

- Turkey

- United Kingdom

- United States

In September 2016, world leaders will convene for the G-20 summit in Hangzhou, China. One focus of the climate agenda will be ensuring that the Paris Agreement takes effect in the near term. Negotiated by more than 190 nations and finalized in December 2015, the agreement set many collective goals, including limiting global warming to 1.5 degrees Celsius above preindustrial levels and ensuring that global financial flows are compatible with low-greenhouse gas development.

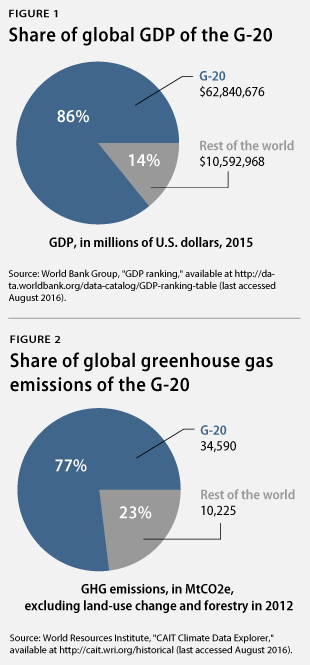

As nations turn to the formidable task of achieving the goals set in Paris, the G-20 has an opportunity to play a leading role. The G-20 is a forum of dominant economies and greenhouse gas emitters: Its members account for more than 85 percent of global gross domestic product, or GDP, and more than 75 percent of global greenhouse gas emissions. The group therefore has the responsibility and influence to successfully lead the transition to a low-carbon global economy.

The G-20 also has a reason to focus on propelling the low-carbon shift that is dictated by its mission: Climate change is among the foremost threats to the prosperity of the global economy, the governance of which is the purpose of the forum. Rising temperatures have the capacity to exacerbate extreme poverty; they also put trillions of dollars in global financial assets at risk. Failure to mitigate and adapt to climate change now registers among experts in the World Economic Forum as the greatest global threat—with the power to produce cascading risks such as water shortages, involuntary migration, and conflict.

Should the G-20 choose to take up the mantle of climate leadership as it looks to the Hangzhou summit and then to the 2017 summit in Hamburg, Germany, a natural step would be to integrate its concerns about climate risk and the infrastructure gap. Although the G-20 is vast and siloed, a leader-level focus on promoting climate-compatible infrastructure investment would create a guiding objective that spans the forum.

There are a number of practices that could help G-20 members steer resources toward climate-compatible infrastructure. One option is to consider the true cost of carbon pollution when determining the viability of potential projects. In fact, adopting such a practice would be a plausible evolution for members of the G-20, who have been moving, albeit slowly, toward an accurate price on carbon. In 2009, the G-20 committed to phase out fossil fuel subsidies—which work as negative carbon prices—and will continue to discuss and refine this commitment.

Climate risk

The global transition to low-carbon energy is underway and irreversible. Evidence of this includes the recent increase in climate cooperation among governments—such as the Paris Agreement and the North American climate partnership—and the proliferation of carbon pricing systems, which have more than quadrupled in the past decade.

It follows that climate change has introduced not only physical risk—in the form of extreme weather events, sea-level rise, desertification, and other effects of greenhouse gas pollution—but also transition risk. As governments coalesce around the necessity of curbing climate change—and as attitudes in civil society and among investors pivot to support nonpolluting energy—high-carbon assets will decline in value, sometimes precipitously.

Foremost among the positive developments in the G-20 is a focus on transition risk and its relationship to the vulnerability of the global financial system. In 2015, the G-20 requested that the Financial Stability Board—an international body that aims to foster global financial resilience—consider how the financial sector could respond to climate change. Recognizing that investors and lenders can make well-informed decisions only if companies adequately disclose their exposure to climate risks, the Financial Stability Board created the Task Force on Climate-Related Financial Disclosures. The task force is currently developing disclosure guidelines for publication by the end of 2016.

The infrastructure gap

A second development in the G-20 is a focus on the global shortfall in infrastructure investment, which is estimated to be in the range of $1 trillion annually. The need for infrastructure projects is particularly stark in developing and emerging economies, where billions of people are without access to basic sanitation or electricity. The G-20 therefore created the Global Infrastructure Hub in 2014, the mandate of which is to increase infrastructure investment worldwide.

The Global Infrastructure Hub, however, conspicuously fails to consider the infrastructure investment gap in the context of climate change. In a primer on how risks are shared in public-private partnerships, the hub notes the existence of regulatory risk as a general hazard affecting infrastructure projects. But the hub makes no obvious references to the transition risk caused by climate change—or to climate change at all.

The practice of divorcing the climate conversation from the infrastructure conversation—which is evident not only in the Global Infrastructure Hub but also throughout the G-20’s statements—is problematic for a forum devoted to economic prosperity. Climate-ignorant investment decisions could result in infrastructure that is vulnerable to climate effects. They also could result in high-carbon infrastructure that is incompatible with—and ultimately financially unviable in—a future in which emissions rapidly decline in order to meet the national and collective goals set in Paris. Such outcomes are manifestly at odds with economic development.

Toward coherence

A natural step for the G-20 would be to couple its focus on transition risk and its focus on the infrastructure gap to create a leader-level priority on climate-compatible infrastructure.

There are multiple methods of steering infrastructure investment toward low-carbon options. Wider implementation of carbon pricing systems, for example, would be helpful. In fact, a number of G-20 members have been integral to the global movement to price carbon. The emissions trading system in the European Union is the world’s largest cap-and-trade system, covering approximately 45 percent of the region’s greenhouse gas emissions. Mexico has a modest carbon tax and an emerging market for offsets. Alberta has announced a carbon tax to take effect in 2017. Ontario and Manitoba intend to implement trading systems linked to those of Quebec and California, which themselves linked in 2014. Canada is currently pursuing a carbon price to span the provinces. China has seven subnational emissions trading pilots with a national trading system slated to take effect in 2017.

French President François Hollande maintains that it is possible for all G-20 members to have a carbon price by 2020. Such a campaign could be an area of focus for Germany—which will host the G-20 in 2017 and, notably, hosted the 2015 G-7 summit that established a dialogue to develop carbon markets.

But until emissions trading systems and carbon taxes become more common—and until they set a price that reflects the true cost of carbon pollution—there are other tools that can be used to drive climate-compatible infrastructure investment. It is notable that current carbon pricing mechanisms cover less than 15 percent of global emissions, even with their increased prevalence over the past decade.

One near-term option is for G-20 members to consider the social cost of carbon—which refers to the damage caused to society by carbon pollution—in their infrastructure investment and permitting decisions. Mexico, the United States, and Canada recently pledged to align efforts to estimate the social cost of carbon—which could form the basis for a broader effort.

Using the social cost of carbon as a so-called shadow or proxy carbon price would help decision-makers determine whether a proposed infrastructure project would be financially viable in and consistent with a world in which nations meet their individual and collective emissions reduction targets. It would therefore help protect the global economy from projects that become obsolete before the end of their useful lives—and that lock in a high level of emissions, propelling climate change and slowing the shift to clean energy.

Such a practice should also extend to the international investments of G-20 members. Proxy carbon pricing has been adopted—along with complementary measures that drive low-carbon investment—in a small set of development finance institutions, including the European Investment Bank. G-20 members should encourage the wider adoption of this practice among the development banks of which they are members, including both established banks and recent ventures such as the New Development Bank, previously known as the BRICS Development Bank, and the Asian Infrastructure Investment Bank, or AIIB.

The G-20 should also promote internal carbon pricing in the private sector as a tool to mitigate transition risk. More than 1,000 companies revealed in 2015 that they assume a price on carbon in their internal decision-making. This helps ensure their continued profitability in the post-Paris world.

Considering the cost of carbon pollution in investment decisions—either via proxy carbon pricing or via an external price set through an emissions trading system or carbon tax—would be a plausible step for the G-20, which is already moving in the direction of accurately pricing carbon through its commitment to phase out fossil fuel subsidies. It is notable that some G-20 countries, including India and Indonesia, have recently implemented—and benefited from—fossil fuel subsidy reforms. Moreover, the capacity of climate change to exacerbate extreme poverty and destabilize the global economy should provide ample motivation for the world’s major economies to narrow the infrastructure gap in a way that is consistent with a rapid decline in emissions.

Gwynne Taraska is the Associate Director of Energy Policy at the Center for American Progress. Henry Kellison is a former intern at the Center.

The authors thank Pete Ogden, Senior Fellow at the Center for American Progress, for comments on an earlier version of this manuscript.