In recent years, the United States has experienced a natural gas boom that has made it one of the largest natural gas producers in the world. Between 2005 and 2013, natural gas production increased 28 percent due to rapid development of shale gas resources. As a result of this new supply, natural gas prices have fallen steadily.

Although these low prices have been a boon for consumers, they pose an economic challenge to domestic producers. Consequently, these producers are eager to find new domestic and foreign markets for natural gas in order to boost demand. Exporting more natural gas will tighten domestic supplies and, in turn, increase U.S. natural gas prices.

The U.S. Department of Energy, or DOE, already has approved several applications to export liquefied natural gas, or LNG, to customers around the globe. The Energy Information Administration, or EIA, predicts that the United States is on track to become a net exporter of natural gas before 2020. Natural gas producers, however, are pushing federal officials to expedite the approval of additional applications to export even higher levels of LNG.

At the request of the DOE, the EIA examined the potential price impact of exporting high volumes of LNG on an aggressive timeline. The EIA concluded that a surge in LNG exports would cause U.S. natural gas supply prices to rise between 4 percent and 11 percent, on average, over its current projections for the 2015 to 2040 period, depending on how much LNG is exported.

Although this could help natural gas producers’ bottom lines, higher prices also could have a significant economic effect on residential, commercial, and industrial consumers of natural gas across the country. The Center for American Progress reviewed the EIA data and found that high levels of LNG exports could increase annual natural gas bills for residential, commercial, and industrial consumers by at least $7 billion per year by 2020 and up to $14 billion per year by 2040.

Given this potentially significant consumer impact, CAP recommends that the Obama administration carefully weigh any decision to approve high levels of LNG exports and urges Congress to reject efforts to truncate or hurry the DOE’s review of pending applications. Additionally, CAP urges states to commit to ambitious renewable energy and energy-efficiency efforts in order to protect consumers from natural gas price spikes and limit the potential economic vulnerability of overcommitting to natural gas.

Approval of new LNG exports

The Natural Gas Act of 1938 requires any company that wishes to export natural gas to obtain an authorization from the U.S. Department of Energy. Under current law, when a company wants to export LNG to countries with which the United States lacks a free trade agreement, the DOE reviews its application and must approve it unless the agency finds the exports inconsistent with the public interest. When a company wants to export LNG to countries with which the United States has a free trade agreement, the DOE must deem its application as consistent with the public interest and approve it without modification or delay.

To date, companies have filed more than 40 applications with the DOE to export LNG to free trade and non-free-trade countries. Gas companies are most interested in obtaining access to the non-free-trade markets in Europe and Asia, where demand and prices are high. The DOE has issued final authorizations to four facilities to export up to 5.74 billion cubic feet per day, or Bcf/d, of LNG to both free trade and non-free-trade countries. The DOE has issued conditional authorizations for four additional applications requesting permission to export up to 7 Bcf/d. If all remaining applications are approved, then gas companies would be authorized to export up to 38 Bcf/d to non-free-trade countries. For context, the Energy Information Administration estimates that the United States consumed an average of 73.6 Bcf/d of natural gas in 2014.

Despite the DOE’s approval of significant volumes of LNG exports, natural gas producers are pushing the agency to expedite approval of the remaining LNG applications. In 2014, the U.S. House of Representatives passed a bill to set an arbitrary 30-day deadline for the DOE’s review of LNG export applications. The 114th Congress is likely to consider similar legislation in early 2015.

Potential consumer impacts of increased LNG exports

In 2014, the U.S. Department of Energy asked the Energy Information Administration to examine what effects higher levels of LNG exports could have on domestic natural gas prices. The EIA looked at three primary scenarios in its reference case: LNG exports of 12 Bcf/d, 16 Bcf/d, and 20 Bcf/d, all phased in at a rate of 2 Bcf/d per year beginning in 2015 and reaching 12 Bcf/d by 2020. The EIA compared the price impacts in each of these scenarios with the business-as-usual baseline scenario, in which LNG exports rise to 5.7 Bcf/d by 2020 and 7.4 Bcf/d by 2040. The EIA concluded, “Increased LNG exports lead to increased natural gas prices.” The EIA estimated that natural gas supply prices would rise an average of 4.3 percent to 10.6 percent over current projections for the 2015 to 2040 period, depending on the volumes of LNG exported.

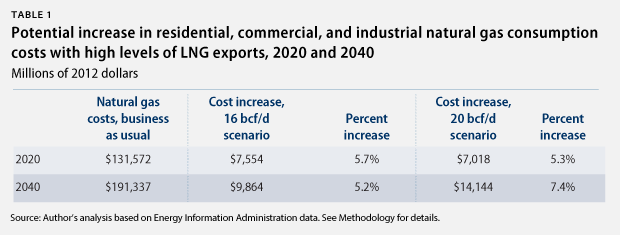

This increase in the supply price translates into higher consumer prices. CAP examined the potential price impact of exporting 16 Bcf/d and 20 Bcf/d on residential, commercial, and industrial natural gas consumers, finding that they could spend at least $7 billion more on their natural gas bills per year by 2020 and up to $14 billion more per year by 2040. (see Table 1) The following sections detail these potential cost impacts by consumer type and geographic region.

Residential consumers

Residential consumers include those who use natural gas “in private dwellings, including apartments, for heating, air-conditioning, cooking, water heating, and other household uses.”

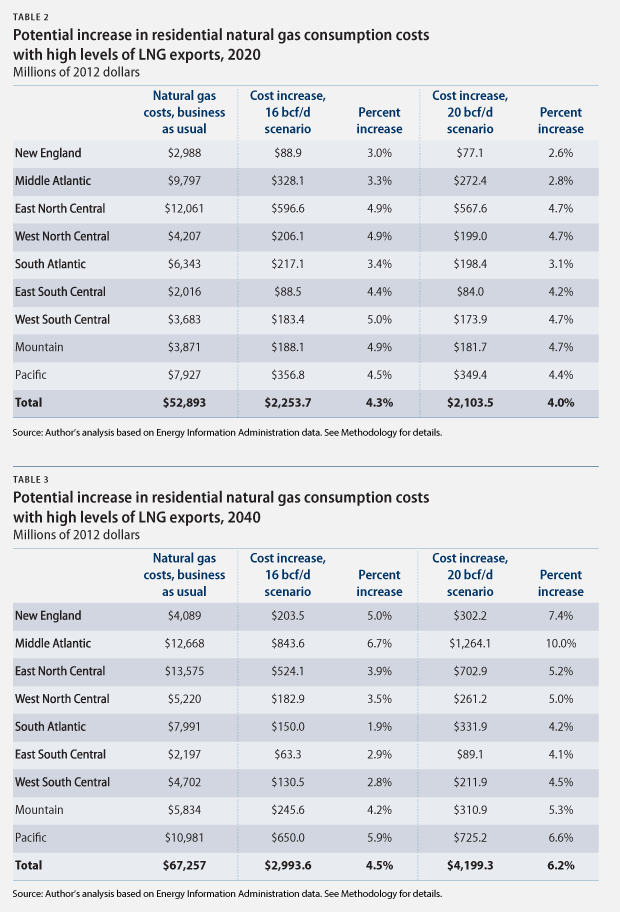

The EIA estimates that residential consumers would pay prices that are 2.1 percent to 4.8 percent higher than currently projected over the 2015 to 2040 period. Table 2 and Table 3 show the potential added cost to residential natural gas consumers in two of these years—2020 and 2040—if LNG exports rise to 16 Bcf/d or 20 Bcf/d.

Under a scenario in which the United States increases its LNG exports to 16 Bcf/day, residential consumers would pay 4.3 percent more per year for natural gas by 2020 than current projections suggest. Increases in residential natural gas bills that year would be most significant in the East North Central and West North Central regions of the Midwest and the West South Central states of Arkansas, Louisiana, Oklahoma, and Texas. (see Methodology for details on this regional breakdown) By 2040, residential natural gas bills would rise the most in the Middle Atlantic states—6.7 percent higher than current EIA projections. Under a more aggressive scenario in which the United States exports 20 Bcf/d, residential consumers in the Middle Atlantic states would pay 10 percent more per year by 2040 than currently projected. In New England, they would pay 7.4 percent more per year than currently projected.

Commercial consumers

Commercial consumers include “nonmanufacturing establishments or agencies primarily engaged in the sale of goods or services,” including “hotels, restaurants, wholesale and retail stores and other service enterprises.” Also included in this category is natural gas “used by local, State, and Federal agencies engaged in nonmanufacturing activities.”

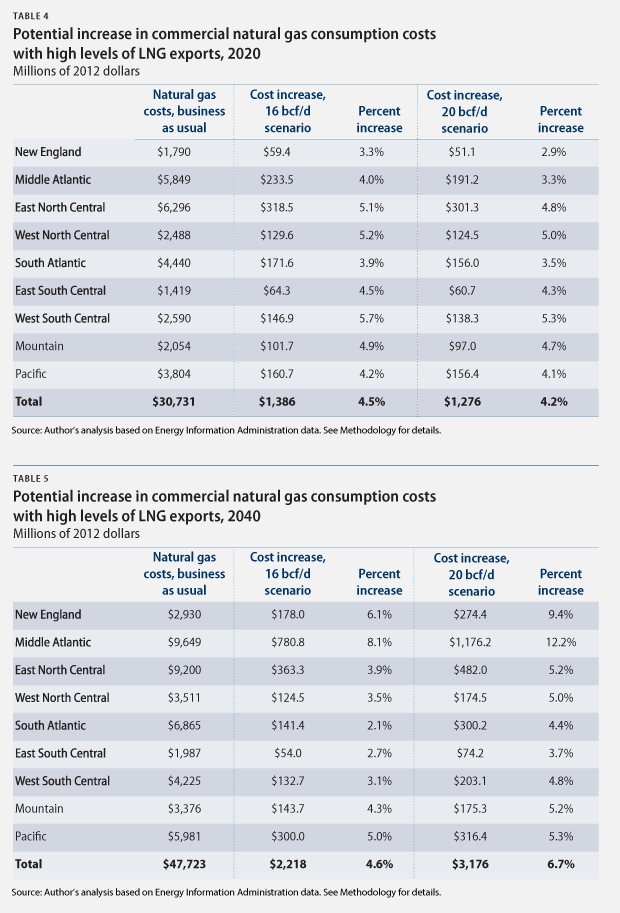

The EIA estimates that commercial consumers would pay prices that are 2.5 percent to 5.7 percent higher than currently projected over the 2015 to 2040 period. Tables 4 and 5 show the potential impact on commercial consumers’ natural gas bills in 2020 and 2040 if LNG exports rise to 16 Bcf/d or 20 Bcf/d.

Under a scenario in which the United States begins to export 16 Bcf/day of LNG, commercial consumers would pay 4.5 percent more per year by 2020 than what is currently projected. Increases in commercial natural gas bills that year would be most significant in the West South Central states of Arkansas, Louisiana, Oklahoma, and Texas. If the United States exports 20 Bcf/d, commercial natural gas consumers in the Middle Atlantic states would pay 12.2 percent more per year by 2040 than currently projected. They would pay 9.4 percent more per year in the New England states.

Industrial consumers

Industrial consumers include those who use natural gas for heat, power, or chemical feedstock. They include “manufacturing establishments or those engaged in mining or other mineral extraction as well as consumers in agriculture, forestry, and fisheries.”

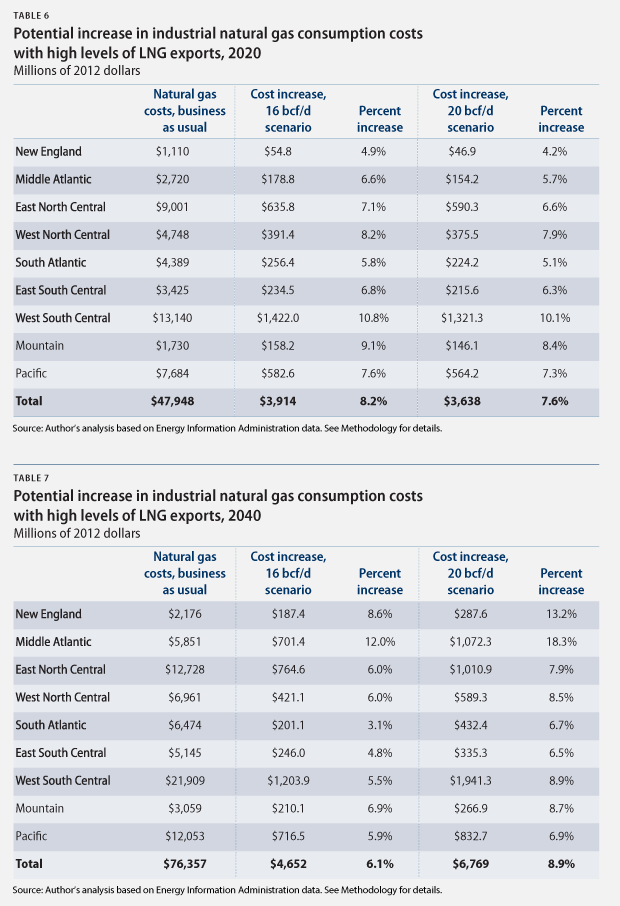

The EIA estimates that industrial consumers would pay prices that are 3.6 percent to 8.8 percent higher than currently projected over the 2015 to 2040 period. Tables 6 and 7 illustrate the potential cost to industrial consumers in 2020 and 2040 if LNG exports rise to 16 Bcf/d or 20 Bcf/d.

Under a scenario in which the United States exports 16 Bcf/d of LNG, industrial consumers would pay 8.2 percent more for natural gas per year by 2020 than what is currently projected. Increases in industrial natural gas bills that year would be largest in the West South Central states of Arkansas, Louisiana, Oklahoma, and Texas, as well as in the Mountain states of Arizona, Colorado, Idaho, New Mexico, Montana, Nevada, Utah, and Wyoming. Under the scenario in which the United States exports 20 Bcf/d, industrial natural gas consumers in the Middle Atlantic states would pay 18.3 percent more per year than currently projected by 2040. In the New England states, they would pay 13.2 percent more per year.

Some manufacturers have raised concerns about the potential economic impact of policies that would raise natural gas prices. The Industrial Energy Consumers of America, or IECA—which represents “manufacturing companies for which the availability, use and cost of energy, power or feedstock play a significant role in their ability to compete in domestic and world markets”—has stated its strong opposition to LNG exports. In a recent letter to President Barack Obama, the organization highlighted the impact that rising natural gas prices may have on the competitiveness and profitability of certain U.S. manufacturers, such as those in the chemical and fertilizer industries that use natural gas as a raw material. IECA urged the DOE to exercise “great caution” when approving future LNG export applications.

Recommendations

If the federal government approves the export of significantly higher volumes of LNG, U.S. residential, commercial, and industrial consumers of natural gas could pay $14 billion more per year by 2040. Given this significant economic impact, CAP makes the following recommendations:

- The Obama administration should carefully weigh any decision to approve high levels of LNG exports. Before approving LNG exports in excess of 16 Bcf/d, the U.S. Department of Energy should ensure that any analyses supporting the conclusion that high volumes of LNG exports are in the public interest reflect the latest projections for natural gas demand in the electricity and transportation sectors. Specifically, the DOE should analyze high levels of LNG exports in combination with proposed policies that are likely to be implemented but are not included in the EIA’s 2014 analysis, such as those that would increase the use of natural gas in cars and trucks and for electricity generation.

- Congress should consider what higher natural gas prices would mean for consumers before it passes any legislation to expedite higher volumes of LNG exports. In particular, Congress should reject any effort to artificially limit the DOE’s authority or its ability to assess whether approving higher levels of LNG exports is in the public interest.

- State policymakers should take aggressive action to increase the use of renewable energy in their states and to make state economies more energy efficient. Renewable energy and energy-efficiency policies can mitigate natural gas use and reduce consumers’ vulnerability to natural gas price fluctuations.

The United States is in the midst of a natural gas boom that few would have predicted a decade ago. This rapid growth in shale gas development has lowered natural gas prices for consumers ranging from the average homeowner to the largest chemical manufacturer. Natural gas producers, however, are pushing to boost natural gas demand—and, consequently, natural gas prices—by exporting higher volumes of LNG to foreign buyers. The DOE should exercise its authority to prevent LNG exports in volumes that could harm the public interest. Moreover, state policymakers need to shield consumers from potential natural gas price spikes by investing in the best defense—energy efficiency and renewable energy.

Methodology

Natural gas price, consumption, and cost data

To calculate the potential costs to residential, commercial, and industrial consumers of natural gas, the author analyzed data generated by the Energy Information Administration for its 2014 report “Effect of Increased Levels of Natural Gas Exports on U.S. Energy Markets.” Those data are available on the EIA website in the Annual Energy Outlook 2014 table browser. The author looked only at the reference case, which reflects the most likely estimates for natural gas supply and economic growth.

The author compared the prices and natural gas consumption projections under the 12 Bcf/d, 16 Bcf/d, and 20 Bcf/d scenarios with the baseline scenario, which is based on projections in the EIA’s Annual Energy Outlook 2014 and reflects a business-as-usual scenario—that is, the scenario that does not involve any policy changes. Notably, the baseline scenario assumes that the United States will export 5.7 Bcf/d in 2020 and 7.4 Bcf/d in 2040. It also assumes that the country’s supply price for natural gas will more than double between 2013 and 2040. Therefore, the author’s conclusions about natural gas price and cost increases are in addition to increases that the EIA already anticipates in the absence of policy changes.

To calculate natural gas costs in the residential, commercial, and industrial sectors under each LNG export scenario in the reference case, the author multiplied the projected natural gas price for a given sector in a given year by that sector’s projected natural gas consumption in that year. She then compared the results with the reference case baseline to calculate the projected cost increases of policy to expand LNG exports.

Regional energy data

The EIA categorizes the country by region according to the Census divisions detailed below.

- New England: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont

- Middle Atlantic: New Jersey, New York, Pennsylvania

- East North Central: Illinois, Indiana, Michigan, Ohio, Wisconsin

- West North Central: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota

- South Atlantic: Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, West Virginia, District of Columbia

- East South Central: Alabama, Kentucky, Mississippi, Tennessee

- West South Central: Arkansas, Louisiana, Oklahoma, Texas

- Mountain: Arizona, Colorado, Idaho, New Mexico, Montana, Nevada, Utah, Wyoming

- Pacific: Alaska, California, Hawaii, Oregon, Washington

Alison Cassady is the Director of Domestic Energy Policy at the Center for American Progress.