Last October, a technological glitch left more than 132,000 RushCard users separated for days from the money in their accounts. Because the prepaid RushCard often works as a bank account substitute for those who do not have or do not want a traditional bank account, many people were ultimately unable to pay their bills or day-to-day expenses until the problem was resolved.

In response, users might be expected to sue. Even if individual victims did not choose to sue because of the costs involved, an attorney might file a class action lawsuit to represent thousands of wronged consumers. However, customers had already—largely unknowingly—agreed to a mandatory arbitration clause in the fine print of their card contracts. This effectively signed away their right to sue, individually or through a class action. Under such a clause, individuals waive their Seventh Amendment right to a civil trial by jury in favor of meeting with an arbitrator—someone chosen by the company involved—to act as judge and jury.

This is entirely legal, due to the Federal Arbitration Act, a 1925 law designed to help businesses resolve their contractual disputes quickly and easily outside of court by validating agreements made by private arbitrators. Over the past three decades, courts have taken a broader view of arbitration clauses to include relationships between businesses and individuals; since then, these clauses have become ubiquitous in contracts, determining how potential disputes will be handled long before a dispute arises. The clauses may include bans on participating in class action lawsuits, as well as requirements that individual disputes go to arbitration.

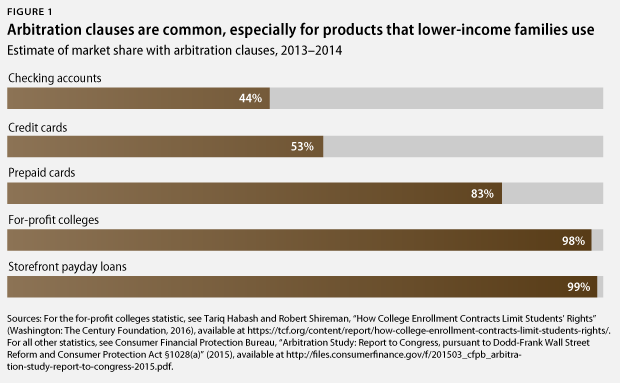

Many everyday products contain these hidden clauses. In 2014, General Mills famously reversed course after attempting to require that anyone who even liked Cheerios on Facebook agreed to arbitration for future disputes. And as part of the 2010 Dodd-Frank Act, the newly formed Consumer Financial Protection Bureau, or CFPB, was charged with studying these clauses in financial products. It found that they are everywhere: For example, roughly half of all checking accounts and credit cards have such clauses. And for consumers using products that are often targeted at lower-income or more vulnerable populations—such as prepaid cards and payday loans—the vast majority of products studied by the CFPB contained these clauses. The usage of these clauses, however, goes far beyond financial products. During the 2013–2014 school year, approximately 98 percent of students who received federal financial aid to attend for-profit colleges had contracts requiring that disputes go to arbitration as well. Figure 1 shows the prevalence of these clauses for different products. Employment contracts, too, may contain similar clauses: Some employment lawyers estimate that as many as one in three nonunion workers is under a mandatory arbitration agreement.

Ultimately, victims of last fall’s RushCard outage narrowly avoided disaster. In a surprising and unusual response to public pressure, the company waived its own arbitration clause and recently reached a $19 million settlement with everyone affected. Millions of victims in other cases are not likely to be so lucky, and most companies are not likely to be so benevolent. Fortunately, some federal agencies and members of Congress are looking to reverse this practice to make sure people are not locked out of the courthouse when harmed by a product or service—although they face an uphill battle in doing so.

Mandatory arbitration often falls short

When large numbers of people are wronged, as in the RushCard case, class action lawsuits are one way to resolve claims and punish wrongdoing. If a class action is successfully resolved in favor of the victims—either by trial or in a settlement—it can have two beneficial effects. First, it provides financial relief to the victims. Second, the threat of a significant monetary penalty may also incentivize changes in behavior. While class actions can have their own limitations and drawbacks—particularly when class members’ individual concerns and needs may differ—they remain a powerful tool for accountability.

Proponents of arbitration have argued that it, too, can adequately execute individuals’ legal rights and ensure that they effectively have access to justice in response to wrongdoing. Court cases have long considered whether arbitration provides effective vindication of individual rights. The concept of arbitration is theoretically appealing: Instead of going to court, two parties attempt to resolve their differences privately with a neutral arbitrator. There are many instances where this makes sense, such as when both parties select the arbitrator, an action that helps ensure an arbitrator is trusted and respected by both sides.

Baseball arbitration’s balancing act

Professional baseball players sometimes use a form of final-offer arbitration in which representatives for a player and the team each propose a salary to a third-party arbitrator, who then hears evidence and picks one side or the other. The arbitrator cannot choose an amount between the two that are given. Because neither party wants to suggest a figure that might be rejected out of hand, this encourages both sides to make reasonable proposals, knowing they will have to live with one or the other. It also encourages both parties to reach an agreement beforehand if either side is concerned that it will not get a favorable outcome from an arbitrator.

However, in cases where the two parties may not be on equal footing, using arbitration to effectively vindicate consumers’ rights is more challenging. To be effective, arbitration needs to be both cost-effective and accessible. This is not always the case. In 2013, Yvonne Cardwell, a part-time dishwasher at a Whataburger restaurant in El Paso, Texas, sued her employer after suffering injuries at work. Company policy dictated that the case go to arbitration instead, which would have taken place several hours away in Dallas. It was difficult and expensive for Cardwell to travel to Dallas to meet with an arbitrator when the matter could have been handled locally in court. And in this case going to court could have been cheaper. The trial judge reviewing the arbitration clause found that it would cost the company $20,000 to pay for the arbitrator, an expense it would not face inside the local court system. Cardwell’s case is still in deliberation in the courts, but it is illustrative of how arbitration can be a more expensive and time-consuming resolution that makes it harder for victims to pursue their claims.

To be an effective deterrent, the results of arbitration would need to be transparent. Yet they are typically confidential, making it difficult for victims to recognize common problems that a company may have already resolved for other customers. While the lack of transparency makes it difficult to pinpoint outcomes, there is some evidence that consumers are also less likely to win in arbitration than in class actions. One analysis of California labor cases in the mid-2000s found that employees won only 21 percent of cases in arbitration, but they won 36 percent of federal employment discrimination cases and more than half of all state court cases. Successful lawsuits also typically resulted in awards roughly 5 to 10 times larger than those reached in arbitration. Similarly, the CFPB’s analysis of arbitration agreements found that within its sample, between 2010 and 2012 consumers received a total of $172,433 as the result of arbitration, plus $189,107 in debt forbearance. Yet during the same time period, class action settlements resulted in more than $1 billion to consumers through cash and in-kind relief, after fees. While some of these settlements were quite large and involved tens of millions of class members, the vast majority of cases in the CFPB’s analysis were for smaller classes and total sums of $10 million in relief or less. For example, 21 million bank account holders were members of 37 class action settlements between 2008 and 2012, but the median class size was only 8,136 and the average was 568,000.

The consequences of arbitration clauses

At a minimum, mandatory arbitration clauses may dissuade victims from pursuing claims. In just one example demonstrated by a New York Times analysis of 57 million Sprint customers nationwide, only six customers sought arbitration between 2010 and 2014. It is unlikely that so few customers would pursue a complaint against a large company. Of course, not all customer complaints will result in legal action. Internal customer service practices may potentially resolve many concerns before reaching that point. However, recognizing that they are unable to take the company to court, many customers may decide to drop their claims rather than pursue an arbitration process that has low odds of success.

When arbitration is a required mechanism from the start rather than a voluntary way to settle disputes with consumers and workers, it gives companies a free pass for low quality and abusive practices. When the risk of being held accountable is low, there is less incentive for companies to do the right thing. In addition, because arbitrators are likely to want to do business with a company in the future, they have a built-in reason to side with the company over the consumer.

The most economically vulnerable individuals are also the most likely to be affected by these clauses. Just as Yvonne Cardwell, the Whataburger employee, was told she would need to travel several hours if she wanted to be present when an arbitrator reviewed her case, products targeted to low-income families are often more likely to include arbitration clauses. A recent report by The Century Foundation found that 98 percent of students receiving federal funds to attend for-profit schools have an arbitration clause in the enrollment agreements that students are required to sign before attending school. Notably, virtually no public or nonprofit higher education institutions in the study used forced arbitration clauses in their enrollment agreements—only for-profit institutions. Given for-profits’ poor track record, this is troubling: Among students who enrolled at these schools in 2001 and 2002 and received federal financial aid, 57 percent were earning less than $25,000 annually 10 years later, suggesting that the economic benefits of their programs were limited. Just as prepaid cards and payday loans frequently contain arbitration clauses, these clauses at for-profit colleges reduce institutional accountability for places that serve those who are most economically vulnerable.

In some cases, these clauses shift risk to victims and to taxpayers. When victims such as Yvonne Cardwell face procedural hurdles to exercise their legal rights, their financial challenges in the meantime may leave them in a worse position. On the national level, taxpayers are on the hook for billions of federal aid dollars that went toward for-profit colleges with very poor outcomes for students. Appellate attorney Deepak Gupta of Washington, D.C., who has argued before the U.S. Supreme Court on arbitration clauses, has suggested mandatory arbitration clauses may even result in a wealth transfer from harmed consumers and workers to the firms that commit wrongdoing. In addition, when bad behavior is less likely to be identified and punished, practices such as unfair or deceptive consumer practices and the use of wage theft are more lucrative. Issues that have not seen the light of day in a courtroom may also elude the attention of regulators and policymakers who have the power to take their own public enforcement actions in response to wrongdoing.

Efforts to reform mandatory arbitration clauses

In a series of decisions since the early 1980s, the Supreme Court has increasingly defended the use of forced arbitration clauses when they exist in contracts. These arguments have concluded that the Federal Arbitration Act supersedes other consumer and worker laws and protections on the books. In response, a number of federal agencies seek to restrict the use of these clauses in contracts to protect consumers and workers. Here are just a few examples:

- The Consumer Financial Protection Bureau proposed a rule in May 2016 to prohibit financial institutions from including language in any new consumer contracts, such as those for bank accounts and credit cards, that would limit consumers’ ability to pursue class-action lawsuits. The proposal would also require data collection when individual arbitration takes place in order to provide transparency about the arbitration process and outcomes for consumers, to possibly inform future rulemaking in this area.

- The U.S. Department of Education in June 2016 released proposed regulations that would retain consumers’ right to sue institutions of higher education. The proposed rule prohibits class action bans and mandatory arbitration for students who take out Direct Loans to attend colleges and universities that receive federal funding, and should be extended to a wider range of claims by students receiving federal financial aid. This is particularly important in the wake of abuses by for-profit colleges that required students to waive their right to sue. If students had that right, fraud and abuse in the higher education marketplace could be identified and corrected much faster.

- The U.S. Department of Defense in July 2015 banned arbitration clauses in loans made to service members under the Military Lending Act. First passed in 2006, the act limits the interest rate that lenders can charge on certain types of loans to 36 percent annually, preventing harmful loans that may trap military families in debt and even risk individuals’ security clearances. This arbitration ban is particularly relevant given that service members may be away from home for long periods of time and may find it difficult to exercise their legal rights while they are away.

- The U.S. Department of Labor’s final rule on conflicts of interest in retirement investment advice, released in April 2016 and commonly known as the fiduciary rule, contains a best interest contract for financial advisers and their clients. This contract prohibits bans on class actions when savers and retirees receive financial advice about their retirement funds. It does, however, permit mandatory arbitration for individual disputes. The availability of “private rights of action” is expected to help enforce the rule, which requires advisers to act in their clients’ best interest rather than their own.

- The Centers for Medicare and Medicaid Services, or CMS, is finalizing new rules for payments to nursing homes that receive federal funding through Medicare and Medicaid that may include restrictions on the use of arbitration clauses in residents’ contracts. These provisions are particularly critical both as a form of accountability and as a way to ensure that elderly residents and their families are not forced to sign nonnegotiable contracts with language that they do not understand, or forced to sign without giving full, informed consent. In one Mississippi case involving a resident who was illiterate, a judge ruled that that factor alone would not invalidate an arbitration clause. Sixteen states and the District of Columbia requested that CMS block funding to nursing homes that use these clauses in residents’ contracts.

- The U.S. Department of Labor and the Federal Acquisition Regulatory Council are finalizing new rules to implement President Barack Obama’s Fair Pay and Safe Workplaces Executive Order. Once implemented, the order will require companies with more than $1 million in federal contracts not to bind their employees to enter into arbitration agreements for claims related to sexual assault or harassment.

Some members of Congress have also introduced legislation to limit the use of arbitration clauses. Sen. Al Franken (D-MN) and Rep. Hank Johnson (D-GA) have introduced the Arbitration Fairness Act, a bill that would restore arbitration to its historical role as a business-to-business dispute mechanism and would allow courts, rather than arbitrators, to determine whether arbitration should apply. Another bill, the Restoring Statutory Rights and Interests of the States Act sponsored by Sen. Patrick Leahy (D-VT) and others, would uphold state laws limiting the use of forced arbitration and ensure that victims’ rights under federal or state law can be exercised in court.

However, both regulators and members of Congress concerned about arbitration clauses face an uphill battle. In 2015, Congress considered blocking the CFPB’s arbitration rule as part of its year-end budget deal, and it may happen again this year. Meanwhile, Congress has attempted to block the Department of Defense from implementing President Obama’s executive order allowing military contractors to sue their employer for civil rights claims and claims related to sexual assault or abuse. Arbitration as a blunt instrument for dealing with disputes may not be going away on a large scale anytime soon.

Conclusion

Mandatory arbitration clauses, which are increasingly upheld by the courts, have in many cases tipped the scales of justice away from consumers and workers by making it more difficult for them to successfully challenge wrongdoing. Taking matters to court often results not only in better outcomes for victims, but in deterring future bad behavior. By limiting the use of these clauses in contracts, regulators and policymakers can reverse a trend of restricting legal remedies and thereby encourage accountability in the marketplace through the realignment of incentives.

Joe Valenti is the Director of Consumer Finance at the Center for American Progress.