When Rep. Paul Ryan (R-WI) was elected Speaker of the House in October 2015, he talked about his goal to “pay off our national debt so that we can grow our economy and give our children and grandchildren a more prosperous future and not saddle them with our debts.”

But the most recent House budget resolution—like earlier House budgets authored by Republican leaders—will burden America’s children and grandchildren with slower economic growth. Many of the most severe spending cuts in the House budget target environmental, health care, and nutrition programs. These programs make children healthier, which in turn raises future workforce productivity and labor force participation—two ingredients for faster economic growth.

These cuts fit into a broader philosophy of austerity and neglect that disproportionately affects low-income families and communities of color. The best recent example of the effects of this philosophy is the water crisis in Flint, Michigan. A callous, short-sighted attempt to cut government spending ended up poisoning Flint’s municipal water with lead. Because childhood lead poisoning permanently reduces academic achievement, cognitive ability, and future job performance, the austerity during the early 2010s will not only affect the health and wellbeing of Flint’s residents in the years to come, but it will almost certainly affect the future productivity of the Flint workforce and the prosperity of the Flint region. Sadly, the Flint water crisis is one of many examples of how excessive austerity falls hardest on communities of color.

At its core, a government’s fiscal policy reflects what—and who—society chooses to value. House Republican leaders are making the same kind of value judgments that government officials made for Flint, and these choices will have devastating consequences for today’s children—and tomorrow’s economy.

Remarkably, the House might fail to pass their budget this year due to opposition from representatives demanding even more severe and immediate cuts. And while these cuts are unlikely to become law this year due to opposition from President Barack Obama, the next president could support and implement this type of agenda.

This brief reviews the research on the importance of health at birth as it relates to future economic outcomes and explains why childhood health is vital for a strong economy. The brief then discusses the importance of environment, health care, and nutrition programs, and examines how the cuts in the House budget would undermine childhood health and the economy.

Some of the most important programs for childhood health are often seen only as consumption, government spending, or regulation—as opposed to investments in the nation’s future. A pro-growth budget would recognize that causing permanent damage to a generation of children is detrimental for the future economy and that investing in healthier children yields substantial economic benefits in the long term.

Health at birth

Increasingly, economists are finding that a child’s health at birth can have a strong causal impact on how productive a worker he or she becomes as an adult and whether he or she joins the labor force at all.

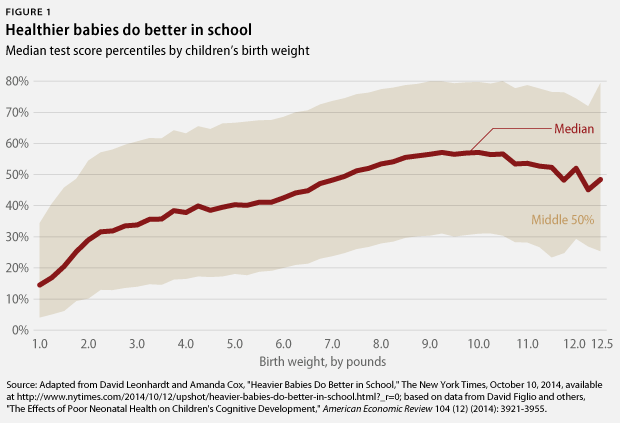

One common measure of newborn health—children’s weight at birth—is highly correlated with test scores. Several studies find a causal relationship between low birth weights and future outcomes by comparing siblings and even twins—finding that children with lower birth weights complete less school; have worse test scores; are more likely to use disability programs; and end up earning lower wages than children with higher birth weights. One study based on twin data suggests that a 10 percent increase in birth weight raises full-time earnings by about 1 percent, making it about as valuable on the labor market as an additional quarter year of education. Another twin study–which found that higher birth weights raise children’s test scores—implies that three-quarters of the increase in earnings is explained by increases in cognitive skills.

The mortality rate is obviously another important measure of children’s health. A high mortality rate reflects negatively on the health of the overall population—including survivors—since it indicates poor overall conditions. This importance is dramatically illustrated by research showing that the narrowing of the black-white test score gap during the 1980s is best correlated with the decline in the mortality rate for black children as a result of the Civil Rights movement—specifically the integration of hospitals during the 1960s. The Civil Rights Act of 1964 and the Medicare Act of 1965 increased access to hospitals for black people living in the South and reduced deaths from pneumonia and diarrhea—both easily treated with adequate medical care—among young black children. Researchers used this reduction in the post-neonatal mortality rate as a proxy for overall early childhood health and found that it explained a significant increase in test scores when these children were in high school.

Measuring the economic impact of public policy

One of the most significant challenges in empirical research is separating causation from correlation. As a hypothetical example, a correlation between pollution and low birth weights does not necessarily prove that pollution causes low birth weights. This correlation might instead be the result of poor parents living in more polluted areas where housing is cheaper, and their children may have lower birth weights as a result of poverty. Pollution might not be causing low birth weights even though the two measures are correlated with each other if a third variable, such as poverty, is causing the variation in both birth weight and pollution in the surrounding environment.

Economists frequently measure the causal impact of environmental factors and public policy with natural experiments. These events approximate a classic laboratory experiment by exposing one group of people to a treatment while leaving a control group unaffected. For example, a study by Princeton University economist Janet Currie and University of California, Berkeley economist Reed Walker established that air pollution causes low birth weights by examining what happened after traffic congestion and automobile emissions declined near New Jersey toll plazas. Currie and Walker found that after the state introduced electronic highway tolls, or E-Z Pass, the ensuing reduction in automobile emissions reduced the incidence of prematurity and low birth weight among mothers who lived within two kilometers of a toll plaza. The 8.5 percent to 11.3 percent reduction was determined by comparing changes in birth weights of children near the toll plaza—the treatment group—and those farther away from the toll plaza—the control group. These and other natural experiments allow researchers to measure the causal effects of exposure to pollution, as well as access to health insurance or receipt of nutritional assistance.

Environment

The House budget includes $887 billion in cuts over 10 years from nondefense programs that Congress funds annually in appropriations bills. Most of these cuts are vague and unspecified reductions that Congress would have to make in future years, but the budget specifically targets the U.S. Environmental Protection Agency, or EPA, for budget cuts. And based on the House Appropriations Committee’s actions in earlier years, these cuts would also be likely to fall particularly hard on lead removal efforts.

Research on the effects of pollution on children’s health has especially focused on how reductions in pollution as a result of environmental regulation improve children’s health, since the introduction of new rules creates a natural experiment that allows researchers to measure causality. One study, for example, found that the Clean Air Act prevented between five and eight infant deaths per 100,000 live births for every a one-unit reduction in airborne particulates caused by the law. Another study found that a two standard deviation increase in two types of pollutants regulated by the EPA—heavy metal cadmium and toluene—increased the incidence of low birth weights by 1.2 percent to 2.7 percent. Cleaning up polluted areas under the EPA’s Superfund program reduces the incidence of congenital anomalies—such as Down syndrome and heart defects—by 20 percent to 25 percent for children born near these sites.

Recent research verifies the causal link between a child’s exposure to pollution and worse economic outcomes as an adult. The Clean Air Act Amendments of 1970 led to a reduction in air pollution that translated into a 0.7 percent increase in the annual number of quarters worked and a 1 percent increase in earnings—equal to $4,300 over a lifetime.

Effective environmental enforcement is therefore pro-growth since the resulting increases in birth weight will raise children’s labor-force participation and earnings once they reach adulthood. In light of this evidence, attempts to reduce the EPA budget are puzzling. In 2015, the House Appropriations Committee attempted to cut the EPA budget by about 9 percent. The House budget resolution would force the House Appropriations Committee to work within even lower spending levels in future years. Therefore, these unspecified cuts would likely force even deeper reductions at the EPA. Adam M. Kushner, the former director of the Office of Civil Enforcement at the EPA, warns that these cuts could reduce environmental laws to “just paper” due to a lack of enforcement, which will increase the amount of pollution to which children are exposed.

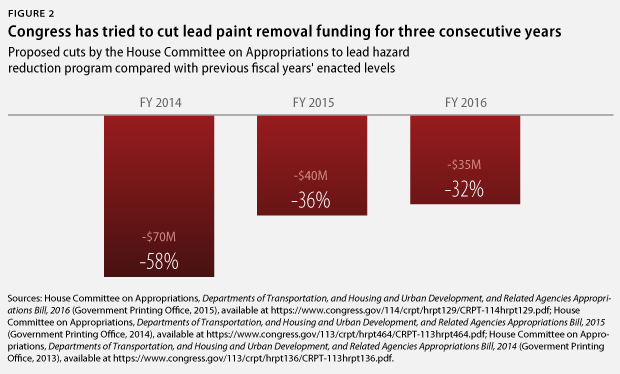

The vague cuts in the Congressional budget resolution also would likely impact a program targeting the removal of lead-based paint from low-income housing. The House Appropriations Committee has attempted to make huge cuts to this program for three years in a row, and the spending limits that this year’s budget resolution endorses for future years could force even steeper cuts. These cuts to the lead abatement program deserve particular attention given the catastrophe in Flint.

The research shows that these cuts will significantly reduce future economic growth because of their effect on children’s cognitive abilities and job performance. One study of Rhode Island children shows that even small increases in their exposure to lead permanently reduce their test scores—an effect that is most pronounced for poor children. A study of Swedish children reached similar conclusions about children’s academic performance, cognitive ability, and job performance. It concludes:

[A] decrease in a child’s blood lead level from 10 to 5 micrograms per deciliter would imply an average increase in 9th grade GPA by 2.2 percentiles and an increase in the high school graduation rate by 2.3%. In terms of labor market outcomes the same decrease would imply an estimated increase in earnings (average for ages 20-32) by 5.5%.

Given the strong negative consequences of lead on children’s future economic outcomes, it is no surprise that cuts to lead abatement programs are the ultimate example of a penny wise, pound foolish budget policy: A dollar of lead abatement spending is estimated to return $17 to $221 in benefits to society as a result of improved health, less need for special education, reduced crime, and higher earnings.

Health care

Perhaps the most serious example of the anti-growth policies in the House budget is a $2.1 trillion cut to Medicaid and the Children’s Health Insurance Program over the next 10 years. This results from converting these programs to a smaller block grant that would fail to adequately support the health care needs of low-income Americans and from repealing the Medicaid expansion in the Affordable Care Act. Urban Institute researchers studied a similar proposal in 2012 and found that it would slash the number of people enrolled in Medicaid by 42 percent to 50 percent. The researchers concluded that, “Enrollment reductions would likely affect children, because they are a disproportionate share of Medicaid enrollment.”

Other research leaves no doubt that reducing the number of children on Medicaid would result in a sicker and less-educated workforce, because Medicaid makes children healthier and better educated. One study found that the 15 percentage point increase in Medicaid eligibility between 1984 and 1992 decreased child mortality by 5.1 percent. Another study found that these Medicaid expansions reduced the internal mortality rate—which accounts for deaths from diseases rather than from accidents or crime—for covered African American children by 13 percent to 20 percent. With regard to education, one group of researchers found that a 10 percentage point increase in average Medicaid eligibility for children reduces their high school dropout rate by 4 percent to 6 percent and raises their bachelor’s degree attainment by 4 percent to 6 percent. Another study found that each additional year of Medicaid eligibility increases the likelihood of college attendance by 0.4 percentage points.

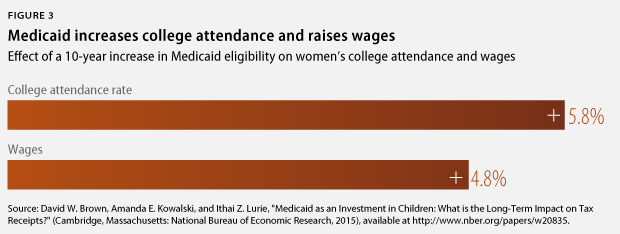

One should expect that making children healthier and more educated—as these studies show that Medicaid has—will boost the future earnings of these children. Using tax data, a group of researchers found that an additional 10 years of childhood Medicaid eligibility raises a 28-year-old woman’s cumulative earnings by 5 percent. Similarly, another study showed that a 10 percentage point increase in Medicaid eligibility for pregnant women increased average future incomes for their children by 1.3 percent to 1.5 percent.

Access to Medicaid also makes children less reliant on safety net programs when they become adults, which offsets much of the government’s initial Medicaid costs. One study finds that the government receives 56 cents back from every dollar of childhood Medicaid spending, because the subsequent increase in earnings lead to more tax revenue and less safety net spending.

Nutrition

The House budget singles out the Supplemental Nutrition Assistance Program, or SNAP—formerly known as food stamps—for particularly severe cuts by converting the program to a smaller block grant. The vague cuts called for in the resolution would also be likely to reduce support for other nutrition programs—such as the School Breakfast Program, or SBP, and the Special Supplemental Nutrition Program for Women, Infants, and Children, or WIC. Numerous studies have found that each of these food assistance programs makes children healthier, which means that cutting these programs will make the future workforce less healthy and productive.

For example, a recent study showed that WIC—a program targeted at pregnant women and children younger than age five—increases birth weights and directly affects other positive health outcomes. This supports the findings of another study showing that access to WIC reduces the probability that a child has a low birth weight. A study on the SBP found that the program allows children to eat healthier foods, which lowers their share of calories from fat while raising their fiber intake. At the same time, access to SBP results in children who are less likely to suffer from deficiencies in vitamin C, vitamin E, and folate and are more likely to meet the U.S. Department of Agriculture’s recommendations for potassium and iron intake.

Research on SNAP by Hilary W. Hoynes, Douglas Almond, and Diane Whitmore Schanzenbach has documented several positive health and economic outcomes of the program. The three researchers analyzed differences at the county level that are linked to the establishment of the Food Stamp Program, which created a natural experiment when it began operating in various counties between 1961 and 1975. A 2011 paper by these aforementioned researchers concluded that access to food stamps reduced the incidence of low birth weights, especially for African Americans. Another paper published by these researchers in 2015 found that a child’s access to food stamps while in utero and during early childhood was associated with positive health effects that lasted for decades. Specifically, food stamps reduced the future incidence of metabolic syndrome—a collection of diabetes, heart disease, obesity, high blood pressure, and heart attacks.

Hoynes, Almond, and Schanzenbach also linked food stamp access during childhood to higher economic self-sufficiency for women in adulthood, which should not be surprising due to the research linking childhood health to future economic success. This study found that increased access to food stamps for young girls—and for their mothers during pregnancy—led to an increase in economic self-sufficiency when those women reached adulthood, as measured by higher incomes, more education, and lower welfare participation.

Conclusion

Progressives and conservatives often disagree about how to grow the economy. Some conservatives claim that massive spending cuts will grow the economy, but this severe and unnecessary austerity will undermine the current recovery and damage America’s economy over the long term. Nor is the country facing a fiscal crisis that requires such extreme cuts. Conservatives may claim that tax cuts are the key to growth, but this trickle-down approach has been repeatedly debunked by the failure of earlier tax cuts. And claims that deregulation will lead to growth focus only on costs and ignore the benefits of the many regulations that the House budget is attacking—benefits such as major improvements in childhood health from environmental rules.

The economic case for the deep cuts included in the House budget disintegrates in light of the long-term impact of making children less healthy. A truly pro-growth budget would boost investment in children to increase the potential for broadly shared economic growth and prosperity over the long term.

Harry Stein is the Director of Fiscal Policy at the Center for American Progress. Brendan V. Duke is the Associate Director for Economic Policy at the Center.