Policymakers agree that the U.S. tax system needs reform. America’s current tax code is out of step with the times—but not necessarily in the way that some politicians want voters to believe. Anti-tax slogans and too-good-to-be-true proposals to replace the current tax system are a smoke screen to avoid the reality the United States faces today: rapid income growth and profits at the top end of the income scale, as well as an aging population. Combined, these issues will present increasing challenges for the U.S. economy and the federal budget over the long term.

The current federal tax system includes an income tax on individuals and corporations; a payroll tax on wages and salaries that funds Social Security and part of Medicare; an estate tax that, in 2013, only affected the wealthiest 0.18 percent of estates; and a set of federal excise taxes targeting specific purposes or products, including the sale of cigarettes, gas, and alcohol. Both the individual and corporate income tax, as well as the estate tax, are progressive: Higher-income households pay a higher percentage of their income for these taxes than low- and middle-income earners. Federal payroll and excise taxes, however, are regressive, placing a heavier burden on low- and middle-income taxpayers than on upper-income individuals. The federal tax system is still progressive overall. However, some of this progressivity is eroded by state and local taxes, many of which are regressive.

Since enactment of the last major reform, the Tax Reform Act of 1986, Congress has inserted—or in some cases re-inserted—a wide range of tax breaks into the tax code. These breaks are also known as tax expenditures—government subsidies for various purposes delivered through the tax code—and there are now more than 250 such expenditures built into the income tax system. As with spending programs, some of these tax expenditures efficiently support important policy goals, while others are less effective. In 2015, the total value of all tax expenditures was about $1.5 trillion—8.1 percent of the total size of the U.S. economy as measured by gross domestic product, or GDP.

Because tax expenditures largely benefit upper-income individuals and corporations, they collectively reduce the overall progressivity of the federal tax system. These subsidies also reduce federal tax revenues and must be offset by increasing taxes elsewhere, cutting spending, or incurring additional federal debt.

Any tax reform plan must be considered within the broader context of the federal budget, which includes Social Security, Medicare, Medicaid, infrastructure, national security, education, scientific and medical research, job training, and other social safety net programs. Tax policy determines how much funding is available for all of these purposes. In the long run, tax revenues generated under current tax law will not be enough to sustain Social Security, Medicare, and Medicaid as the U.S. population ages. Therefore, tax reform will need to raise additional revenues in order to avoid steep cuts to these programs and other investments that strengthen and expand the middle class.

But the tax system itself is not fundamentally broken. Any tax system is subject to erosion as the political process generates exceptions and special rules and as the digital economy changes the speed and nature of how people and companies earn income and transact business. This, however, does not mean that the entire tax system must be thrown out. It does mean that we need to re-evaluate the costs and benefits of individual and business tax expenditures and make other changes in order to rebalance the system so that everyone pays their fair share and the tax system operates efficiently within the global economy. In many cases, these reforms will have the added benefit of simplifying the tax code.

Since the adoption of the 16th Amendment in 1913, which gave Congress the power to impose taxes on incomes, most Americans have understood that taxation should be based on each individual’s ability to pay. Thus, when considering proposals to reform personal income taxes, business taxes, or any other part of the tax system, the most important question to ask is: Who wins and who loses? If the winners are those who have the ability to pay more, or if the losers are those who have less ability to pay, policymakers and citizens should be skeptical.

With that question in mind, this report examines seven claims commonly employed in the tax reform debate and separates myth from reality. Politicians frequently use these claims to dodge the fundamental question of who wins and who loses—who would pay more, and who would pay less—under their respective tax agendas.

1. We cannot close any tax loopholes until Congress takes up comprehensive tax reform

The last major tax reform effort occurred in 1986, when Ronald Reagan was president and Tip O’Neill was speaker of the House of Representatives. During the negotiations leading up to passage of the Tax Reform Act of 1986, much of the consensus—and, ultimately, the reduction in individual and corporate income tax rates—was achieved by inflicting a little pain on everyone. Nearly every special interest gave up a tax break in order to achieve the shared goal of lowering tax rates overall. The vision of repeating that comprehensive process at a hypothetically ideal moment in the future leads some policymakers to argue that even egregious loopholes should not be reformed or eliminated until Congress is prepared to take on comprehensive tax reform.

Unfortunately, this rationale allows undeserving recipients of widely recognized tax loopholes to continue paying far less than their fair share of taxes for years on end. While reforming certain tax breaks must await comprehensive reform due to the need to work out complex interactions between tax provisions, others are simply hidden forms of spending through the tax code that benefit specific special interests. The so-called carried interest loophole—enjoyed by investment fund managers—is a perfect example of this sort of tax spending. Other examples include the $4 billion of annual tax spending on the mature and extremely profitable oil and gas industry. Proposing cuts to federal programs that benefit struggling families while leaving these tax expenditures off the table simply makes no sense.

This is especially true given the hidden nature of many tax spending measures. Tax spending is not subject to rigorous annual review—nor is there any regular process of coordination between the tax-writing committees in the Senate and House and the committees that handle similar explicit spending programs. For example, the congressional committees and executive departments that oversee and administer government spending on housing programs generally do not coordinate their actions with the committees and departments responsible for large housing tax breaks.

Lawmakers should not continue to support wasteful government spending for years or decades until sufficient political momentum builds to pursue comprehensive budget reform. Likewise, preserving wasteful tax breaks until the political will exists to undertake comprehensive tax reform is equally misguided. Egregious tax loopholes, once brought to light, should be eliminated in order to make the tax code incrementally more fair and efficient.

2. Economic growth depends on tax cuts for the wealthy because they are job creators

Many proposals for reforming the tax code would reduce tax rates on the wealthy. Proponents of these reforms claim that tax cuts for high-income taxpayers would encourage them to work harder or free up capital that would be invested in job-creating enterprises, which, in turn, would increase economic growth. This is the logic that underlies the old “tax cuts pay for themselves” theory, whereby tax cuts generate so much economic growth that tax receipts actually increase enough to overcome the revenue lost from the tax cut.

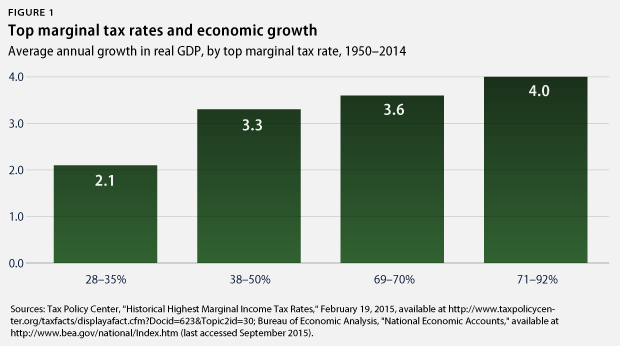

But this theory—that tax cuts for the rich will dramatically increase economic growth—has been consistently refuted by experience. In reality, economic growth in the United States since World War II has tended to be greater in times with relatively high top marginal income tax rates. This is not to say that high tax rates promote economic growth—correlation does not prove causation—but this data makes it hard to believe that low tax rates on the wealthy are a powerful engine for economic growth. When a 2011 study by economists Thomas Piketty, Emmanuel Saez, and Stefanie Stantcheva analyzed the economies and tax systems of the United States, as well as 17 other developed countries, it found no observable correlation between reductions in top tax rates and economic growth. Another study, conducted by William Gale and Andrew Samwick at the Brookings Institution, found no evidence that increased economic growth resulted from major tax cuts under President Reagan in 1981 or President George W. Bush in 2001 and 2003. Likewise, the study found no evidence of reduced economic growth from tax increases under President Bill Clinton in 1993.

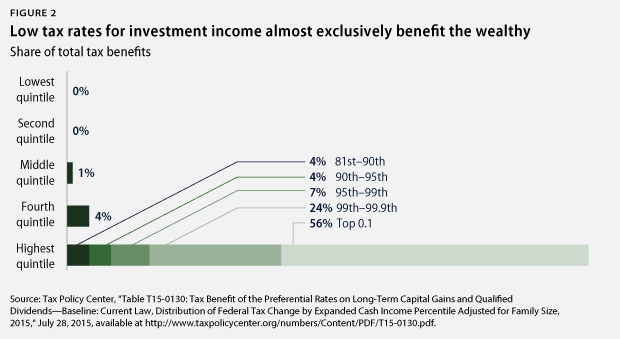

In addition to reducing the top income tax rate for high earners, proponents of tax cuts for the wealthy strongly advocate for reducing taxes on investment income—especially stock dividends and capital gains on the sale of stock. Individuals already pay a significantly lower rate of tax on capital gains and dividends than they do on earned wages and salaries. Because high-income taxpayers hold the majority of capital assets, a full 95 percent of the benefit of reduced tax rates on capital gains and dividends accrues to the top 20 percent of taxpayers.

A study by Danny Yagan of one of the largest reductions to a capital tax rate—the 2003 dividend tax cut—showed zero change in corporate investment and no effect on employee compensation. As with top tax rates generally, changes in capital gains tax rates are not correlated with a corresponding shift in economic growth.

Not only does the tax code provide reduced rates of tax on capital gains and dividends, it offers a number of other tax breaks for capital income. For example, under a special provision of the tax code known as stepped-up basis, individuals who hold onto assets until they die never have to pay income tax on the gain in value of those assets—a tax break that also benefits their lucky heirs who take ownership of the assets free of income tax. When the heir sells the asset, capital gains taxes are only due on the gain that occurred after they inherited the asset: The gain that occurred during the previous owner’s lifetime is never subject to income taxes. Because of these and other tax breaks, capital income tax breaks lead to faster and greater accumulation of wealth for those lucky few who have significant capital income than for the majority of Americans who earn their income via wages and have precious few dollars to save or invest.

Experiences at the state level are instructive for measuring the economic outcomes of tax cuts for the wealthy. A number of states have subscribed to the myth that such tax cuts will result in huge economic growth—most notably in Kansas under Gov. Sam Brownback (R)—with disastrous results. Gov. Brownback believed that dramatically reducing taxes on both individual and business income would spur economic activity to such a degree that the tax revenue generated from lower rates would still be adequate to fund the state government. The approach has proved catastrophic. Gov. Brownback’s administration is now looking to increase consumption-related taxes to fill the gap, thereby shifting the burden of funding the state government from the wealthy and corporations to low- and middle-income Kansans.

A healthy economy requires strong aggregate demand for goods and services, and increasing demand is especially important when the economy is operating below its full potential, which has been the case since the Great Recession. Since low- and middle-income taxpayers spend a greater share of their incomes contributing to aggregate demand, Congress should—at a minimum—avoid tax reforms that shift a larger share of the tax burden onto those at the lower end of the income scale. With some narrow exceptions, lawmakers should focus revenue generation efforts on high-end earners who save a larger portion of their income and whose spending thus has a more limited effect on aggregate demand.

3. Taxes are crushing American corporations, and they need more tax breaks

Conservatives often decry the 35 percent statutory income tax rate on U.S. corporations as the highest in the world. But the truth is that few U.S. companies actually pay that rate.

Tax spending in the form of corporate tax breaks for certain groups of companies—such as oil and gas producers, insurance companies, U.S. multinationals, as well as others—amounts to more than $150 billion annually. These tax breaks enable companies to pay a much lower effective tax rate. In other words, these tax breaks dramatically reduce the amount of a corporation’s income that is subject to the 35 percent statutory corporate income tax rate, making their overall effective tax rate lower than the statutory rate—in some cases, much lower. For example, in a study that compared income companies reported on their 2010 financial books with income that they reported on their 2010 corporate tax returns, the Government Accountability Office, or GAO, found that profitable U.S. corporations paid an effective tax rate of 22.7 percent. In a 2012 report, the U.S. Department of the Treasury found that U.S. corporate effective tax rates were in the same range as those of its G7 trading partners despite the higher statutory corporate income tax rate in the United States.

While a number of U.S. trading partners, including Japan and the United Kingdom, have since lowered their statutory corporate income tax rates, evidence suggests that lowering U.S. corporate tax rates may only cause U.S. trading partners to lower their rates even further. Moreover, reducing the U.S. corporate tax rate from 35 percent down to 25 percent—as many conservatives have called for—would result in a significant loss of U.S. tax revenue. As economist Jane Gravelle of the Congressional Research Service has explained, while a country may cut its corporate tax rate and initially attract capital from other countries that could benefit its labor and national welfare, similar rate cuts by all countries will result in no gain in capital for anyone and lower revenues for everyone. In fact, this international race to the bottom is a concern of government and civil society leaders in many of the world’s developed economies.

Some lawmakers argue that the solution to this problem is for the United States to adopt a territorial tax system, whereby companies would be taxed only on income they earn in the United States and not abroad. But this would encourage companies to shift even more income out of the United States to jurisdictions with lower tax rates.

Currently, the United States taxes the worldwide income of U.S.-resident corporations. However, the tax code gives corporations credit for taxes they have paid in other countries so that the income is not taxed twice and allows corporations to defer taxation of foreign earnings until those earnings are brought home. While the current corporate tax code contains a number of large loopholes, this worldwide approach generally enables the U.S. Treasury to better protect the U.S. corporate tax base than it could under a territorial tax system.

A few conservatives say the United States should abolish the corporate tax altogether. There are several problems with this approach, not the least of which is that the corporate income tax raises more than $300 billion each year. Abolishing the corporate tax would require replacing that revenue by increasing taxes on individuals, making huge cuts to spending programs, or increasing the national debt. Eliminating corporate taxes would also constitute a huge tax cut to the wealthy because the top quintile of income earners bears about 79 percent of the corporate tax burden. With no corporate tax, wealthy individuals would use corporations to shelter large portions of their personal income from taxation. Finally, without a corporate tax, corporations would no longer contribute to the cost of the many public services that enable them to earn profits in the United States in the first place.

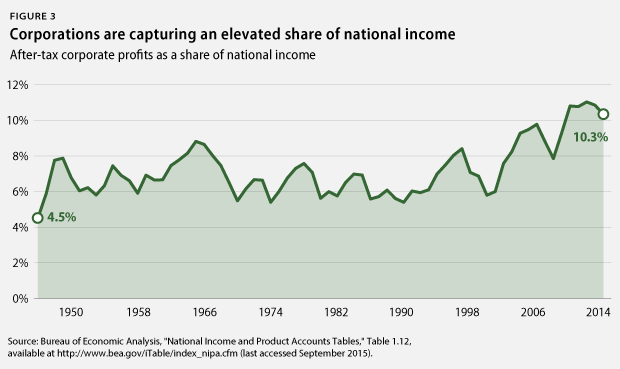

In reality, U.S. corporations are far from being crushed by the U.S. tax system. While corporate tax revenues have increased somewhat since the Great Recession—from 1 percent of GDP to 1.9 percent of GDP—corporate profits have soared.

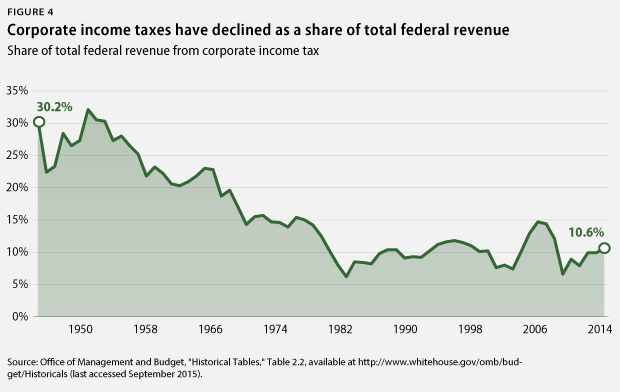

From 1950 to 1970, corporate income tax revenues were between 3 percent and 6 percent of GDP. Today’s lower corporate revenues are partly due to the fact that many corporations have converted to S corporations and other business forms that are taxed only at the individual level—a strategy that began in the 1990s after the Tax Reform Act of 1986 altered the relative advantages of the corporate and individual tax codes. Businesses that elect to be taxed at the individual level do not pay a separate corporate tax, although distributions received by shareholders of these companies generally do not qualify for lower dividend tax rates. Furthermore, owner-shareholders of these firms can take advantage of the more than $1 trillion of individual income tax preferences in the tax code to reduce the amount of their business income that will be subject to tax. Lower corporate tax receipts in the United States also reflect the prevalence of corporate tax spending, and—in particular—the significant tax avoidance among the largest U.S. companies, which operate in the global marketplace and make use of complicated strategies to protect large amounts of earnings from taxation in the United States and elsewhere.

There is no doubt that the U.S. corporate income tax code is in need of reform. Tax spending in the form of corporate tax breaks should be reduced and reformed in order to ensure that these subsidies achieve their public purpose in a targeted manner, and loopholes should be closed to prevent corporate tax avoidance. Reducing or eliminating unnecessary corporate tax spending might pay for some reduction in the statutory corporate income tax rate and would also inject more fairness across business sectors. Beyond that, the U.S. government should coordinate with its trading partners, as well as other countries, to ensure that corporations pay their fair share of taxes regardless of where they operate. The United States should also seek ways to build on its own strengths—such as its highly educated and creative workforce, the strong legal system, and the country’s infrastructure—to attract and keep corporations and investment capital within its borders.

4. If we repeal our current tax system, we can abolish the IRS

When politicians say they want to abolish the Internal Revenue Service, or IRS, all they really mean is that they want to rename it. As long as the United States has any kind of tax system, the government will need an agency to administer it.

To begin with, most if not all public figures who make this claim envision some sort of replacement tax system, usually a consumption tax such as a national sales tax or a value-added tax, or VAT. After all, no matter how small they may think government should be, some revenues will be needed to maintain the system of courts and law enforcement officers; air traffic control; military and other defense and homeland security infrastructure; as well as other critical functions.

Any replacement tax system, regardless of its apparent simplicity, will need to be administered. The tax must be collected in a fair manner, which entails keeping track of everyone who is required to pay the tax and contacting them if they fail to pay or pay the wrong amount. Tax revenues collected must be tabulated, deposited, and reported to the U.S. Treasury Department. Someone must be available to answer taxpayers’ questions about the new tax system. Every tax system has a tax base—whether it is income, sales price, or something else on which the tax is imposed—and in a complex society, defining what falls into the base can involve case-by-case factual determinations.

The fairness and efficiency of any tax system depends on a competent and adequately funded tax administration agency. Recent cuts to the IRS budget have made the current tax system less fair and efficient. It is not fair to require taxpayers to wait for hours to speak with the IRS over the phone or in person at a Taxpayer Assistance Center—but this is exactly what is happening after Congress cut the IRS budget by 18 percent compared to the inflation-adjusted 2010 level. Because every dollar spent on the IRS budget returns about $5 in tax collections, IRS budget cuts also make the tax system less efficient and increase budget deficits. The only beneficiaries of these budget cuts are wealthy taxpayers and big corporations who have the legal and accounting resources to outmaneuver an overwhelmed IRS and avoid paying their fair share.

Attacking the IRS might be a good political sound bite, but it makes for terrible tax policy.

5. A flat tax would be simpler and fairer

The idea of having everyone pay the same rate of tax on their income may sound simple and fair, but in reality these proposals always deliver the largest windfalls to the wealthiest households. They violate the fundamental principle that tax systems should be based on ability to pay.

The fallacy of the claim that a flat tax promotes fairness is easily illustrated by a hypothetical in which the current progressive tax system, using the 2014 tax brackets, is replaced by a flat tax with a rate of 15 percent. A teacher with $20,000 of taxable income filing as single would have paid $2,550 under the current tax code compared to $3,000 under a 15 percent flat tax. Meanwhile, a lawyer with a taxable income of $500,000 would have paid $155,046 under the current system but only $75,000 under a 15 percent flat tax. Since the current tax system has a progressive rate structure—meaning that higher incomes are subject to higher tax rates—those at the top will always benefit the most from a flat tax, regardless of the level at which the single tax rate is set.

Flat taxes are often advocated as a way to simplify the tax code, but this simplicity is an illusion. The premise of the simplicity claim is that marginal tax rates are eliminated. Under current law, income tax rates are stacked, with the lowest rate applying to the first $18,450 of taxable income for a married couple filing jointly and higher rates applying to each additional chunk of income above that. Thus, the top marginal rate of 39.6 percent does not apply to the entire income of a single filer making $500,000; that rate only applies to the portion of their income that exceeds $413,200—in this case, $86,800—using the 2015 tax brackets. Fortunately, no one has to calculate the tax on each chunk of income because the IRS provides charts for taxpayers to look up the appropriate combined rate to apply to any given level of taxable income. And the software that many taxpayers now use makes even this calculation unnecessary. Thus, a flat tax rate alone does not make it easier for anyone to complete their tax return, since tax tables and computer software already make it easy to calculate the tax on any amount of taxable income.

Flat tax advocates may claim that the elimination of tax breaks could make a flat tax fairer for everyone, but this argument does not stand up to scrutiny. While tax expenditures currently deliver significant benefits to the wealthy, eliminating those preferences would not generate enough revenue to pay for a significant reduction in top tax rates without increasing taxes on less wealthy households. That means that the single flat tax rate would still have to be relatively high in order to raise enough revenue, or tax preferences would have to be reduced for nonwealthy households, which in turn would mean higher taxes on low- and middle-income taxpayers.

Even tax reform proposals that do not fully adopt the flat tax still embrace the myth that collapsing the current tax rate structure down to far fewer tax rates will always make the tax code simpler or fairer. But, depending upon the income level at which those few rates kick in, the effect may be a significant tax increase for some middle-income taxpayers.

The progressivity of the income tax—asking higher-income taxpayers to pay a larger share of their income—offsets the regressive effect of federal payroll and excise taxes, as well as state and local sales taxes and fees—all of which represent a larger percentage of income for low- and moderate-income people than for higher-income taxpayers. Replacing the progressive income tax with a flat income tax while retaining the Social Security payroll tax would result in massive financial windfalls for high-income taxpayers. At the same time, enacting a flat income tax and repealing the Social Security payroll tax would either threaten the critical retirement program upon which most Americans rely or require a flat tax rate much higher than the rate currently paid by lower- and middle-income earners. No matter how a flat tax is structured, the wealthy would always win.

6. Replacing the income tax with a consumption tax, such as a national sales tax or a value-added tax, would yield massive economic growth

Some policymakers argue for repealing the federal income tax and replacing it with a tax based on what people consume. Even some economists say that this approach would free from taxation any income that is saved or invested instead of spent on the purchase of goods and services, thereby increasing the amount of investment associated with economic growth. A national sales tax and a value-added tax—which is like a sales tax collected by businesses at each stage of production—are two consumption taxes most commonly put forth in these proposals. Both proposals are broad-based, potentially applying to just about anything that people buy, and the burden of both would ultimately fall on consumers.

Consumption taxes are regressive; that is, they impose a heavier burden on lower-income taxpayers than higher-income taxpayers for two reasons. The first is that the dollar amount of tax paid on any given item does not vary according to the purchaser’s income or ability to pay. The result is that the tax would hit low-income people harder. Paying $100 of tax on the purchase of a new refrigerator represents a greater relative burden for someone making $10,000 a year than it does for someone making $100,000 a year.

The second reason why consumption taxes are regressive is that, by definition, they do not apply to what is not consumed. In general, people with higher incomes are able to save and invest more of their income and thus spend a smaller share of their income on goods and services that would be subject to a consumption tax. By comparison, low- and moderate-income people must spend all or most of their earnings on goods and services with little left over to save or invest. As a result, they would pay a greater share of their income in consumption tax than a higher-income person.

Replacing the income tax with a consumption tax would cause a massive downward shift in the tax burden from upper-income taxpayers to low- and middle-income taxpayers. The individual income tax currently raises about $1.5 trillion a year. Because the income tax is spread across a broader tax base, including wages, salaries, and investment returns, replacing it with a consumption tax, which has a narrower base, would require a much higher consumption tax rate. Again, the burden from this higher consumption tax would fall more heavily on low- and middle-income people.

The effect of consumption taxes on low-income people could be decreased by exempting or reducing the rate on food, clothing, housing, and other necessities. However, doing so would further reduce the revenue raised and require an even higher tax rate on everything else. Exceptions would also increase the complexity of the consumption tax system. And enacting any new national sales tax or VAT would involve significant start-up and transition costs. Finally, a new consumption tax would be vulnerable to tax avoidance just like any other type of tax.

Given all of these drawbacks, replacing the current income tax with a federal consumption tax, such as a national sales tax or a VAT, would constitute a sweeping and unfair mechanism to promote investment and economic growth in the United States. A tax system that imposes no tax at all on savings and investments would reward a wide range of investments that do little or nothing to actually create new jobs and grow the U.S. economy. Meanwhile, such a system would ensure that the lucky few who already possess wealth could easily accumulate much more. The American income tax system already provides a multitude of exceptions that disproportionately benefit the wealthy. Replacing the income tax with a consumption tax would make the tax code even less fair than it currently is. It is telling that consumption tax proponents often also want to repeal the inheritance tax, which only falls on the very wealthy.

Consumption tax proponents point out that most European countries have a national consumption tax—typically some form of VAT. Due to the regressive nature of the tax, however, most of those countries have maintained a progressive income tax to ensure that high-income citizens pay their fair share and to offset revenue lost from VAT exemptions for food and other necessities. Some consumption tax proposals in the United States would also maintain a progressive tax on wages.

Supplementing the current tax system with a consumption tax could raise revenue to meet the needs of an aging population, such as increases in Social Security and Medicare costs. However, the merits of any specific proposal would depend on the details of the consumption tax and the distributional effects of other tax and spending policies adopted at the same time. When a tax reform plan completely eliminates the progressive income tax, the corporate income tax, or the estate tax, it is almost certain that the wealthy would win and everyone else would have to foot the bill. As always, the key question is who wins and who loses.

No system of taxation is ideal—all distort economic behavior to some extent—and some taxpayers will find ways to either avoid or game any type of tax. The more the United States relies on one particular tax, the larger the distortions caused by that particular tax will become and the greater the incentives will be for bad actors to game the system. That is why the tax code should continue to raise revenue from a variety of sources, as it does now, rather than relying on a single source.

7. Tax reform should be revenue neutral

Approximately half of the members of Congress have signed the Taxpayer Protection Pledge from Americans for Tax Reform, pledging their opposition to any tax increase. When viewed in the context of the long-term fiscal pressures created by an aging population, it becomes clear that this pledge would require making huge spending cuts that would either eliminate or radically alter Medicare and Medicaid; divesting from sectors that strengthen the middle class; and slashing the safety net that helps struggling families climb into the middle class.

The clearest illustration of this dynamic is the fiscal year 2016 congressional budget resolution in which Congress advocates balancing the federal budget without raising any new tax revenue. This budget would make significant cuts to Medicare and massive cuts to Medicaid in addition to repealing the Affordable Care Act, or ACA—changes that could double the number of Americans without health insurance. The budget would also force a massive disinvestment from infrastructure, education, research, child care, job training, and other sectors that grow the economy by supporting the middle class. It would mean huge cuts to nutrition assistance and other safety net programs that help families make ends meet in tough times.

The Center for American Progress recently published a long-term budget plan that would substantially increase public investment while gradually reducing budget deficits over the long term. This would significantly reduce the national debt as a share of the economy and eventually balance the budget. In this plan, the two primary targets for reform to achieve fiscal sustainability are slowing the growth of health care costs and reforming the tax code to ensure that those at the top pay their fair share. This plan was one of five plans submitted by think tanks from across the political spectrum for the Peter G. Peterson Foundation’s Solutions Initiative III. All of the plans—including those from conservative organizations—included new tax revenue. When bipartisan commissions have recommended long-term budget plans, these plans have also consistently included new tax revenue.

Even revenue neutrality—as inadequate as it is to address long-term fiscal pressures—is a problematic constraint for conservative tax reform plans due to the commitments that those plans make to cut taxes for those at the top. If a revenue-neutral plan reduces tax rates for the highest earners and for big corporations, that plan must raise taxes elsewhere in order to make up for the lost revenue. Tax reform plans generally raise revenue by scaling back tax expenditures, but conservatives also advocate increasing tax preferences for investment income and the profits made abroad by U.S. multinational corporations. Instead of scaling back these preferences—a choice that has the potential to raise substantial revenue—these commitments would increase the revenue losses that a tax reform plan must recoup from cutting other tax preferences or raising other taxes.

The dual commitment to revenue neutrality and large tax cuts for those at the top inevitably leads to tax increases for low-income or middle-class taxpayers. For example, during the 2012 presidential campaign, the nonpartisan experts at the Tax Policy Center concluded that any revenue-neutral tax reform plan that included the tax cuts promised by former Massachusetts Gov. Mitt Romney (R) would have to “provide large tax cuts to high-income households, and increase the tax burdens on middle- and/or lower- income taxpayers.”

Former House Ways and Means Committee Chairman Dave Camp (R-MI) made the most comprehensive recent attempt to follow through on conservative commitments within a revenue-neutral tax reform plan that did not raise taxes on low- and middle-income Americans. Rep. Camp’s tax plan scaled back a large number of tax preferences and included a number of policies to reduce tax breaks for the wealthy, many of which have progressive support. Rep. Camp’s plan even included a new tax on large financial institutions in order to raise additional revenue from these corporations.

Rep. Camp’s plan, however, failed on three fronts: It fell short of conservative ambitions to reduce tax rates; it would have likely resulted in lower federal revenues over the long term; and it would have raised taxes on many working families. Conservatives blasted Rep. Camp for reducing the top individual tax rate by only a few percentage points—down to 35 percent—and sharply criticized the new tax on large financial institutions, as well as other revenue raising elements of the plan. Rep. Camp’s plan managed to avoid overall revenue losses within the 10-year window used by congressional scorekeepers but only by using significant timing gimmicks that pushed losses into future years. Finally, many low-income families would have faced higher taxes due to reductions in the Earned Income Tax Credit, or EITC.

Rep. Camp’s effort shows what happens when conservative tax reform rhetoric meets reality; and many of the other myths analyzed in this report are best understood as attempts to avoid this reckoning. If tax cuts for the wealthy and corporations actually did benefit everyone, then it would be less significant that working families have to pay more in order to fund these policies. Sweeping tax reform proposals that completely remake the tax system can be used to dodge the question of who wins and who loses because these new tax systems are hard to directly compare to existing law.

While these proposals may initially sound fair, replacing the current income tax with a flat tax or consumption tax would cause a huge upward redistribution of income and wealth. When the claims are examined closely, it becomes clear that any plan promising huge reductions in top tax rates will have to include increased taxes on low-income and middle-class Americans; reduced federal revenues that jeopardize critical programs such as Social Security and Medicare; or some combination of the two.

Conclusion

Because it must be applied to a diverse range of people, businesses, and scenarios in an increasingly fast-paced and mobile economy, any fair tax system will, by necessity, be somewhat complicated. Perhaps this is why so many potential tax reformers succumb to the claims debunked in this report. Analysis of the underlying assumptions and the data behind these claims, however, demonstrate that the claims are more myth than reality.

An individual need not be an expert in tax policy or economics to understand why the above claims are not true. Even those unfamiliar with tax policy can easily understand that a fair tax system should be based on one’s ability to pay. And, when confronted with a proposed tax reform, anyone can legitimately ask: Who wins and who loses?

Alexandra Thornton is the Senior Director of Tax Policy on the Economic Policy team at the Center for American Progress. Harry Stein is the Director of Fiscal Policy at the Center.