Tomorrow, the U.S. Bureau of Labor Statistics will release its Employment Situation Summary for the month of October. These numbers come at the end of a busy week of economic news, with the Federal Reserve meeting Wednesday and the U.S. Bureau of Economic Analysis (BEA) releasing the advanced estimate of third-quarter gross domestic product (GDP) for 2019. The Federal Open Market Committee also agreed to cut interest rates by 25 basis points, citing weakening global growth and trade pressures, while hinting strongly that it would adopt a wait-and-see approach to further propping up the economy this year. The BEA release showed U.S. GDP slowing slightly, growing by just 1.9 percent last quarter. Business investment also continued to fall after turning negative in the second quarter, as government and consumer spending continue to prop up an otherwise slowing economy.

While headline employment numbers haven’t weakened much, other labor market indicators spark reason for concern. Real wages have remained largely stagnant for many workers—even through the economic recovery—and employment gains have not been shared evenly across regions, job sectors, races and ethnicities, or age groups. With GDP already showing signs of sluggishness—and the Congressional Budget Office projecting that it will soon fall below its long-term historical average of 1.8 percent—it is increasingly important that policymakers and economists look beyond top-line indicators when evaluating the health of the labor market following this month’s release.

Many regions face unemployment rates that are significantly higher than the national average

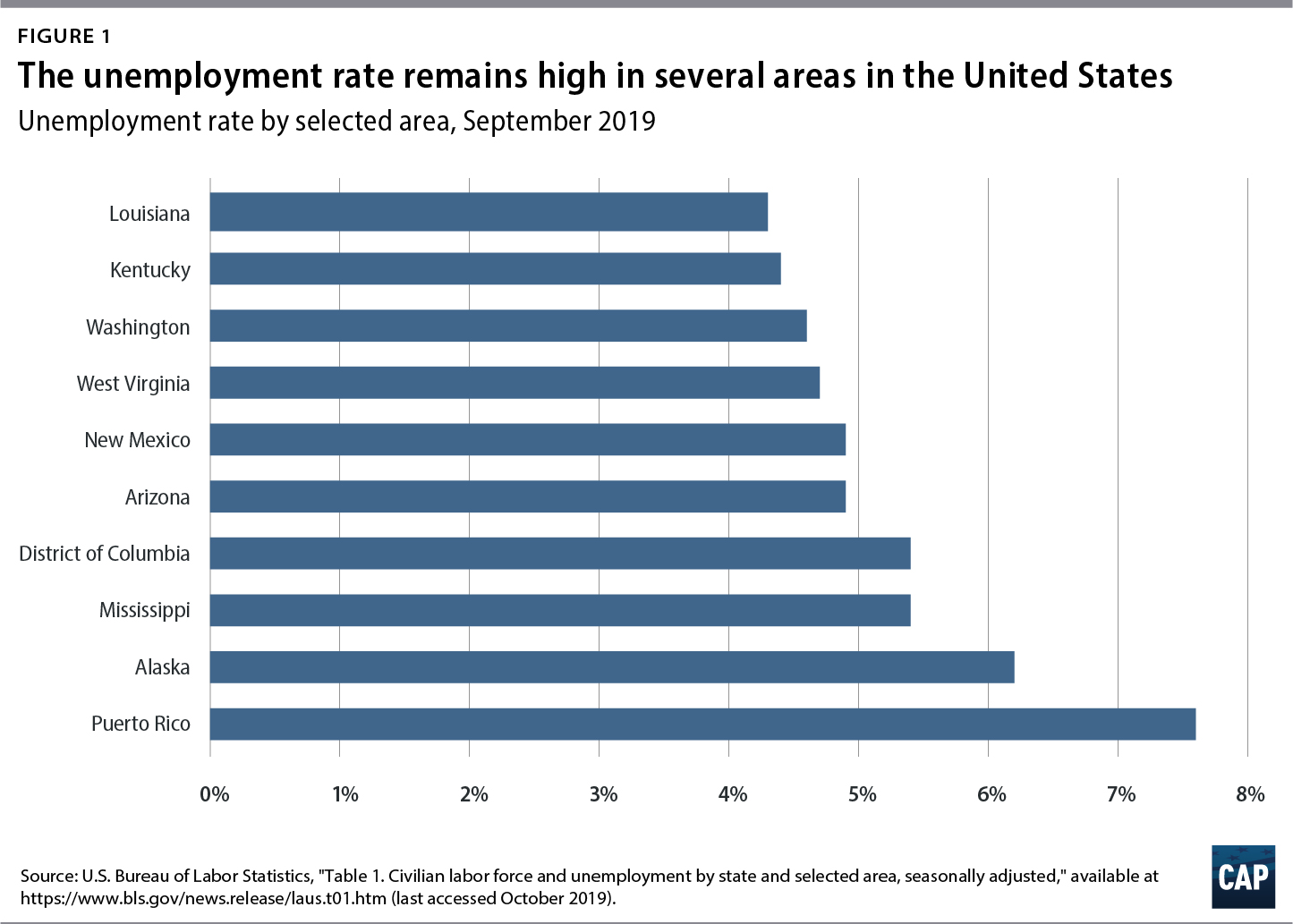

Earlier this month, the White House reported that the U.S. unemployment rate had reached a 50-year low of 3.5 percent in September 2019. However, the unemployment rate remains high in several states and U.S. territories—most notably in Puerto Rico, where the unemployment rate is roughly twice as high as the nationwide average. The states with the highest unemployment levels have diverse economies and span every region of the United States, indicating that there is no simple explanation, such as an energy price shock, for why they are struggling.

Manufacturing employment has declined in several states

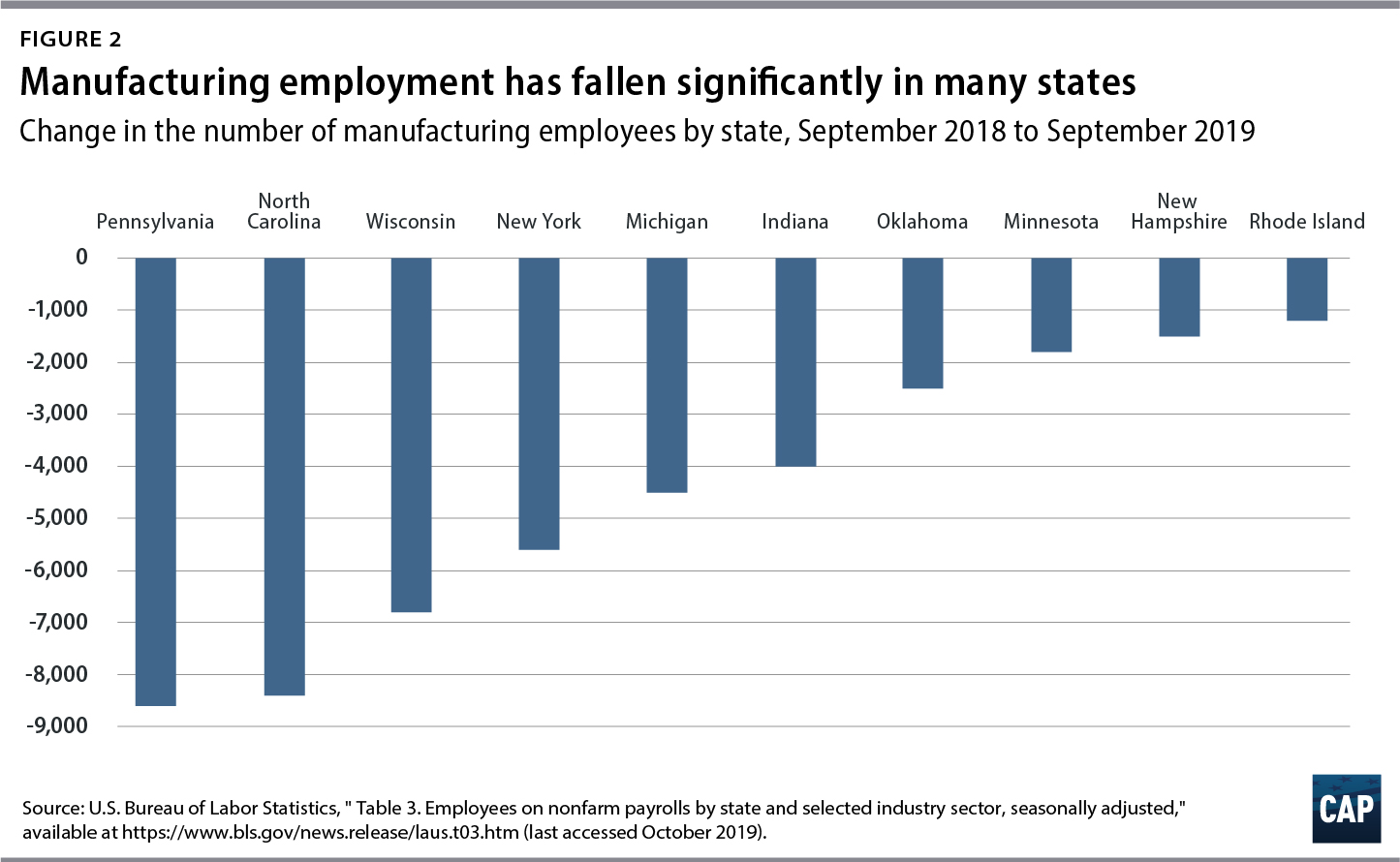

Some states saw a significant decline in manufacturing employment from September 2018 to September 2019. There are various possible explanations for these changes, including interstate migration, transitory factors from plant closures, automation, or import competition.

During the 2016 presidential election, Donald Trump accused previous administrations of signing “horrible” trade deals that caused manufacturing job losses throughout the United States. He promised to bring manufacturing jobs back from China and other countries to Pennsylvania and Wisconsin. However, these employment figures show that as president, Trump has done the opposite. Amid trade uncertainty under the Trump administration, Pennsylvania and Wisconsin have each lost thousands of manufacturing jobs in the past year. (see Figure 2)

According to a recent Wall Street Journal survey, most economists believe that U.S manufacturing is in recession. The story of what is driving these job losses isn’t as simple as tariffs, although the administration’s trade posturing certainly isn’t helping. Economic growth around the world has slowed over the past two years, and manufacturing jobs depend on foreign demand much more than service jobs, which represent the overwhelming majority of U.S. employment.

Sizeable gaps in unemployment persist for certain groups

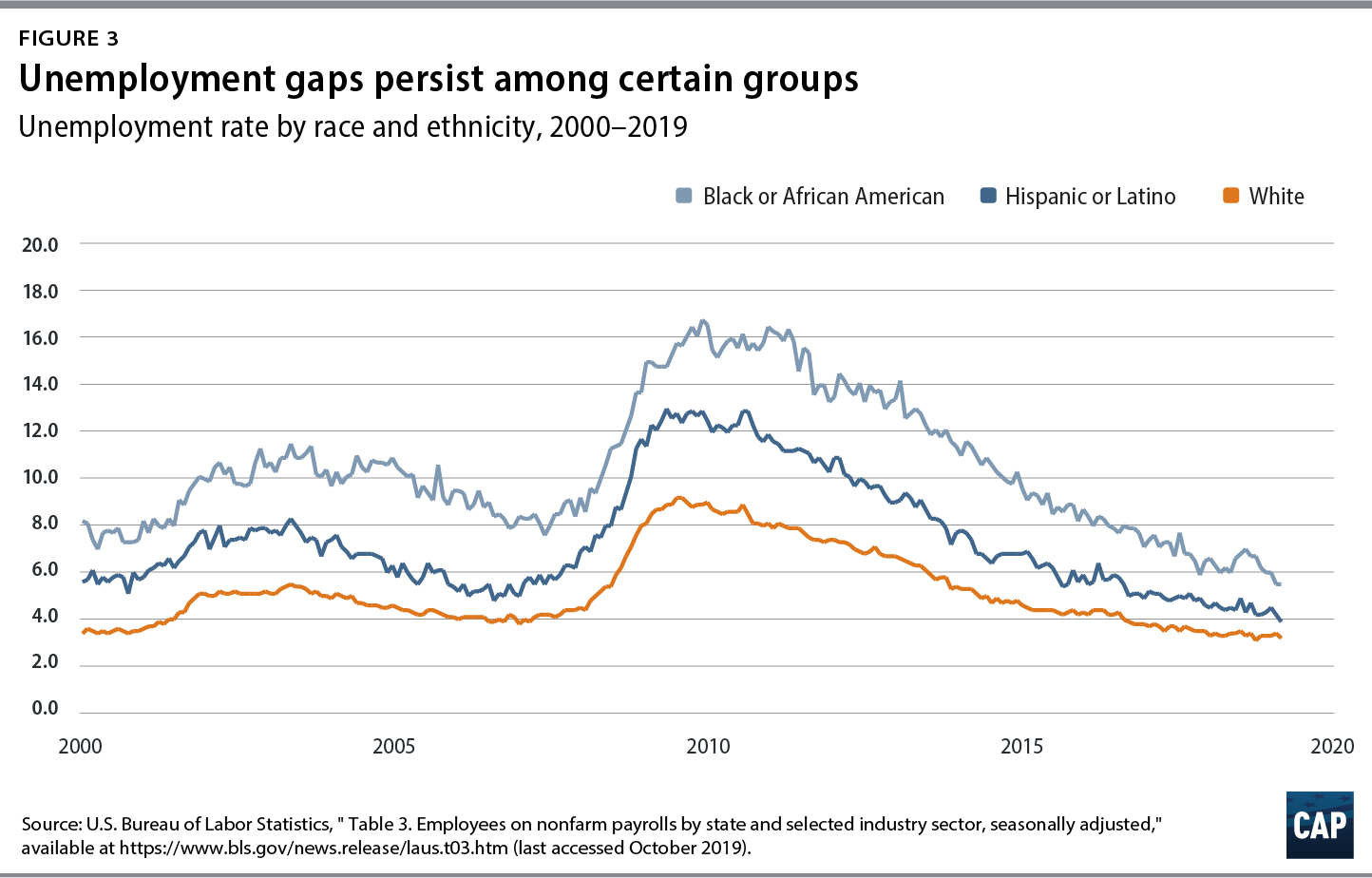

During the Great Recession, gaps in unemployment rates for workers of color and white workers widened substantially. While these gaps have slowly begun to narrow, the gains from an extended economic recovery have not been experienced equally among racial and ethnic groups. Black or African American and Hispanic or Latino workers, who historically face more difficult labor market conditions, continue to see higher unemployment rates than their white counterparts. Black or African American workers in particular face unemployment rates that are 2.3 percentage points higher than those of white workers.

Older workers have been driving job gains since 2000

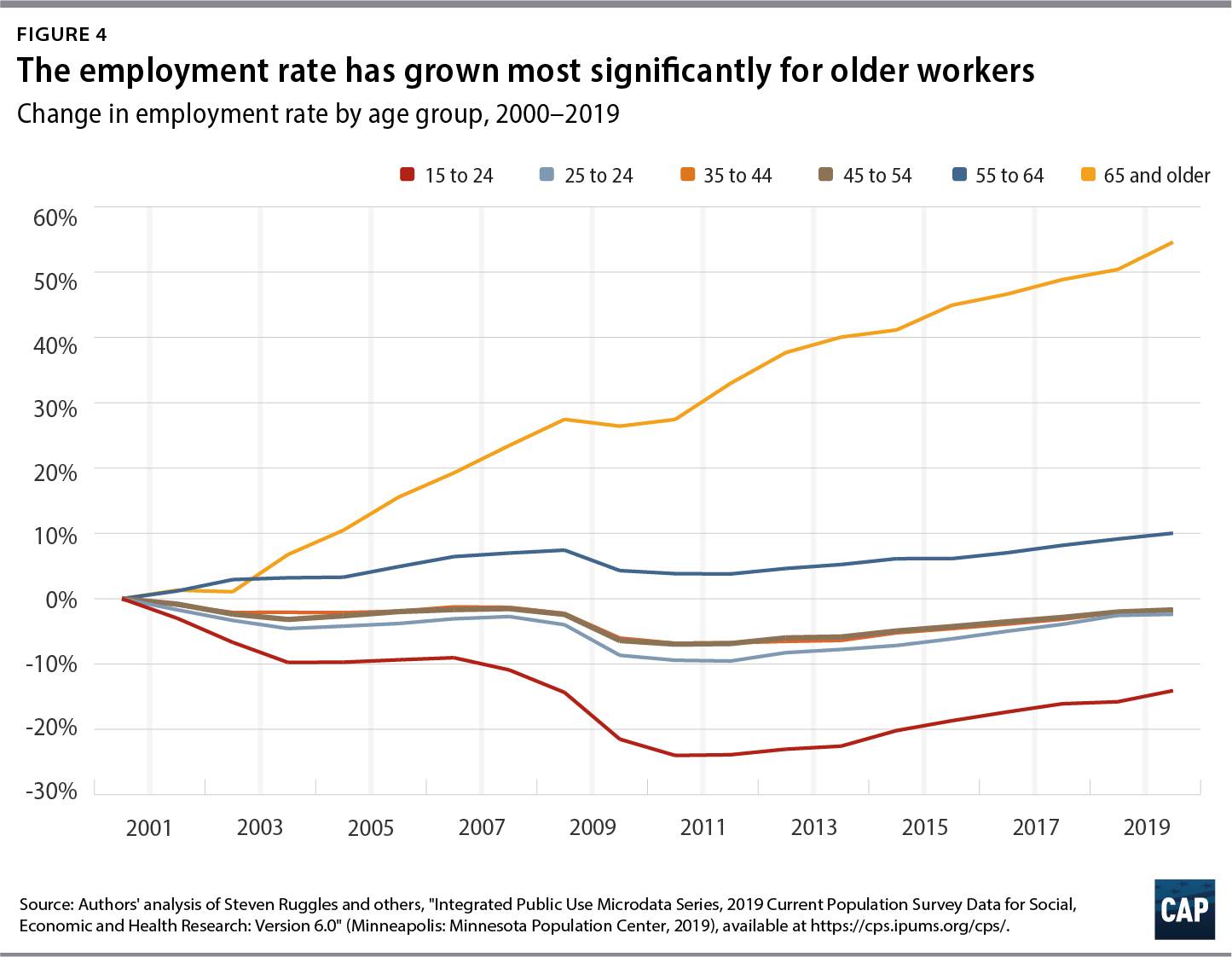

Macroeconomists often focus on the labor market conditions for prime-age workers—those aged 25 to 54—because this group is considered more resilient to longer-term changes in the labor market. Prime-age employment has yet to recover to its 2000 levels for workers under the age of 55. Yet, the number of workers aged 55 to 65 is up 10 percent, and there are 50 percent more workers over the age of 65 today than there were in 2000.

There are a variety of nonwork-related factors making changes in employment for workers outside of prime ages—both young and old—more difficult to interpret. Older workers, for example, have had a persistent increasing trend of employment since 2000, as a combination of factors has made retirement harder, riskier, and costlier over time.

Over the same period, the youngest employed workers—those aged 15 to 24—were hurt the most by the financial crisis. The current employment rate for this group is still 14 percent less than it was in 2000, even though today’s youngest workers did not enter the labor market until well into the recovery.

Conclusion

Friday’s jobs numbers will provide an updated snapshot of the U.S. economy and labor market performance. Although headline economic indicators are important to consider, it is also essential to examine the gaps among regions, job sectors, races and ethnicities, and age groups to fully assess the overall health of the economy. With rising economic uncertainty and weakening economic conditions, it is clear that more work needs to be done to improve labor market outcomes for many people. Policymakers and economists must consider these challenges when evaluating the health of the labor market and implementing policies that affect it.

Cuong Nguyen is an intern for Economic Policy at the Center for American Progress. Galen Hendricks is a research assistant for Economic Policy at the Center. Michael Madowitz is an economist at the Center.