President Donald Trump and House Republicans are reportedly bringing forward “round two” of their tax plan in the coming months—a sequel to the tax law they enacted in December 2017. That law, informally known as the Tax Cuts and Jobs Act (TCJA), is enriching the wealthiest Americans while inflating federal deficits and raising health care costs for working families. Round two of the Trump-Republican tax plan would compound the damage already done in the first round by giving even more tax cuts to high-income Americans, causing long-lasting damage to the federal budget, and further threatening priorities such as Social Security, health care, and education.

The White House and the congressional majority have not yet released details on the so-called round two of their tax plan, but according to press reports, it is likely that it will focus mainly on making the TCJA’s individual and estate tax provisions permanent. Almost all of the TCJA’s individual tax provisions and its estate tax provisions are due to expire after 2025, while the law’s corporate tax changes are generally permanent, with some exceptions.* The TCJA’s authors made major parts of the bill temporary to elude constraints imposed by the congressional budget process; By providing that many of the costly tax cuts expire after 2025, proponents buried the bill’s long-term costs and allowed it to get around the Senate’s so-called Byrd rule—the procedural hurdle against bills that increase long-term deficits.

The TCJA’s individual provisions are skewed to the rich

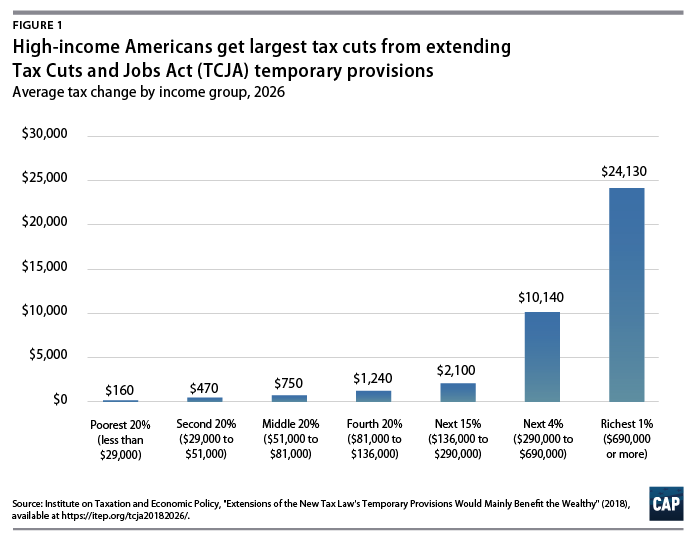

Like the law in its entirety, the individual and estate tax provisions of the TCJA are skewed to the wealthy. In other words, even when not taking into account the TCJA’s permanent massive corporate tax cuts—which predominantly benefit wealthy shareholders—the law favors high-income Americans over the middle and working class. The individual and estate tax provisions of the TCJA, if extended as part of a second round, would provide a $24,000 annual windfall for the average household in the top 1 percent—more than 52 times greater than the average tax cut for a household in the bottom 60 percent, according to estimates from the Institute for Taxation and Economic Policy (ITEP). Forty-three percent of the tax benefits would go to Americans with incomes in the top 5 percent—above $290,000—while only 19 percent of the benefits would go to Americans with incomes in the bottom 60 percent, or those making less than $81,000. The reason behind the windfall for those in the top 5 percent is that the temporary provisions of the TCJA include four major tax cuts that benefit high-income Americans either predominantly or exclusively. (see text box)

The TCJA’s individual provisions: 4 big tax cuts for the rich

The individual tax titles of the TCJA include four major tax cuts for high-income Americans that are in effect from 2018 through the end of 2025. The rumored round two of the Trump-Republican tax plan would make these four major tax cuts for the rich permanent:

- Top tax rate: The TCJA cuts the top-bracket tax rate—the rate paid on income exceeding $500,000 for singles and $600,000 for couples—from 39.6 percent to 37 percent. Extending the TCJA’s temporary provisions would permanently lock in that top rate, perpetuating a wasteful giveaway for millionaires and other very high-income individuals. Notably, 39.6 percent was the top tax rate in effect before the Bush tax cuts of 2001, and it was restored in the fiscal cliff agreement at the end of 2012.

- Estate tax: The TCJA gave large tax cuts to wealthy estates. Extending the TCJA’s temporary provisions would make the estate tax cuts permanent. Before the TCJA, the estate tax was paid only by the wealthiest 0.2 percent of estates in the country, or about 1 in every 500 estates, because up to $11.2 million in wealth for couples and $5.6 million in wealth for singles was exempted. The TJCA doubled that already generous exemption to $22.4 million for couples and $11.2 million for singles. By raising the exemption, the TCJA conferred a windfall for America’s wealthiest estates—those valued at more than $22.4 million—of $4.5 million each. The benefit will accrue to the heirs of those estates.

- Pass-through loophole: The TCJA carved out a new tax loophole that predominantly benefits wealthy owners of partnerships, limited liability companies (LLCs), and other so-called pass-through business entities. As New York University School of Law professor and tax scholar Daniel Shaviro explained, the new pass-through deduction “achieved a rare and unenviable trifecta, by making the tax system less efficient, less fair, and more complicated.” That is because the new pass-through deduction creates a byzantine set of new eligibility rules that allows those with high-priced tax advisers to game the system in their favor, all while causing headaches for regular taxpayers and disadvantaging regular employees who are not eligible for the deduction. The richest 1 percent of Americans receive 61 percent of the tax cut from the pass-through deduction, while Americans in the bottom two-thirds of income distribution receive only 4 percent of the benefit. Extending the TCJA individual provisions would make this egregious new loophole permanent.

- Alternative minimum tax: TCJA also dramatically cut back the alternative minimum tax (AMT), providing another tax cut for high-income households. Since Congress permanently patched it at the end of 2012, the AMT applied almost exclusively to taxpayers with incomes of more than $200,000, with most of the tax falling on those with incomes of more than $500,000. The TCJA cuts back the AMT by increasing the exemption amount and indicating that the exemption does not begin to phase out until a taxpayer reaches $1 million in income.

Key members of Congress are reportedly considering also including a permanent extension of one of the major tax cuts for corporations and businesses with round two of the tax bill: the “expensing” of capital investments. The permanent extension, which is enacted on a temporary basis in the TCJA, would further skew round two toward high-income Americans.

The Trump administration and congressional majority may even seek to tack on additional tax cuts for the wealthy within round two of the tax bill. For example, they are reportedly considering cutting the capital gains tax. Since more than three-quarters of the capital gains tax is paid by millionaires, cutting it would confer another windfall for the wealthy.

Extending the tax law would cause permanent fiscal damage

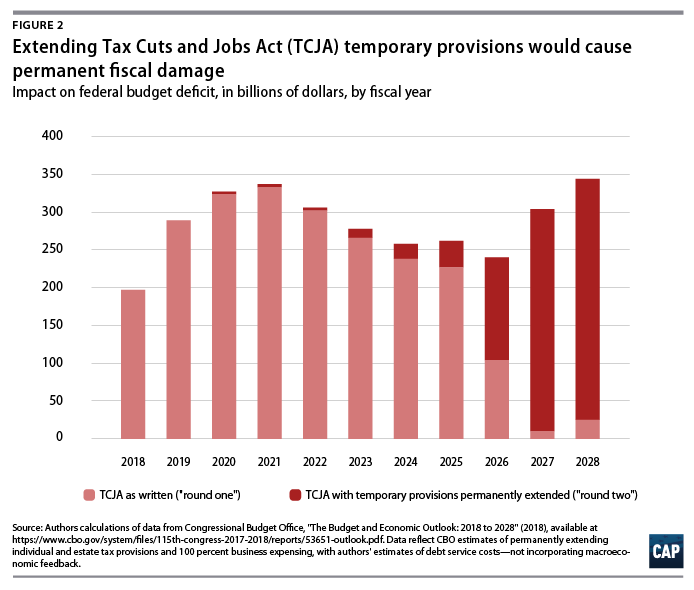

This second round of tax cuts would compound the fiscal damage caused by the TCJA. According to the Congressional Budget Office, the TCJA as enacted will add $1.9 trillion to deficits over the next decade. Making the TJCA’s individual and estate tax provisions permanent would add an additional $650 billion to deficits over that time period—not including debt service. Since those provisions are already in effect through 2025, those costs explode in the years after 2025, raising the deficit by $266 billion in fiscal year 2028 alone.

In the TCJA, congressional leaders agreed to gradually phase out expensing of capital investments over several years so that in the future, Congress would not extend the tax break and thereby drain revenues further. The 10-year cost of expanding the TCJA would swell from $650 billion to $772 billion if it also makes expensing of capital investments permanent.

As shown in Figure 2, extending the TCJA’s individual and estate tax cuts, as well as business expensing, would worsen the act’s already severe impact on federal deficits—an impact that would persist over time. The costs could run higher if additional tax cuts are included.

Congressional Republicans have already made it clear that they wish to pay for their tax cuts by cutting critical services such as Social Security, Medicare, and Medicaid. Hiking deficits by piling on more top-heavy tax cuts would only hand them a bigger excuse to do so.

Making a deeply flawed tax law permanent would take away the chance to fix it

With the TCJA, President Trump and the congressional majority made a flawed and unfair tax code much worse. The new law favors people with the highest incomes and has opened up vast new opportunities for well-heeled taxpayers to game the system. Major provisions within the TCJA expiring after 2025 will give future congresses a chance to revisit the law and consider real tax reform that prioritizes working- and middle-class families. The last thing Congress should do is engrave the deeply flawed 2017 tax changes into permanent law.

Seth Hanlon is a senior fellow at the Center for American Progress. Galen Hendricks is a special assistant on the Economic Policy team at the Center.

*Authors’ note: TJCA provisions that expire after 2025 include the changes to individual tax rates, the changes to major credits and deductions for individuals; the elimination of personal exemptions; and the new pass-through business deduction (tax code section 199A). Individual-side provisions of TCJA that are permanent include the repeal of the Affordable Care Act’s individual mandate; the shift to a new measure of inflation to index tax parameters (“chained consumer price index”); and a few other relatively smaller provisions, including changes to the tax treatment of alimony and to “529” savings accounts.