On Friday, the U.S. Bureau of Labor Statistics will release the employment report for the month of June. This month’s data will likely mark a return to healthy growth in the job market—but if another slump catches policymakers by surprise, it will be a difficult decision-making time for the Federal Reserve. Just as it seemed like Fed governors would finally agree to raise their benchmark interest rate in June, a disappointing May employment report and the recent Brexit vote gave them pause. Downward revisions of employment numbers for the first half of 2016 are a source of similar hesitation.

Fed watchers have been white knuckled this week as different Board of Governors members have expressed varying opinions on the rate-hike question. Consensus building after a startling set of data may prove difficult enough to waylay action until much later this year. For some, the lack of evidence that inflation is nearing its 2 percent target makes a rate hike seem particularly unwise. It is possible that this area of decision limbo signals a larger movement to adjust targets entirely.

Even reaching an agreement on what the latest labor market data mean is proving a challenge, for those in power and sideline pundits alike. If the economy is merely leveling out after a period of strong growth, that may signify a strong economy with near-full employment. The alternative perspective suggests that labor force participation is slumping and clouding the real meaning of recent unemployment rate numbers.

There should be no doubt: Adding less than 80,000 jobs per month is hardly the new normal. May showed that the labor market has flukes, something economists are more willing to take in stride than the general public. Whether the long-term thinkers or short-term alarmists will win out this month will only be seen on Friday.

The national unemployment rate for the month of May slipped slightly down to 4.7 percent, less than half its peak of 10 percent in October 2009. In the past year, the labor market has seen robust job growth at an average rate of about 205,000 new jobs per month. Meanwhile, wages have ticked up 2.5 percent over the past year, and the number of long-term unemployed workers has finally begun to slip lower than that of last summer.

Here is a quick look at the labor market trends to watch as the release of the upcoming report approaches.

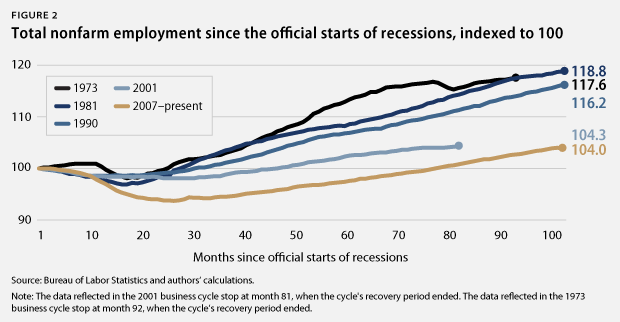

Job growth has picked up, but the depth of the Great Recession means that employment growth since before the recession still lags behind historical standards

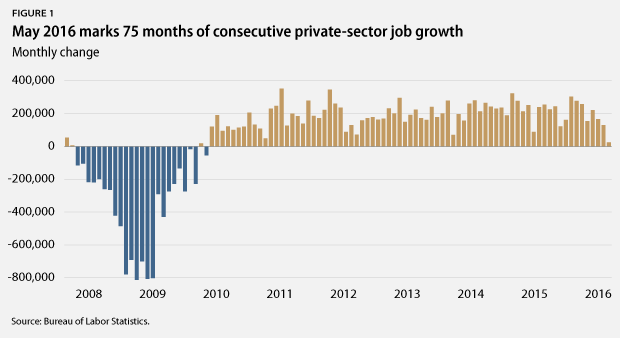

There were 12.9 million more jobs in May 2016 than in June 2009, when the recession officially ended. During this same time period, the private sector added 13.4 million jobs. In May 2016, the private sector added 25,000 jobs to the economy, marking 75 months of consecutive private-sector job growth despite the low figure.

While job growth has been strong in the past year, overall growth in this recovery has not been especially robust relative to previous economic expansions. During the economic expansion of the 1990s, for example, the economy added at least 250,000 jobs per month 49 times. During the current expansion, which has now lasted more than half as long, we have seen 21 months of job growth greater than 250,000, which includes abnormal hiring involved with conducting the decennial census. Combined with the extraordinary job losses that the U.S. economy sustained during the recession, the pace of both job and wage growth suggests that there is much more slack in the labor market than the headline unemployment rate may indicate.

Headline unemployment hits a record low, but other economic measures show room for improvement

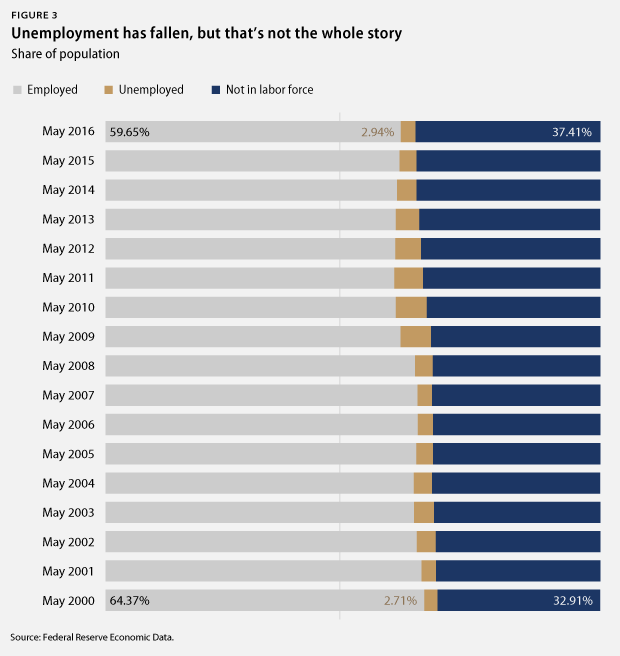

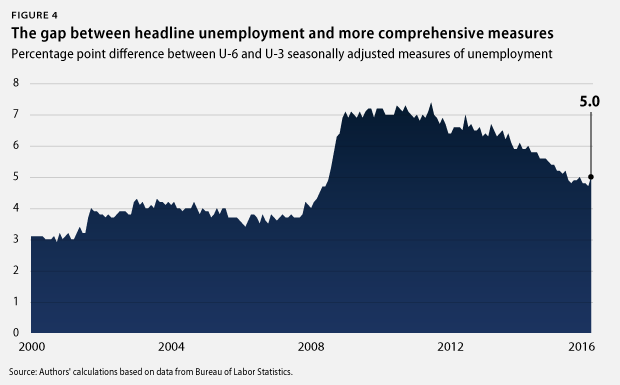

May 2016 marked the 20th consecutive month that the headline unemployment rate—otherwise known as U-3—was less than 6 percent, as it lowered to 4.7 percent. While this does mark significant progress in the recovery, it is important to remember that there are broader measures of unemployment that paint a clearer picture of the employment situation.

U-3, the typical measure, is pretty restrictive, as it counts the percentage of people who are actively looking for work but cannot find it. U-3 does not, however, capture the millions of people who want jobs but have given up looking or who would like full-time work but cannot find it in this economy. Perhaps the most comprehensive unemployment measure, called U-6, alleviates this problem by including marginally attached workers—those who have recently looked for work but are not currently looking—and those working part time but who would prefer full-time work. U-6 is always higher than U-3, but the gap grew much larger than usual during the recession and has remained above or near prerecession records over the course of the recovery.

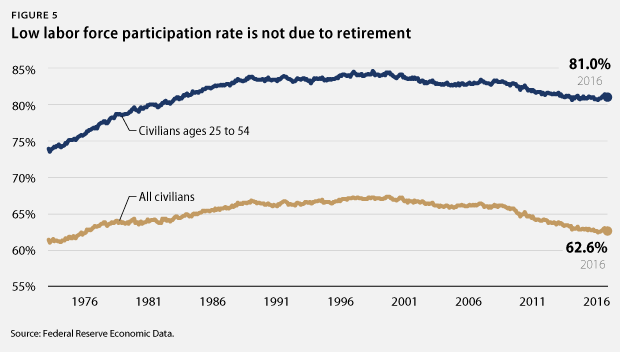

Another important measure is the labor force participation rate. When the economy is doing well, more people typically enter the labor market because there are more jobs available. So one should expect the labor force participation rate to be increasing in the aftermath of the recession. However, it hasn’t been. Rather, it has declined since the recession’s end and is as low today as it was in the late 1970s, when women entering the workforce became the norm. After slipping down slightly from April to May, labor force participation is still low by historical standards, which suggests that there is considerable room for job gains going forward.

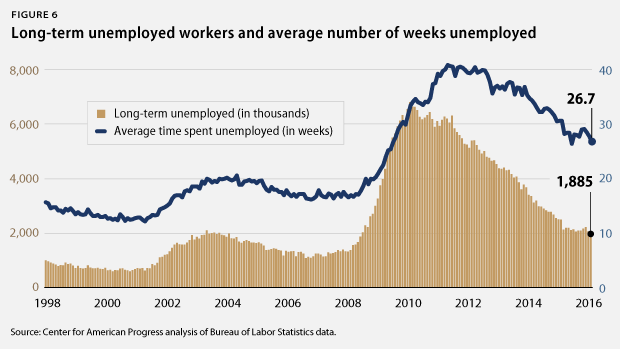

Long-term unemployment is down sharply but still remains high

In November 2015, long-term unemployment was at a record low since the end of the recession, hitting less than one-third of its postrecession peak. Today, while down sharply, the number of long-term unemployed people is still nearly as high as its highest prerecession level in 2003. There are still almost 2 million Americans who have been unemployed for more than half a year and are still actively searching for work. 25.1 percent of all unemployed workers fall into this long-term unemployed category. The average length of time someone has spent unemployed is almost seven months, well above what it was right before the recession.

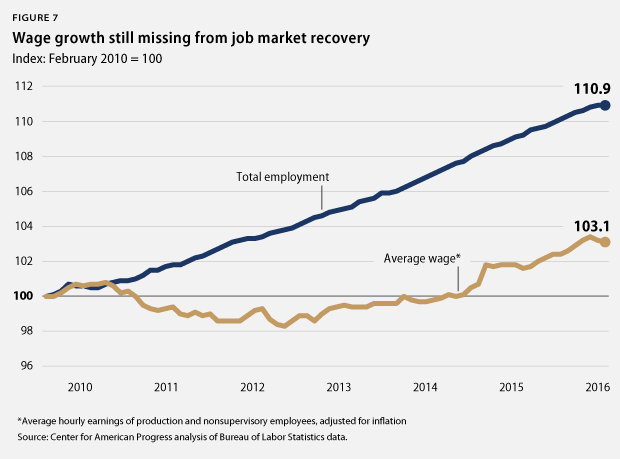

Americans are still waiting for a raise. Due to the slack caused by slow employment growth, real wage growth remains largely stagnant. As depicted above, the labor market has experienced significant gains in employment in this recovery, but growth remains slow by historical standards. Slow employment growth has caused slack in the labor market, thereby leading to stagnation in real wage growth. Continuing the trend of the past 30 years, while corporate profit growth has been strong, middle-class workers continue to grapple with the challenges of rising prices for basic needs, such as health care and housing, and slow wage growth. While the past year has seen wages tick up slightly, more growth is needed to help working families keep up.

Conclusion

While meaningful progress has been made since the end of the Great Recession, it is important to remember that many Americans are still suffering from its effects. It’s not exactly a secret that the Great Recession was much deeper than any other recession in recent memory, and slack in this recovery still remains. Identifying the exact cause of the considerable slack in the labor market is a challenge—maybe it’s the underperformance of the housing sector or of Congress—but the slack in the economy is real. Many people who want full-time work are still missing from the labor force or are working fewer hours than they would like. These workers are the key to raising the nation’s potential economic output and future gross domestic product, or GDP. Beyond employment gains, wages had stalled before the recession, and they have yet to gain much momentum in the recovery.

As the Fed mulls over its decision, the May employment data may be a boon to long-term economic growth by pushing back rate hikes. Even more influential would be a move to reassess target interest rates and inflation altogether, given how much has changed since the Great Recession and how much may yet change in the larger economy. Pulling the long-term unemployed off the sidelines and raising wages for the middle-class remain pressing concerns for progressives, and a wise Fed will bear them in mind when making decisions this year.

Michael Madowitz is an Economist at the Center for American Progress. Juliana Vigorito is a Special Assistant for the Economic Policy team at the Center.