The federal student-loan programs should operate in a manner that consistently puts students first and rewards individuals for enrolling in and completing college. It is a national economic imperative that we have more college graduates in our workforce. But interest on student-loan debt can stand in the way of some students deciding to enroll, while it may cause others to drop out. Keeping the interest rates low on student loans enables students, workers, and people who are unemployed to get the postsecondary training required to adapt to new economic realities.

On July 1, 2013, interest rates on federally subsidized Stafford student loans are scheduled to double from 3.4 percent to 6.8 percent. Interest rates on unsubsidized Stafford loans and PLUS loans would remain unchanged at 6.8 percent and 7.9 percent, respectively. On May 23, 2013, we published a column that highlighted the differences between the primary proposals being considered. In this brief we provide additional detail and context for the current interest-rate debate. We also make policy recommendations based on the three major proposals currently on the table.

Definitions of student loans

Subsidized Stafford loans are available to undergraduate students with financial need. The federal government does not charge interest on a subsidized loan while the student is in school at least half time, for the first six months after the student leaves school, and during an approved postponement of loan payments.

Unsubsidized Stafford loans are available to both undergraduate and graduate students; there is no requirement to demonstrate financial need. The student must pay interest, or it accrues and is added to the principal amount of the loan.

PLUS loans allow parents of undergraduate and graduate students to borrow up to the cost of attendance—tuition and fees, room and board, and allowances for living expenses—less any other aid.

Pay As You Earn, or PAYE, is an income-based repayment option under which eligible borrowers’ payments are capped at 10 percent of their discretionary income, with any outstanding balance forgiven after 20 years.

Congress acted to prevent an identical rate hike from going into effect on July 1, 2012, and is preparing to act to keep rates low again this year. There are key differences, however, between the various proposals. Unfortunately, some of the proposals are worse than the status quo, particularly for low- and middle-income students that take out subsidized Stafford loans.

The goal of the federal student-aid programs, including the loan programs, is to help increase access to postsecondary education. These programs have been largely successful. Since the mid-1970s, the college-going rate for low-income recent high school graduates increased. While this rate has gone up, because of increases in the cost of college, these students are dependent on loans, with more students borrowing than ever before and in larger amounts.

Even though they have more debt, college graduates are better off: They are nearly twice as likely to find a job compared to those with only a high school diploma, and college graduates will earn 63 percent more in a year than those with only a high school diploma. (see Figure 1) Finally, the majority of student loans are repaid, and repayments will result in substantial revenues to the federal government.

Primary student-loan interest-rate proposals

As we noted in our May 23, 2013, column, there are several student-loan proposals currently on the table that offer more than another one-year solution and have elements that could be brought together to achieve an agreement before July 1, 2013.

President Obama’s proposal

In his budget, President Barack Obama used a variable model to determine loan rates when they are issued. After the loan is made, the interest rate would remain fixed for the life of the loan. The president’s proposal sets the interest rate to the 10-year Treasury note plus an additional 0.93 percent for subsidized Stafford loans, 2.93 percent for unsubsidized Stafford loans, and 3.93 percent for PLUS loans. Under Congressional Budget Office projections, that would result in 2013-14 interest rates of 3.43 percent for subsidized Stafford loans, 5.43 percent for unsubsidized Stafford loans, and 6.43 percent for PLUS loans. Unfortunately, the proposal does not include a cap on interest rates, nor does it provide for refinancing of old loans. The proposal is intended to be budget neutral, and it neither costs new money nor generates new savings.

Federal investment in higher education pays off

The goal of the federal student-aid programs, including the loan programs, is to help increase access to postsecondary education. These programs have been largely successful. The college-going rate for low-income, recent high school graduates increased from 31 percent in 1975, three years after the Pell Grant program—then called the Basic Educational Opportunity Grant—was created, to 54 percent in 2011. While not on par with students from middle- and upper-income students—at 66 percent and 82 percent, respectively—significant progress has been made. (see Figure 2)

Today students enrolled in higher education are more dependent on student loans than they were in 1975. Indeed, the maximum Pell Grants met more than half of the cost of college in the 1980s; today they meet only a third.

Low-income students, particularly those that depend on Pell Grants, are more likely to rely on subsidized Stafford loans to meet postsecondary expenses. Low-income students are also more sensitive to changes in the cost of attending postsecondary education. The additional cost of borrowing resulting from an increase in interest rates may therefore deter enrollment at the very time that education beyond high school is critical for millions of students and their families as they seek to move into or remain a part of the middle class.

Recent reports from the Bureau of Labor Statistics now show that college graduates are nearly twice as likely to find work as those with only a high school diploma. (see Figure 1) An advanced degree provides individuals with a clear path to the middle class, a higher likelihood of meaningful and gainful employment, and lifelong financial and personal benefits. College education also provides for a skilled workforce that is crucial to rebuilding the entire American economy.

Rep. John Kline’s proposal

The Smarter Solutions for Students Act, or H.R. 1911, passed the U.S. House of Representatives on May 23, 2013. The bill, proposed by Rep. John Kline (R-MN), chairman of the House Committee on Education and the Workforce, would adopt a completely variable interest-rate proposal, meaning that the rates on all loans would fluctuate from year to year. Similar to the administration’s proposal, the interest rate would be tied to the 10-year Treasury note but with an add-on of 2.5 percent to both subsidized and unsubsidized Stafford loans and 4.5 percent to PLUS loans. It also includes a fairly high cap on interest rates—8.5 percent for Stafford loans and 10.5 percent for PLUS loans. Unfortunately, the 2.5 percent and 4.5 percent add-ons are more than is necessary, resulting in $3.7 billion in additional revenue, which would go toward paying down the federal debt. The proposal also fails to make a meaningful distinction between subsidized and unsubsidized Stafford loans, and it does not include the Pay As You Earn expansion or a refinancing mechanism.

Sens. Tom Coburn and Richard Burr’s proposal

Sens. Tom Coburn (R-OK) and Richard Burr (R-NC) have a similar proposal with a 3 percent add-on for all Stafford and PLUS loans. The Coburn-Burr proposal is more generous to the PLUS borrowers than any other proposal. As such, the proposal would most benefit those with higher incomes by actually reducing the interest rate that would be charged to PLUS loan borrowers. On June 7, 2013, the Coburn-Burr proposal was voted on by the U.S. Senate as an amendment to the Agriculture Reform, Food, and Jobs Act of 2013 (S. 954) but it did not pass.

Sen. Tom Harkin, Senate Majority Leader Harry Reid, and Sen. Jack Reed’s proposal

Sen. Tom Harkin (D-IA), chairman of the Senate Health, Education, Labor, and Pensions Committee, put forth legislation—S. 953—with Senate Majority Leader Harry Reid (D-NV) and Sen. Jack Reed (D-RI) to extend current student-loan interest rates for two years. The legislation, which has 20 co-sponsors, proposes that subsidized Stafford loans would remain at 3.4 percent for two years, and other interest rates would be unaffected. This legislation would cost $8.3 billion but is fully paid for through a package of three noneducation offsets.

The offsets included in the Harkin-Reid-Reed proposal include closing three loopholes related to the oil industry, tax-deferred accounts, and non-U.S. companies. On June 7, 2013, the U.S. Senate considered the bill as an amendment to the Agriculture Reform, Food, and Jobs Act of 2013, but a motion to move for a vote failed to pass.

Sen. Elizabeth Warren (D-MA) has also introduced a proposal that is a one-year plan to set subsidized Stafford loan interest rates at a lower rate than they are currently. She accomplishes this by tying interest rates to the Federal Reserve discount rate, which is the rate the Federal Reserve charges their member banks for borrowing money. Sen. Warren’s Bank on Students Loan Fairness Act (S. 897) has not been scored by the Congressional Budget Office. A companion bill, H.R. 1979, has been introduced by Rep. John Tierney (D-MA). Sen. Warren is also a co-sponsor of the two-year extension. The proposal presents significant administrative issues. Since the secretary would borrow from the Federal Reserve for one year, loans made with those funds would have to be separately tracked, with payments made to the Federal Reserve instead of all other loans where the secretary pays the Treasury.

Policy position and recommendations

It is time for Congress to adopt a comprehensive student-loan interest-rate approach that lowers student debt levels when compared to the current policy. Student-loan borrowers must be better off than they would be if no action is taken and the subsidized Stafford student-loan rate doubles on July 1 to 6.8 percent.

To ensure the long-term viability of the student-loan program and ensure greater equity, student-loan interest rates should be made variable, fixed at the time the loan is originated, and capped at a level that is meaningful. Federal student loans create both private and public good. As such, student-loan interest-rate changes need to be justified by more than just the excess earnings being applied to deficit reduction.

Under current scoring rules, the federal student-loan programs return significant savings to taxpayers. (see Figure 3) This is true under all of the current proposals for setting interest rates. The challenge is to develop an approach to interest rates that treats students fairly.

In the long term, we believe that students need to know that interest rates on their student loans are set in a manner that is fair and equitable. Generally, students know—and to an extent understand—the general economic environment in which they are living. They know, for example, what interest rate is being offered to homebuyers even if they don’t understand the differences between the various home-loan options available. The current mechanism for setting interest rates, however, is purely political and is therefore perceived to be inequitable. For this reason, having student-loan interest rates vary based on a market mechanism would have a significant advantage not only because it would be fair but also because it would be perceived to be fair and would allow borrowers to take advantage of today’s historically low interest rates.

A plan that relies exclusively on variable interest rates set by market mechanisms, however, would not provide students with protections against interest rates rising dramatically in the future. High interest rates on student loans, which would significantly increase the cost of going to college, could discourage some students from enrolling and persisting in postsecondary education.

A plan that uses a market mechanism to establish the student-loan interest rate requires the setting of the base interest rate and an add-on. The add-on interest-rate amount should be as low as possible and avoid additional deficit reductions that shift the national debt onto students.

In addition, expanding protections such as PAYE—which lets borrowers limit their monthly payments to an affordable percentage of their income—to include all borrowers, along with the addition of a refinancing mechanism, would further strengthen the federal student-loan program. The PAYE expansion, outlined in the president’s budget for fiscal year 2014, would ensure that all federal student-loan borrowers could cap their monthly loan payments to 10 percent of their income so that the payments are affordable and achievable.

A refinancing and loan-modification mechanism would provide borrowers with the option to switch their loans from their current interest-rate model into the new system.

Conclusion

The federal student-loan programs should operate in a manner that consistently puts students first and rewards individuals for enrolling in and completing college. Among low-income borrowers, who principally benefit from subsidized Stafford loans, student-loan debt burden can stand in the way of enrolling and completing a degree or certificate. Keeping interest rates low helps people get the postsecondary training required to adapt to new economic realities and ensures that employers have the skilled workforce they need to compete. It is time for Congress to adopt a comprehensive student-loan interest-rate approach that lowers students’ debt burden compared to the current policy. Student-loan borrowers must be better off than they would be if no action is taken and the subsidized Stafford student-loan rate doubles on July 1 to 6.8 percent.

David A. Bergeron is the Vice President for Postsecondary Education at the Center for American Progress. Tobin Van Ostern was formerly the Deputy Director of Campus Progress.

Appendix

Elements of interest-rate setting

Since the beginning of the federal student-loan program, a primary issue has been what the interest rate should be. A number of elements need to be considered when setting an interest rate. Each of these elements are described in this appendix.

Variable or fixed interest-rate loans

Loans are funds that are provided to an individual with an expectation of repayment of the amount provided plus interest. The interest rate on most loans is fixed over the entire life of the loan. When a loan’s interest rate is fixed, the lender sets the interest rate. In terms of student loans, Congress has generally set the interest rate for the life of the loan. In 1992 Congress moved away from the fixed rate to a variable interest rate. Under a variable-rate approach, the interest rate changes annually in concert with the reference rate. In 2007 Congress went back to fixed interest rates in the College Cost Reduction and Access Act.[i] Subsequently, Congress temporarily lowered the interest rates on subsidized Stafford loans. In his FY 2014 budget, President Obama proposed going back to an alternative approach to setting a variable interest rate where the rate is fixed for the life of the loan at origination. This type of variable-fixed interest-rate loan has not been used in the federal student-loan programs before.

The original intent of a fixed rate was to have predictability for students, lenders, and the federal government. A variable interest rate, tied to the prevailing interest rate in the economy, was viewed as more sustainable over the long term than one with a fixed interest rate. It was also intended to reduce the cost to the federal government. The rates, however, were difficult for borrowers to understand. In addition, private-sector loan servicers, working under contract to the lender, often made errors in billing, which in some cases went undetected for a decade. Today there are far fewer servicers, and the servicers can therefore be monitored more closely by the federal government.

Base rate

When setting an interest rate, a primary consideration is the cost of the loan program to taxpayers of the particular interest rate selected. When the rate is fixed in law, the cost of a federal loan program rises and falls with the cost of capital to the government. When an interest rate varies, the cost of capital is just another variable that moves and affects the cost of the program. In selecting the base rate to which an add-on may be applied, therefore, two factors can be considered: (1) the cost of capital to the federal government; and (2) the more general prevailing interest rates in the economy.

In terms of cost of capital to the lender, the federal government borrows to meet current expenses through approximately 14 different funding instruments ranging from 4-week Treasury bills to 10-year Treasury notes to 30-year bonds. One commonly used instrument for setting interest rates is the 91-day Treasury bill. The 91-day Treasury bill accounts for a fifth of all debt held by the public. The 91-day Treasury bill rate has been used to set lender yield and interest rates in federal loan programs. So it is a logical instrument to consider as a base for setting a variable interest rate.

Another Treasury-derived rate that has been considered by Congress and various administrations for setting student-loan interest rates is the 10-year Treasury note. The average maturity of the 10-year Treasury note matches the historic norm for the length of repayment of student loans. The average length of repayment will likely increase as the debt load taken on by students increases over time and the new types of repayment options extend the length of repayment. The Pay As You Earn repayment option, for example, which caps a borrower’s payment at 10 percent of his or her discretionary income, will likely extend the time required to repay student loans. As a result, an instrument of longer duration—20 years or 30 years—could be justified.

Another base that some private-sector lenders have used to set interest rates for private student loans is the rate at which commercial paper, or CP, trades. CP consists of short-term promissory notes issued primarily by corporations. Maturities range up to 270 days but average about 30 days. Many companies use CP to raise cash needed for current transactions, and many find it to be a lower-cost alternative to bank loans. The Federal Reserve Board disseminates information on CP weekly in its H.15 Statistical Release.

Recently, another alternative base was proposed—the rate that the Federal Reserve charges commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Bank’s lending facility. This is known as the discount rate. The discount rate is the rate charged to the most stable lending institutions for overnight borrowing. The discount rates are established by each Reserve Bank’s board of directors, subject to the review and determination of the Board of Governors of the Federal Reserve System. While this approach has only been proposed for loans made between July 1, 2013, and June 30, 2014, it offers another alternative that has not been in the debate until now. It is therefore helpful in expanding the range of options being considered.

Except for the 10-year Treasury note, all three other instruments are relatively short term. As a result, they fluctuate in very similar ways. The 91-day Treasury bill, however, is consistently the lowest of the rates, followed closely by the discount rate. The average gap between the 91-day Treasury bill and the 10-year Treasury note was just under 1.75 percent but ranged between 0.07 and 3.11 percent over a 15-year period. (see Figure 4) When compared to the 10-year Treasury note, the 91-day Treasury bill, the commercial paper, and the discount rate are very volatile, and the maturity does not match that of student loans.

Add-on

Any exercise in lending is essentially a transfer of risk. Commonly, creditors price these risks by charging three premiums: (1) inflation premium, (2) liquidity premium, and (3) credit-risk premium. Tying the borrower’s interest rates to the 10-year Treasury note (or to any other long-term instrument) takes care of the inflation and liquidity premiums because these rates are set in the bond markets based on the future expectations of inflationary trends and the ability to sell or trade the notes.

The add-on, therefore, only needs to cover the credit risk, which includes the cost of administering the loan program. The cost of insurance provided to borrowers explicitly and implicitly under the federal student-loan program—death, disability, unemployment, etc.—is another element of the credit risk and should be covered.

Beyond covering these costs, any addition to the add-on would be profit for taxpayers. If the value to society in providing loans to low- and middle-income students is high because of the impact that college graduates have on the nation’s economic and social well-being, then the add-on should be relatively low, with federal taxpayers holding more of the credit risk. If the add-on is high, however, it suggests that the loan program and the students that benefited from it are less valuable to society.

One alternative would be to charge no add-on above the base interest rate. This approach would signal that there is only public good generated by the investment in students and that society should bear more of the risk. As previously discussed, there are significant private benefits of student loans.

Another approach would be to charge an add-on equal to the estimated cost of administering the federal student-loan programs. These costs would include the direct cost of making and servicing the loans as well as the cost of insurance provided to borrowers under the federal student-loan program.

Approaches that keep the cost of borrowing low make good sense for individuals, including those from low-income families and those from certain debt-averse minority groups, which are also extremely sensitive to the cost of enrolling in higher education. For this reason, a very modest add-on should be considered for low-income students. Having an add-on and resulting interest rate that is too low, however, could cause middle- and upper-income students to borrow more than necessary to meet educational expenses. This potential overborrowing, while profitable for the federal government, has long-term impacts on the economy by suppressing consumer spending, particularly in key segments of the economy such as housing and automobile sales. It is this division that led to the difference in interest rates charged under the subsidized and unsubsidized loan programs.

Beyond a modest add-on intended only to cover costs for low-income students, it is unclear how an objective standard for setting the add-on could be reached. As shown in Figure 5, low-income students rely on both subsidized and unsubsidized student loans, but so do more affluent students. So the distinction between the two loan types is blurred.

One consideration is that setting a higher add-on could prevent excessive borrowing, which could be an issue in the unsubsidized Stafford loan and, perhaps more significantly, in PLUS loans. Because of the relatively low loan limits on subsidized Stafford loans, preventing excessive borrowing is not a consideration. But it is a legitimate consideration in the unsubsidized Stafford and PLUS loan programs, where interest rates that are too low could promote overborrowing.

Interest-rate ceiling

In addition to the base rate and the add-on, policymakers must decide whether to include a ceiling or maximum interest rate that a borrower could be charged. A ceiling on the interest rate charged to borrowers will ensure that even if the result of the base plus add-on exceeds an established level, the interest rate will not go higher than, for example, 8 percent. This is an especially important protection for borrowers that could see interest rates rise to a level that makes it difficult for them to make payments except under an income-based repayment plan. As such, a ceiling on the interest rate charged is an important protection for borrowers.

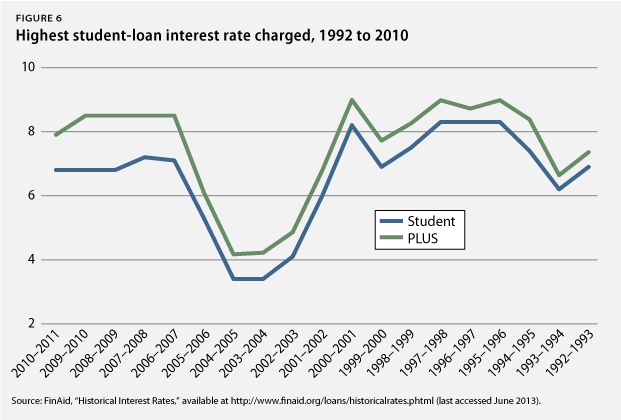

Where to set the ceiling is based, again, more on values than empirical analysis. That being said, the history of student-loan interest rates is instructive. Since 1992 student-loan interest rates have ranged from a low of 3.4 percent to a maximum of 8.25 percent, with an average of 6.6 percent. (see Figure 6) Consistent with historical trends in interest rates overall, the trend has been toward lower interest rates. As a result, a ceiling at or below the current unsubsidized student-loan interest rate would seem reasonable for Stafford loans. For PLUS loans, a ceiling of approximately 7.5 percent would seem reasonable.

Refinancing and other borrower protections

As can be seen in Figure 6, student-loan interest rates have fluctuated significantly in recent years, reflecting the cost of capital and of servicing student-loan debt. Various other protections for students could be included in legislation to keep interest rates from rising. A refinancing option, for example, could be provided to permit existing borrowers to move into the new interest-rate model. This would allow borrowers that currently have interest rates as high as 8.25 percent to move down to the newly established rate. To defray the cost of a refinancing program, borrowers could be assessed a one-time fee or charged a slightly higher interest rate similar to the current consolidation loans. Under the consolidation-loan program available to some borrowers today, the interest rate charged is rounded up to the nearest one-eighth of a percent. A different rounding convention—to the nearest 0.5 percent, for example—would generate additional revenues to defray program expenses.

Finally, repayment tools such as Pay As You Earn could be expanded to help borrowers who have a difficult time making payments on their loans. While such protections are not directly related to student-loan interest rates per se, they do provide a mechanism to address the most significant impacts of student-loan debt on the most vulnerable.