This is the third straight winter of our discontent, due in large part to high gasoline prices. The Energy Information Administration reports that as of February 25, “The average U.S. retail price for regular motor gasoline is up about 45 cents per gallon since the start of 2013.”

As was the case in previous years, higher prices at the pump are primarily—but not entirely—due to high global oil prices because the price of oil comprises nearly three-quarters of the price of gasoline. The Energy Information Administration reports that in 2013, “the price of Brent crude oil—the waterborne light sweet crude grade that drives the wholesale price of gasoline sold in most U.S. regions—rose about $6 per barrel, or about 15 cents per gallon.” The agency determined that, “The rise in gasoline prices is partly due to higher crude oil prices. … Year-over-year global product demand is up, and further rises are expected.”

Higher oil prices are also due to Wall Street speculators bidding up oil prices to make a fast buck. The State in Columbia, South Carolina, concluded that financial “speculators [are] driving gas prices up, up, up.” The other major factor is some domestic refinery disruptions, which also boost gasoline prices.

Unfortunately, you wouldn’t know this by listening to Big Oil. This enormously profitable industry is using Americans’ pain at the pump as an excuse to again trot out its “moldy oldies,” regurgitating its longstanding proposals to “drill, baby, drill.” Their agenda benefits oil companies, but it won’t lower gasoline prices or help American middle-class families.

Jack Gerard, president and CEO of the American Petroleum Institute, recently issued a statement that encompassed nearly all of the misleading statistics, half-truths, and false claims that Big Oil uses to support its demands. He claimed that:

Unfortunately, 83 percent of the land and offshore areas controlled by the federal government are still off-limits to oil and natural gas development. President [Barack] Obama must follow through by implementing a national energy policy, lifting existing restrictions in support of responsible development of our vast energy resources, approving the Keystone XL pipeline, and standing up against unnecessary and burdensome regulations that chill economic growth.

Let’s correct Big Oil’s agenda one myth at a time.

Myth No. 1: Too few federal lands and waters are open for oil production

Gerard falsely asserted that the Obama administration is limiting oil production from federal lands and waters when, in fact, the vast majority of these resources are already available to the oil industry. In 2012 the Congressional Budget Office “estimate[d] that about 70 percent of undiscovered oil and gas resources are on federal lands that are available for leasing under current laws and administrative policies.” Further opening up these protected places—including off the California and Florida Gulf coasts—would do little to lower oil or gasoline prices.

Richard Newell, the administrator of the Energy Information Administration, testified before Congress in 2011 to explain that, “We do not project additional volumes of oil that could flow from greater access to oil resources on Federal lands to have a large impact on prices given the globally integrated nature of the world oil market.” In other words, because the price of oil is set on a global—rather than a domestic—basis, opening up protected lands and waters would not alter the price of oil or gasoline in a substantial or noticeable way.

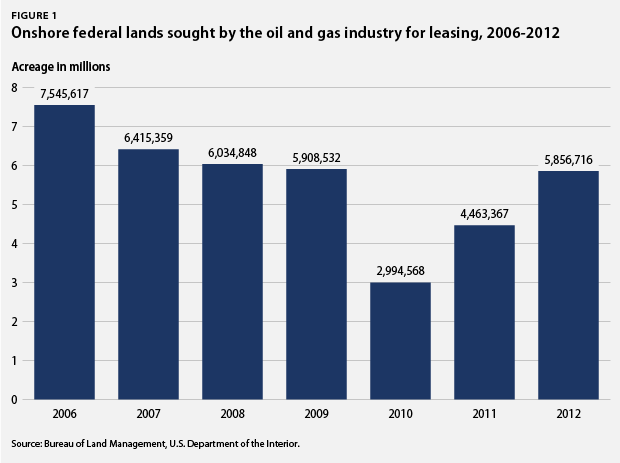

Interestingly, the oil industry itself has expressed a declining interest in leasing the onshore public lands that are already eligible for drilling. Under current leasing rules, oil companies can make industry “expressions of interest [that] identify lands sought by industry for possible oil and gas leasing.” These requests to lease eligible onshore public lands averaged 6.6 million acres annually from 2006 through 2008. The average acreage sought by oil companies dropped by 27 percent from 2009 to 2012, to an average of 4.8 million acres annually. (see Figure 1)

Though oil companies sought less federal land to expand their drilling, oil production from already-leased federal lands and waters grew from 2009 to 2011, the most recent year for which data are available. The Energy Information Administration estimated that in 2011 the United States produced 646 million barrels of crude oil from federal lands and waters, compared to 575 million barrels in 2008—a 12 percent increase. According to the agency, oil production from federal areas was higher in every year from 2008 to 2011 than it was from 2006 to 2008.

If the Big Oil companies are truly concerned about production from federal lands and waters, they should strongly urge their congressional allies to block the upcoming budget sequester, which will ultimately slow the approval of federal drilling. The Department of the Interior estimated that, “Efforts to expedite processing of offshore oil and gas permitting in the Gulf of Mexico would be thwarted by delays, putting at risk some of the [pending] 550 exploration plans.” And approximately 300 fewer onshore oil and gas leases would be issued in western states such as Wyoming, Utah, Colorado, and New Mexico, delaying prospective production from those lease tracts and deferring payments to the Treasury Department.

Myth No. 2: Domestic oil and gas production faltered under new protections and safeguards

After the tragic BP Deepwater Horizon oil spill in 2010, the Department of the Interior adopted new safeguards to protect offshore oil-rig workers and established rules to reduce the likelihood of another rig blowout. Even with these new regulations, offshore oil production continues to flourish, despite what Big Oil would have you believe.

The Department of the Interior recently reported that, “In fiscal year 2012, Interior paid out $12.15 billion in revenue generated from energy production on public lands and offshore areas—a $1 billion increase over the previous year.” And the Energy Information Administration’s Short Term Energy Outlook Supplement projects that offshore oil production will only continue to increase in the coming years:

During 2012, oil production in the Federal GOM [Gulf of Mexico] is projected to have increased from about 1.31 million bbl/d [barrels per day] in January to about 1.39 million bbl/d in December (up 6 percent). … EIA [Energy Information Administration] expects Federal GOM production to increase from an average 1.27 million bbl/d in 2012 to an average 1.39 million bbl/d in 2013.

Myth No. 3: Tar sands oil transported by the Keystone XL pipeline will lower U.S. gasoline prices

Oil companies want the Keystone XL pipeline to transfer relatively dirty tar sands oil from landlocked Alberta, Canada, to Canadian or American ports for export. This oil is extracted and produced “far from the massive refining hub on the U.S. Gulf Coast, and far from ocean ports that would allow [it] to reach energy-hungry customers overseas,” according to Toronto’s The Globe and Mail.

Though the pipeline’s owners and proponents originally lobbied for passage of the pipeline based on the promise that importing tar sands oil to the United States would improve gasoline prices and energy security, The Globe and Mail noted that tar sands producers are “seeking new markets” for their oil beyond the United States. The paper reported that, “Alberta has long depended on central Canada and the middle of the United States as its oil markets. But those regions are now saturated with crude from booming North American production, and the glut has driven down prices.”

In other words, Canadian oil producers want the pipeline built so that they can export some refined petroleum products to other countries—not just to the United States.

This sheds some light on why the CEO of the pipeline’s owner company TransCanada testified in December 2011 before Congress that it could not guarantee that the Canadian tar sands oil transported by the pipeline and refined into petroleum products would only be sold to American drivers.

In 2012 the House of Representatives passed the Protecting Investment in Oil Shale the Next Generation of Environmental, Energy, and Resource Security Act (H.R. 3408), which included a provision to force the Obama administration to approve the Keystone XL pipeline. Rep. Ed Markey (D-MA) offered an amendment to the bill to “ensure that if the Keystone XL pipeline is built, the oil that it transports to the Gulf of Mexico and the fuels made from that oil remain in this country to benefit Americans.” The amendment failed 173 votes to 254 votes, however, demonstrating congressional support for exporting fuels made from tar sands oil.

An Ensys report conducted for the Department of Energy concluded that the “pipeline scenario is projected to have small impacts on crude and product prices.” It also determined that, “Building versus not building Keystone XL would not of itself have any significant impact on U.S. total crude runs, total crude and product import levels or costs.”

Time summed it up best when it reported that, “Keystone would have little immediate [gasoline price] effect.”

Myth No. 4: Big Oil needs its special tax breaks

In 2011 and 2012 the five biggest global oil companies—BP, Chevron, ConocoPhillips, ExxonMobil, and Shell—made a combined total profit of $255 billion. Fortune ranked ExxonMobil and Chevron as the first and second most profitable companies in 2012, ahead of Apple, Microsoft, and many others; ConocoPhillips was the 13th-most profitable company. Yet these three companies, along with BP and Shell, receive an annual total of $2.4 billion in annual special tax breaks, according to the Congressional Joint Committee on Taxation.

Despite their huge profits and tax breaks, these five companies produced 3 percent less oil in 2012 than in 2011 because higher gasoline prices translate into greater profits without more production. And although Big Oil claims otherwise, retention of these tax breaks won’t help protect American jobs. While oil companies were profiting from our pain at the pump, four of these companies—BP, Chevron, ExxonMobil, and Shell—were causing even more pain: According to a report by the House Natural Resources Committee Democrats, these companies let go of 11,200 U.S. employees between 2005 and 2010—even with the existing tax provisions.

Myth No. 5: New safeguards against air pollution from gasoline will drive up prices

Gerard claims in his statement that, “Unnecessary, burdensome regulations … chill economic growth.” He could be referring to the Environmental Protection Agency’s pending “Tier 3” rule, which includes removing two-thirds of the sulfur currently in gasoline. This would provide the pollution-reduction equivalent of “eliminating over 33 million cars” from the road, according to the association of state air-pollution control agencies. Navigant Economics, an economics consulting firm, estimated that, “By 2030, Tier 3 is expected to generate health benefits of $10.1 [billion] to $10.8 billion annually. … These health benefits alone are much larger than the estimated increase in annual refining costs of about $1.5 billion.”

The cost of enacting the Tier 3 rule? The Environmental Protection Agency “estimate[s] the costs to be approximately one penny per gallon in 2017.” The American Petroleum Institute did a study that estimated a higher cost for removing the sulfur, but it was thoroughly discredited by Navigant Economics, which concluded that the study “exaggerates the costs of Tier 3 to the refining industry.”

Conclusion

Big Oil’s tired and phony solutions to high gasoline prices won’t help American families. Instead, the federal government should pursue real solutions, including better fuel-economy standards—which are currently underway—more investment in recharging infrastructure for electric vehicles, and investments in public transportation so families have alternatives to driving when gasoline prices spike.

We’ve had enough of the myths, Big Oil. It’s time to move forward with real solutions for our rising gasoline prices.

Daniel J. Weiss is a Senior Fellow and the Director of Climate Strategy at the Center for American Progress.

Thanks to Tom Kenworthy, Senior Fellow; Jessica Goad, Manager of Research and Outreach for Public Lands Project; and Kiley Kroh, Associate Director for Ocean Communications, all at the Center for American Progress. Thanks also to the American Lung Association.