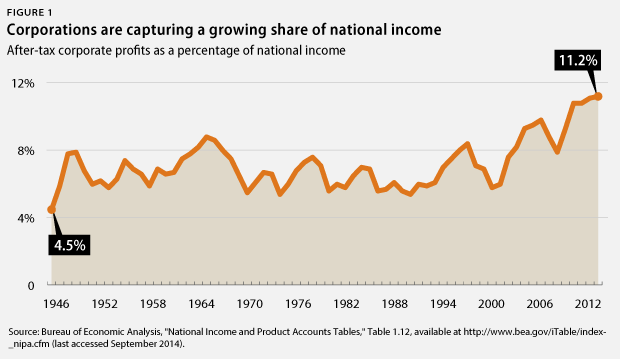

While middle-class and low-income Americans struggle to get by, corporate profits are soaring. In 2013, corporate after-tax profits consumed a record-breaking 11.2 percent of total national income. Between 1946 and 2010, after-tax corporate profits always remained below 10 percent of national income, but 2013 was the fourth consecutive year in which corporate profits exceeded 10 percent of national income.

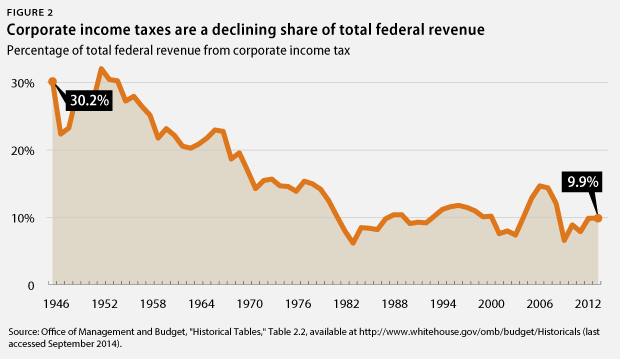

Meanwhile, corporate income taxes only constituted about 10 percent of total federal revenues collected in fiscal year 2013, which is right in line with their average contribution since FY 1980 but down sharply from earlier decades, when corporations contributed double or triple that percentage.

The claim that taxes are somehow “crushing” corporations gets it backward—corporations could not survive without taxes. To list just a few examples, federal taxes fund education and training for the American workforce, a national transportation network to deliver products to market, a navy to keep shipping lanes safe from piracy around the world, and a legal system to protect copyrights and patents.

While the federal tax code has many flaws, it does not prevent corporations from competing in the global economy. Indeed, American corporations are doing better than ever.

Harry Stein is the Associate Director for Fiscal Policy at the Center for American Progress.